Private equity has grown tremendously in Canada, and may still be a good option for some. There are several ways to use it. Make sure you’ve got the right approach.

The amount of private equity capital available has soared in recent years, and now stands at close to $600 billion in North America alone.

In addition to the many Canadian-based private equity firms searching for good investment opportunities, a growing number of players from the U.S. and other parts of the world are looking to Canada due to the scarcity of good prospects in their own country and the quality of the companies and management teams that reside here. Private equity firms are increasingly competing among themselves for the chance to secure an opportunity that meets their investment criteria.

Private equity firms may take a minority equity interest or a majority stake in an investee company. They may invest in the form of common share equity and/or offer other forms of financing (e.g. a combination of debt and equity). Some private equity firms will even specialize in certain industry segments. In most cases, private equity firms will set out their investment criteria on their websites (e.g. company size, investment size, purpose of financing, industry sectors, and so on).

Private equity can be a great resource in helping business owners and executives to fulfill strategic goals. In particular, private equity capital can be used for the following:

Acquisition or expansion financing. This tends to be a particularly appealing type of investment for private equity firms, which generally prefer to see their capital injected directly into a business to help it grow in contemplation of an ultimate exit strategy. In many cases, the ability to secure equity financing in respect of an acquisition or expansion enables a company greater access to additional debt financing as well, which allows all equity participants to leverage their investment returns;

Capital restructuring. Business owners who aren’t ready to sell, but who want to “take some chips off the table” can use private equity financing as a vehicle to accomplish their goals. Capital restructuring allows business owners to diversify their risk, since not all of their wealth will be tied up in their business. In other cases, private equity is used to help overly-levered companies reduce their debt burden, thereby freeing up more cash flow for investment as opposed to debt servicing;

Facilitating a management buyout (MBO). There’s a tremendous interest by private equity firms in financing an MBO for a company that is backed by a strong management team. Research has shown that MBOs have offered private equity firms more consistent returns than venture capital-type investments. MBOs can offer exceptional upside potential for managers who co-invest, as well as for business owners who retain a residual interest in their company;

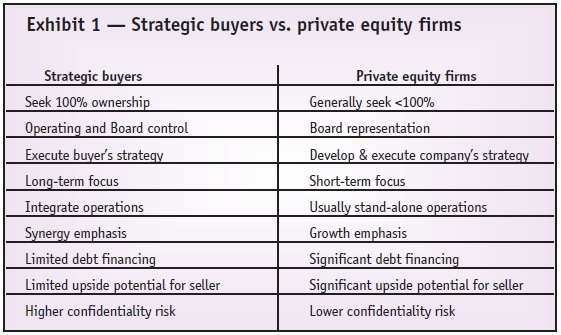

Selling a business. Many private equity firms are actively pursuing a rollup or consolidation strategy, whereby they acquire several companies in a particular industry segment and then either sell the combined entity to a large industry player or take it public. Private equity firms will normally employ considerable amounts of debt in an acquisition, which allows them to offer a price that rivals strategic buyers. Private equity firms have the advantage of ready access to capital and the ability to move quickly, which many strategic buyers are unable to do. A comparison of traditional strategic buyers vs. private equity firms is provided in Exhibit 1.

What private equity firms look for

Prior to approaching a private equity firm, business owners and executives should take steps to make their company a more attractive investment prospect. Private equity firms generally seek companies that have the following characteristics:

Strong business fundamentals. Private equity firms generally are more interested in companies having a sustainable differential advantage in the marketplace as opposed to those offering ‘me too’ type products and services. Companies that are leaders within a market niche may be particularly attractive. Private equity firms will emphasize a company’s ability to generate cash flow, both to reinvest for growth and to service debt;

Growth potential. Most private equity firms seek companies that can grow rapidly, either organically or through acquisition. This feature is consistent with their interest in exiting the investment within a few years;

A strong and committed management team. Private equity firms generally manage their investments through a presence on the company’s Board of Directors. They rely on management for both strategic input and daily operations. Therefore, private equity firms seek out dedicated management teams with a proven track record. They prefer companies with strong breadth and depth in their management ranks. In addition, many private equity firms will insist that key managers personally invest in the company in order to secure their commitment. In most cases, the absolute amount of the investment is not an issue, so long as it represents a meaningful commitment by the individual(s). Managers that do co-invest can realize lucrative upside potential where things turn out as planned;

Ability to leverage. Private equity firms generally seek to place a considerable amount of debt financing into their investee companies in order to reduce the size of their equity investment and magnify their returns. Therefore, private equity firms seek companies with good assets and strong cash flows, which can support debt financing at reasonable rates. However, it is important for business owners and executives to recognize that increasing debt financing also increases financial risk, and may result in cumbersome operating restrictions; and

Exit strategy opportunities. Private equity firms generally have a 3-7 year time horizon to liquidate their investment. They seek companies that can either be sold to a strategic buyer or are believed to be good candidates for an initial public offering. Also of increasing popularity is the sale to a larger private equity firm once the investee company has achieved a certain size. These various avenues offer ‘exit multiple expansion,’ which means that the effective valuation multiple paid on exit is expected to be richer than that paid on acquisition.

Private equity firms generally manage their investments through a presence on the company’s Board of Directors. They rely on management for both strategic input and daily operations.

Selecting a private equity firm

Private equity financing shouldn’t be seen as a one-way street. Business owners and executives should expect to receive more from their private equity partner than just a lump sum of cash on closing. Other important considerations include:

The structure of the private equity investment. Many private equity firms will look to increase their upside potential or protect their downside risk through the use of different share classes, convertible securities or other means of investment structuring. The structure of the investment can have major implications on the other stakeholders in the company;

The terms of the shareholders agreement, when the private equity firm doesn’t acquire 100% of a company. In some cases, even if the private equity firm does not have a majority of the voting shares, it can have ‘de facto’ control through the use of covenants, restrictions and other provisions contained in the shareholders agreement. The shareholders agreement will also stipulate each party’s entitlement to representation on the company’s Board of Directors;

Reporting requirements. This includes periodic financial statement preparation, as well as management and board presentations. Such requirements can represent a significant change from the way a company operated in the past, and may prove onerous for business owners and management;

The ability of the firm to accommodate follow-on financing, which may be needed to support growth or an unexpected shortfall in cash flow;

Alignment of interests with those of the business owner and management in terms of growth strategies, participation in upside potential and the implications if the company’s actual results fall short of plan; and

Value-added service offerings. Business owners and executives should expect that their private equity partner will provide things such as sound business advice, business contacts, and other services that will help their company to grow and prosper.

Business owners and executives should expect that their private equity partner will provide things such as sound business advice, business contacts, and other services that will help their company to grow and prosper.

In summary, private equity financing is a growing resource that can be tapped to facilitate expansion/ acquisition, capital restructuring, MBOs or the sale of a business. However, it’s important for business owners and executives to ensure that they select the right private equity partner and structure a deal in a way that allows them to satisfy their personal and financial goals.