Making the complex simple Malta VAT Treatment

In November 2005, the Maltese VAT Department issued Guidelines explaining the Department's policy with regard to the VAT treatment of yacht leasing arrangements entered into by Maltese companies.

The following is a summary of the Guidelines:

a) The Guidelines relate to a leasing arrangement with respect to a yacht, entered into between a Maltese company and a lessee, which may be either a company or an individual, whether resident in Malta or not.

b) Since the lessor company uses the yacht for its economic activity [the leasing and potentially the sale of the yacht to the lessee], it has a right to deduct any input VAT incurred on the purchase of the yacht.

c) The monthly lease charges by the lessor to the lessee are subject to VAT at the standard Malta VAT rate of 18%. However, since it is deemed that the yacht will be used partly in EU territorial waters and partly outside EU territorial waters, VAT would be chargeable only on the portion that the yacht is deemed, during the period of the lease, to be used in EU territorial waters.

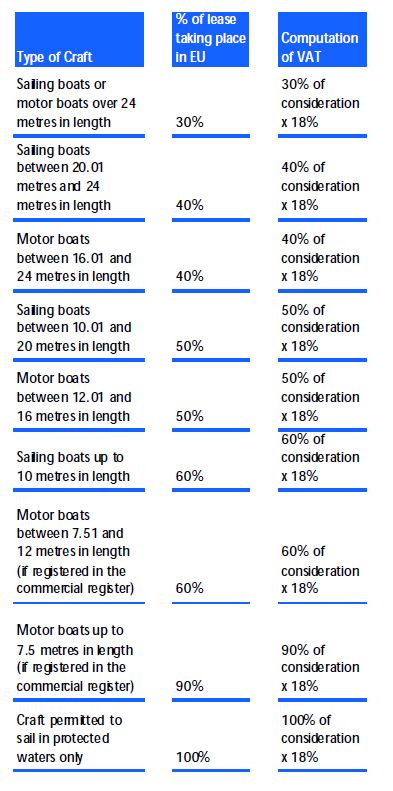

d) In view of the practical difficulty in trailing the movements of yachts to determine the time they spend in EU territorial waters and the time they spend outside EU territorial waters, the VAT Guidelines indicate that this percentage will be determined according to the type of the craft as demonstrated in the following table that can be found overleaf.

Thus, for example, a sailing boat that is over 24 metres in length is deemed to be used for 30% of the time in EU territorial waters and for 70% of the time outside EU territorial waters. Consequently, Maltese VAT would be chargeable by the lessor to the lessee on 30% of the lease payments, whilst no VAT would be chargeable on 70% of the lease payments as they are considered to be in relation to the time the yacht was used outside EU territorial waters.

Conditions for VAT treatment to apply

In order for the above VAT treatment to apply, a number of conditions have to be satisfied. These are:

a) The yacht must come into Malta, preferably at the beginning of the lease agreement;

b) An initial contribution shall be paid by the lessee to the lessor amounting to at least 50% of the value of the craft;

c) The lease instalments shall be payable every month and the lease agreement shall not exceed 36 months;

d) The lessor shall be expected to make a profit from the leasing agreement, over and above the value of the boat;

e) The final payment at the end of the lease agreement, as a result of which the ownership of the yacht effectively passes to the lessee shall not be less than 1% of the value of the yacht. The final lease payment is chargeable to VAT at 18%.

f) Prior approval must be sought in writing from the Commissioner of VAT who must approve the value of the yacht and the applicable percentage on which VAT is chargeable according to the use of the yacht in EU territorial waters.

VAT paid certificate

If the lessee opts to purchase the yacht at the end of the lease, a VAT paid certificate will be issued to the lessee provided that all VAT due has been paid.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.