Electrochromic glass has gained increasing attention in the last decade for its potential to improve the energy efficiency of buildings and cars. Senior Consultant and Chemistry Practice Leader Nicolas Nowak shares key findings from Questel's patent landscape analysis of this fascinating field of innovation.

The term "smart materials" is used to describe materials that can sense and react to external forces, such as light, temperature, stress, or electric or magnetic fields. One such smart material is electrochromic glass, which can improve the energy efficiency of buildings and cars by controlling the amount of sunlight that passes through a window.

What Is Electrochromic Glass?

We know glass mainly as the go-to material for windows and bottles, and it has specific properties (high hardness, transparency, stability, etc.) that make it very suitable for these applications. However, its transparency can also be one of its main drawbacks, as in buildings and cars, for example, where it can let in visible light and infrared radiation even when you don't want it to, creating overheated spaces.

Electrochromic glass describes smart types of glass that can change their tint or opacity in response to an electric voltage. It often consists of two glass layers, with a thin electrochromic coating in between. In the standard state, ions within the coating are distributed randomly, causing the light arriving upon them to be mostly diffused or reflected, rendering the glass dark or opaque. But when an electric current is applied, ions within the coating migrate or align themselves, causing the light to be able to pass through, making the glass transparent. The process is fully reversible, and the change in tint can be modulated as a function of the voltage applied.

To perform best, electrochromic glass needs software and controls to dictate when and how it should tint. These can use a combination of predictive and real-time inputs, such as weather, location, and cloud cover, to allow the software and controls to manage daylighting, glare, energy use, and color rendition throughout the day. With these, and additional set-up parameters, the glass can change automatically depending on the light and heat conditions and the users' preferences.

Electrochromic glass could be confused with photochromic glasses, which are often used in "transition" (sun)glasses but are very different from them. In photochromic glasses, the glass darkens when the number of photons it receives increases; there is no external action needed, the property is intrinsic to the material itself, and the change is gradual and very slow compared to most electrochromic systems.

Apart from the rapidity of action of the different types of electrochromic glasses, their main advantages concern:

- Energy efficiency: they can reduce energy consumption in buildings and cars by regulating the amount of heat and light that enters the space.

- Improved comfort: they can improve occupant comfort by reducing glare and heat gain, creating a more pleasant and comfortable environment.

- Privacy: they can provide privacy by darkening the glass on demand, reducing the need for curtains or blinds.

- Aesthetics: they can be used to create visually appealing facades and interiors, with the ability to change the appearance of the glass at the touch of a button.

Thanks to this ability to regulate light and heat transmission, they also have applications in various industries, such as automotive, construction, aerospace, and eyewear. In addition, they have recently been introduced into mobile phones for their camera shutters and screen displays, which will create ample opportunities for the electrochromic glass market. This market is expected to grow from $1.8 billion (bn) in 2022 to nearly $4 billion by 2030, meaning global demand should rise by around 9% per year.

Analysis of the Competitive Landscape and Market Share for Electrochromic Glass

Patent landscape analysis offers valuable insight into innovation, including helping us to predict the future of technology. In this part, I will share what patent filings for electrochromic glass innovation can tell us about the next generation of these materials, including the major industry players and main research and development (R&D) markets behind this innovative solution.

What do patent dynamics tell us about the innovation status of this technology?

To understand the innovation and R&D activities in this technology, we performed a macro search using our proprietary IP intelligence software. By analyzing the patents collected using our IP consulting services expertise, we were able to create a fascinating global insight into research advancement and investment in this field.

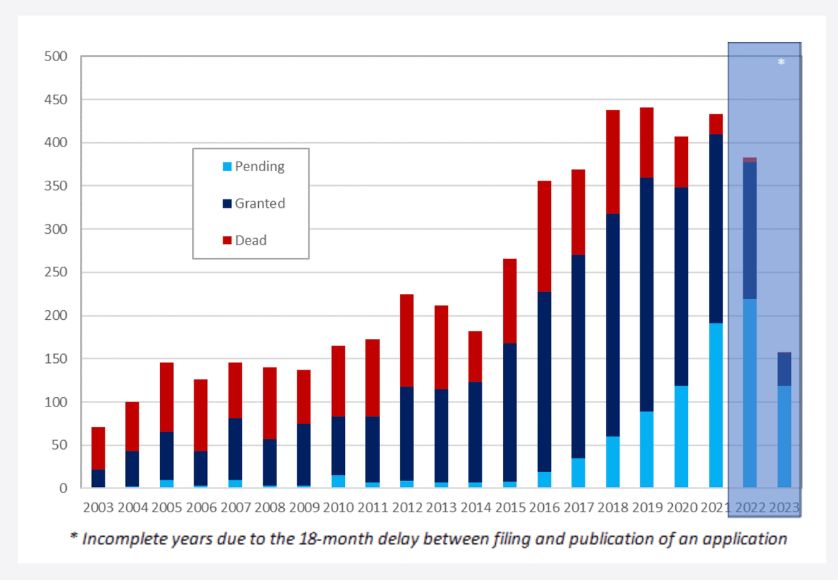

In total, the database comprises 5,080 patent families filed in the last 20 years. Patent filing dynamics reveal an established technology that still saw an activity increase in the last 20 years, although this trend seems to be coming to a halt in the last four years (2018-2021). The number of patent families retrieved was around 70 in 2003 and now lingers at around 440 fillings per year.

