Today marks a turning point for the EU's anti-subsidy regime. The Foreign Subsidies Regulation (FSR) will now become fully operational. As of 12 October 2023, the European Commission (EC) can review deals and tenders under the FSR's M&A and public procurement tools. Businesses are now also able and, where applicable, required to submit notifications on transactions and tenders in public procurement procedures. In this edition of our series, we explain why today is so significant.

M&A notifications

The FSR's M&A tool applies to transactions signed after 12 July 2023 (see here). It allows the EC to intervene in foreign state-backed M&A transactions. Deals that were signed after 12 July but have not been closed before today (12 October) are – if the notification thresholds are met – subject to the mandatory filing and review process. It is only as of today that notifications can be submitted to the EC under the FSR and the EC can formally review these deals.

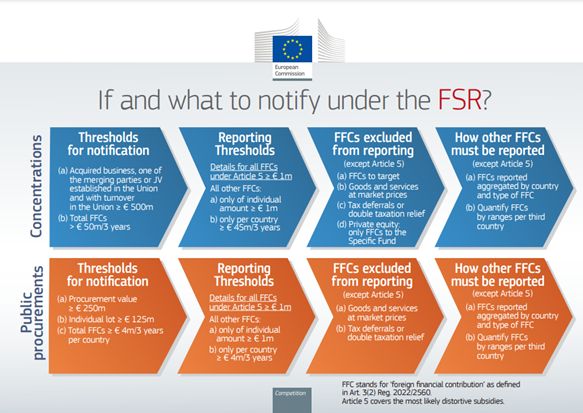

The FSR captures all transactions that result in the acquisition of control (as defined under the EU Merger Control Regulation), provided that

- at least one of the merging undertakings, the target or the joint venture, is established in the EU and generated a turnover of EUR 500m in the last financial year; and

- the financial contributions granted by third countries to the parties cumulatively exceeded EUR 50m over the last three years.

From now on, the EC may also use its call-in power. This authorises the EC to review (non-implemented) transactions even if the thresholds are not reached.

Public procurement notifications

As for the M&A tool, the FSR's provisions on public procurement notifications become fully applicable as of today, when the first formal filings may be submitted. The FSR's public procurement tool aims to prevent foreign-subsidised companies from distorting competition in the internal market by submitting unfairly advantageous bids in public tenders (see here).

If the value of the public contract exceeds EUR 250m (or EUR 125m in the case of tenders divided into lots), the bidders must either submit a full notification (if the bidder has received foreign financial contributions of at least EUR 4m per third country over the last three years) or a declaration of no notifiable subsidies as of today (12 October). The notification obligation kicking in today relates to any public procurement process initiated on or after 12 July 2023.

The EC can call in contracts that have been awarded since 12 July 2023 and may examine subsidies provided as far back as 12 July 2020.

Implementing Regulation

In the lead-up to the full application of the FSR, the EC enacted implementing rules, i.e. Implementing Regulation (EU) 2023/1441, which specify the information that needs to be provided in the notification under the M&A and public procurement tools. Scaling back from the initial proposal, the EC has now made it clear in the Regulation that detailed information on subsidies would only have to be provided if the foreign financial contributions (FFCs) are likely to distort the internal market (under the FFCs categories set out in Art. 5 FSR).

Source: European Commission

Nevertheless, comprehensive continuous monitoring of all FFCs will be required for the purposes of understanding whether the "subsidies" notification criterion (be it for the M&A or public procurement tool) is met.

In addition to the Implementing Regulation, the EC also introduced a Communication dealing with technical aspects such as submitting and signing notifications.

Conclusion

As of 12 October 2023, the Foreign Subsidies Regulation becomes an integral part of the EU regulatory framework, adding a new instrument to the EU's toolbox for tackling distortive foreign subsidies.

Mindful of the uncertainty and novelty of the FSR, the EC has pledged to publish guidance papers clarifying its functioning over the coming three years, reflecting on its experience up to that point. Until then, the EC will publish its decisions, which will hopefully help to solidify rules that are not yet fully clear.

For businesses, this new regime means another layer of red tape, which requires them to monitor and trace FFCs that may make them subject to the FSR.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.