Overview

Business owners and executives who are contemplating a sale of their business or a division of their company will begin by asking themselves “who would want to buy my company?” But beyond a few “obvious suspects”, identifying good quality buyers can require extensive research and “out of the box” type thinking. This guide discusses how to identify qualified buyers and, importantly, how to approach them in order to attract their interest.

Types of Buyers

Buyers can be loosely categorized into various groups, including: (i) corporate buyers; (ii) individuals; (iii) the management team; and (iv) private equity firms.

Corporate Buyers

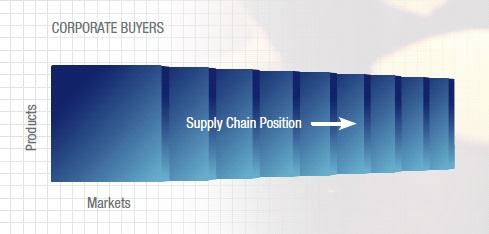

Corporate buyers comprise a wide range of possible buyers, including direct competitors, companies with complimentary product or service offerings, companies ina different geographic region, and other companies along the supply chain. The spectrum of alternatives can be graphically depicted as follows:

Direct competitors are an obvious choice, on the basis that they will perceive synergies through cost saving and the reduction of competition. However, dealing with a direct competitor can be problematic given confidentiality concerns.

Buyers who offer complementary product and service offerings may view your company as a compelling acquisition opportunity. This is because they can often achieve significant synergies in the form of cost reduction, and by entrenching customer relationships through multiple product or service offerings and cross-selling opportunities.

Buyers in different geographies can present a compelling opportunity. Many buyers perceive geographic expansion through acquisition as a key component of their corporate strategy, as it helps to broaden their customer base. But don’t limit your search to other parts of North America. Many companies based in Europe, Asia and South America are interested in expanding into North America through acquisition. In dealing with our colleagues at M&A International, we are constantly amazed (and flattered) by the level of interest in Canada from around the world. As a practical matter, it’s easier for larger companies to attract international interest than it is for smaller companies, due to the time and cost to the buyer of undertaking such endeavours.

Finally, you should consider corporate buyers that are located along your supply chain, such as suppliers and customers. In some cases, those groups are looking to vertical integration as part of their corporate strategy. However, those groups need to be carefully approached in order to avoid creating a concern that a change in control would have if that supplier or customer were not part of the transaction.

Individual Buyers

There is no shortage of individuals who are looking to buy a company. But many of these individuals represent “scared money” because they are not truly prepared to place a significant amount of their wealth at risk. Others are just looking for a bargain.

Finding the right individual buyer can be a needle in a haystack. But in some cases they do emerge. In particular, individuals who have relevant executive operating experience combined with a meaningful amount of personal net worth are more likely to do a deal. Some of these individuals will team up with private equity funds or other sources of capital in order to acquire a business that represents a meaningful size.

Management Buyouts (MBOs)

One group of buyers that is often overlooked is the existing management team. An MBO can represent an attractive alternative because it is quicker and more confidential than selling to a third party purchaser.

The biggest challenge in consummating an MBO normally revolves around financing. MBOs are more likely to be consummated where the management team is prepared to put “skin in the game” in terms of a meaningful equity investment. It is also helpful where the seller is prepared to accept a portion of the proceeds over time, such as in the form of a promissory note that is subordinated to third party debt financing.

Private Equity Groups

There is literally billions of dollars of private equity capital awaiting a transaction in today’s market. This has caused private equity firms to become increasingly aggressive in bidding for quality acquisition candidates. While private equity firms will often focus on larger companies, this is not always the case.

Where the private equity firm has an existing portfolio company within a given industry, it will look for “bolt-on” acquisitions of almost any size. This can be a powerful combination, as it provides the buyer with the opportunity to realize synergies as well as the capital required to consummate a transaction. Private equity firms also have a strong interest in supporting MBOs where the right management team is in place.

What Are the Characteristics of a Good Buyer?

While a seller should consider different types of would-be buyers, it is also important to rank those buyers based on their expected level of interest and their ability to transact. Specific considerations for ranking buyers include the following:

- Fit with the buyer’s strategic initiatives. Identifying a buyers’ strategic initiatives is easier in the case of public companies that have disclosed such things in their MD&A or other publications;

- The synergies that the buyer should be able to realize from the transaction. While the synergies that may accrue to each buyer are unique, the seller should get a sense as to whether each particular buyer would realize significant economies of scale (e.g. cost savings) or realize synergies through incremental revenues (e.g. complimentary products and services);

- Previous transactions. Where a buyer has been an active acquirer within a particular industry, that usually suggests that they are looking to grow through acquisition and will therefore be more responsive to new acquisition opportunities; and

- Financial resources. Buyers that have significant cash on their books or the ability to raise debt financing are more attractive than those that must rely on deferred payments to the seller in terms of promissory notes or other forms of consideration. In particular, public companies that find themselves with excessive cash may feel compelled to undertake acquisitions in order to appease market expectations.

Attracting Buyers

Enticing would-be buyers generally is best accomplished through a direct approach, i.e. telephone contact with the President, CFO or chief business development officer. Such an approach can be tedious and time consuming, but it can prove highly effective.

The direct approach allows the seller or their intermediary to tailor the script to each potential buyer, based on what is most likely to be of interest to them. In this regard, most buyers tend to be lured by the intangible aspects of what a company has to offer, such as a diverse base of repeat customers, highly trained employees, proprietary technology, and so on.

The direct approach also allows the seller or their intermediary to gain important feedback from the buyer. In many cases, the buyer will disclose considerable details regarding their business strategy or the reasons for their interest, which can become invaluable information in subsequent negotiations. Even buyers that do not have an interest can provide important feedback in terms of market expectations and value parameters.

Summary

At any point in time, there can be a variety of different buyers for a given business, including corporate buyers, individuals (for smaller businesses), management and private equity firms. Would-be sellers should consider a broad spectrum of potential buyers and rate them based on factors such as strategic fit, synergies, previous transactions and financial resources. Initiating direct contact with would-be buyers can provide useful feedback regarding the valuation metrics for a particular business and sometimes even invaluable information that can be used in subsequent negotiations.