Smart Materials: Geographical Hotspots for Electrochromic Glass Innovations

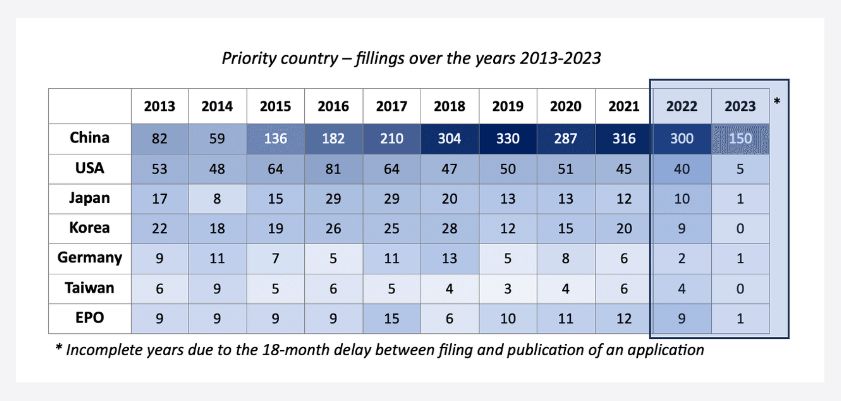

Priority country filling most often occurs in the country in which the R&D is made, so looking at this data shows us which countries are the most innovative and which are the ones that seek to protect their inventions. Although the top three players are European and American, China is still identified as the major country of origin for electrochromic glass inventions, with approximately 52% of the total number of patent families.

U.S. and Japanese companies follow with 17% and 9% of patents being filed first in these countries. European contribution to research activities is still small compared to those of Asia and the U.S., but the filing activity in Europe seems to be more important than at the beginning of the period. The numerous European legislations relating to saving building energy consumption might be one of the reasons for this activity, although it is still far below China and U.S. levels.

Market Coverage for Electrochromic Glass Innovations

It is no surprise to see the highest number of inventions have been published in the main innovation countries, namely China and the USA. But Europe climbs to third place here as the market seems more mature with more advanced energy savings programs like the Green Deal.

Patent Dynamics and Top Players

Major players from the glass and chemistry industries can be found among the main innovation investors in electrochromic glass patents. The main contributor is Saint-Gobain—in particular, its subsidiaries Saint-Gobain Glass and Sage Glass. The group owns 175 patent families, 148 of them still live.

View is a pure player in the field, having specialized in smart windows, and the company has 115 patent families in our database, 110 of them being live. However, the company has recently been having problems with the U.S. Securities and Exchange Commission (SEC),which has brought alleged fraud charges. Nonetheless, its patent portfolio remains a leading one and could interest potential buyers or investors for the company.

Other important players are Corning, LG Chem, BOE Technology Group, and Schott, which are established companies that are getting into the field or ensuring a leading position as a visible player in the domain. However, there are also smaller companies of note, most of which are pure players; for example, Gentex, an original equipment manufacturer (OEM) for car manufacturers specialized in developing and manufacturing custom high-tech electronic products for the automotive and aerospace fields. Similarly, Halio (formerly Kinestral Technologies) is active in the building/construction domain as a developer and manufacturer of advanced electrochromic technology to make fast-tinting smart glass windows.

The following table shows the patent activity ofsome of the main actorsin the last 10 years.

What we can see here is that Saint-Gobain, an established actor in the glass industry, is still innovative in the field, with the company's patenting activity in the last five years at the highest it has ever been. On the other hand, Corning, Schott, and AGC Glass, three other main actors in the glass industry, seem to be slowly reducing their activity in electrochromic glasses.

Another interesting takeaway of this graph is the recent arrival, from 2017 to 2019, of actors from the telecommunications world (Guangdong Oppo Mobile Telecommunications, Truly Opto-electronics, Legend Vision Electromechanical), filing patents for electrochromic glass with a main application for mobile phones. Patent landscape analysis confirms here the growing interest in these materials for the sector.

Accordingly, we can clearly see that the market for electrochromic glasses is set to grow, thanks to demand from three main sectors:

- the building industry, for which electrochromic glasses can help regulate heat and light and save energy in the context of climate change;

- the car industry, whose glass sunroofs would similarly benefit from these innovations by helping to regulate light and heat, and

- the mobile phone sector, which has seen fast-growing demand in the last five years.

Patent landscape analysis can provide valuable insights into R&D and innovation trends and markets, as we hope this analysis on the electrochromic glass illustrates. For further details on patent activity in the mobile telecommunications sector or for specific advice or support,contact the Questel IP Consulting team.

For further insights, follow our publications and webinars in ourResource HubandWebinars & Eventspage.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.