Capital gains arising on the disposal of qualifying shareholdings by a UK company are not subject to UK corporation tax. Capital losses arising on the disposal of qualifying shareholdings will not be available for offset against other taxable gains.

This regime while appearing relatively straightforward in the first instance is actually quite complex in practice, although the government is currently consulting on simplifying the rules. The operation of the new regime is explained in more detail below.

The main conditions to benefit from the exemption are as follows:

- The shareholding in the participation must be 10% or more;

- The shares must have been owned for at least one year;

- The subsidiary sold must be a trading company or the holding company of a trading group both before and after its sale.

- The UK holding company must be a trading company or the member of a trading group both before and after the sale of the subsidiary[1].

Where the relevant conditions are met, the exemption is automatic and a claim does not need to be made.

Qualifying shareholding and holding period

A "qualifying shareholding" is defined as a holding of 10% or more of the ordinary share capital which includes the entitlement to at least 10% of the profits and 10% of the assets available for distribution. However, it is important to note that the shares sold do not themselves need to be a qualifying shareholding, i.e. the actual sale may be for example a 2% shareholding. Also it is not necessary that the qualifying shareholding is held at the time of the disposal. It is only necessary that the UK company held a qualifying shareholding in the subsidiary for at least twelve months in the two year period up to the date of sale.

For example, in the circumstances given below the sale of the final 2% would qualify for the exemption as would the sale of the first 8%.

01/01/2013 10% shareholding held in subsidiary.

01/05/2015 8% shareholding is sold, i.e. only a 2% shareholding is retained.

01/12/2015 The remaining 2% shareholding is sold.

In the above example within a two year period prior to the disposal of the 8% shareholding and the 2% shareholding, the UK company held a 10% shareholding for at least twelve months, therefore both the 8% disposal and the final 2% disposal will qualify for the exemption subject to the other conditions being met.

Activities of the subsidiary

The subsidiary company must be a qualifying trading company or a qualifying sub-holding company throughout the period of time which starts on the first day of the last twelve month period (within the period of two years prior to the disposal) for which the company met the qualifying shareholding requirements and ending with the time of disposal.

A qualifying trading company is a company whose activities do not to any substantial extent include activities that are not trading activities. 'Substantial' is not defined by the legislation but is considered by HMRC to amount to 20% or more. That 20% test may be in terms of income, profit, asset base or time spent by staff. Generally all relevant factors will be required to be considered before arriving at an overall view “in the round” as to the trading status of the company. It is also possible to take into account the trading history of the company, so that, for instance, a sudden increase in investment income in the year before sale does not jeopardise the position of a company with a long trading history,

A qualifying holding company will be a company whose activities, together with those of its 51% or greater subsidiaries do not to any substantial extent include activities that are not trading activities.

For example a company involved in the purchase and sale of machinery would be a qualifying trading company. A company would be a qualifying holding company if its only activity was the holding of a 100% shareholding (or at least 51%) in a company involved in the purchase and sale of machinery.

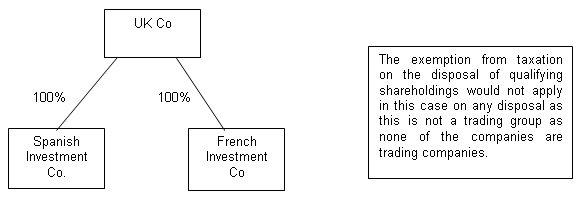

A company whose only assets are rented property would not be a trading company, although the activity of property development does qualify as a trade.

Activities of the UK holding company

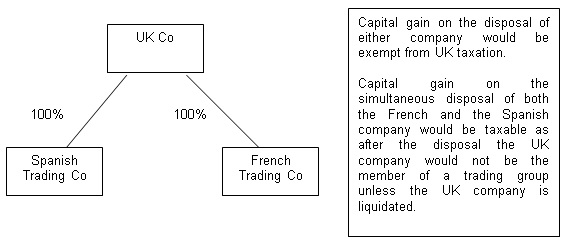

In order for the exemption to apply the UK holding company must be a trading company or a member of a trading group immediately after the sale of the qualifying shareholding. The legislation does not state for how long the UK company must remain a trading company or a member of a trading group after the sale.

As previously mentioned the legislation defines a trading company as a company whose activities do not to any substantial extent include any activities other than trading activities and describes a trading group as a group the activities of whose members taken together do not include to any substantial extent activities other than trading activities. A group for the purposes of the capital gains exemption is a group of companies who are 51% or more subsidiaries of each other.

A company which only holds portfolio shareholdings in other companies would not be a qualifying holding company. However, a UK holding company holding a 10% or greater interest in a joint venture will also qualify. A joint venture company is one where five or fewer persons between them beneficially control 75% or more of the share capital of the joint venture company.

The practical effect of these provisions is that where a UK holding company holds shares in just one trading subsidiary, the capital gains exemption will not apply to a sale of the subsidiary unless the UK company itself carries on a trade after the disposal or the disposal arises due to the liquidation of the UK company and liquidation is the only reason why the exemption would not apply.

Summary

The exemption from taxation on the sale of qualifying shareholdings, in conjunction with the exemption for most inbound dividends, greatly enhances the UK as a holding company location and brings the UK more in to line with other jurisdictions such as Luxembourg, the Netherlands and Ireland. A UK holding company also has the added benefit of being able to pay dividends to shareholders in any location free of any UK withholding tax deduction. However as should be apparent from the above, the rules of the exemption are complex and it should not be assumed to apply in all cases.

Examples

1.

2.

3.

4.

[1] The requirement for the UK company to be a member of a trading group or a sole trading company after the disposal is not applicable if the UK company is in liquidation or is about to be liquidated.