FOREIGN INVESTMENT REGIME IN TURKEY

- "Foreign investments" are

defined as:

- incorporation of new companies,

- establishment of branches,

- acquisition of shares in Turkish companies, or

- acquisition of at least 10% shareholding or voting rights in Turkish companies traded on a stock exchange,

- Foreign investments are not subject to government approval, except for setting up liaison offices and investing in regulated industries such as banking, financial services, capital markets, civil aviation and education.

- Foreign investments are required to

be notified to the Investment Incentive and Foreign Investment

General Directorate of the Ministry of Economy (the

"FIGD") through an internet-based

application ("E-TUYS") in the following

circumstances:

- within one month following the transfer of shares in the Turkish company to an existing Turkish or foreign shareholder or a non-shareholder;

- within one month following a capital contribution; and

- on an annual basis (no later than May of each year) regarding their operations in the preceding year.

- Foreign investors are free to transfer dividend payments, sale or liquidation proceeds, compensation payments or loan repayments (whether principal or interest) they receive in Turkey through banks or other authorized financial entities.

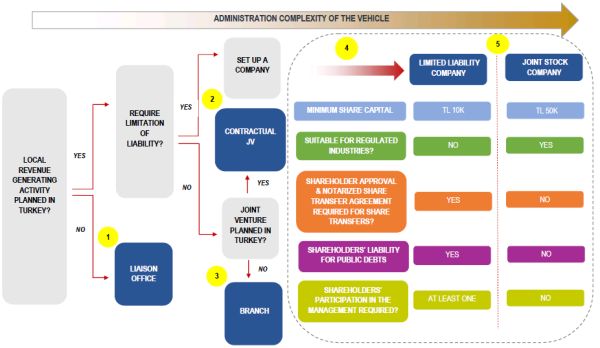

INVESTMENT VEHICLES

(1) LIAISON OFFICE

- Foreign companies are allowed to establish liaison offices subject to the prior approval of the FIGD.

- IMPORTANT: Liaison offices are prohibited from engaging in any commercial activity. Any activity which involve invoicing clients for goods and services would be deemed as "commercial activity".

- Liaison offices can be set up to

engage in activities such as:

- representation of the parent company and coordination and organization of business contacts located in Turkey,

- quality and standards control of suppliers and selection of suppliers based in Turkey,

- providing technical, educational and quality standards improvement support to suppliers and distributors based in Turkey,

- collecting and transferring of information to the parent regarding market developments, consumer trends, sales and performance of competitors and distributors,

- market research,

- regional hub operations for providing coordination and management services to the parent's investments in other countries relating to investment and management strategies, planning, marketing, sales, post-sales services, brand management, financial management, technical support, R&D, supply, testing of new products, laboratory services, personnel training, etc.

- FIGD evaluates requests by foreign companies to set up liaison offices to operate in regulated industries such as banking, capital markets and insurance, in coordination with the relevant regulatory authorities.

- All expenses of the liaison office must be paid by the funds transferred to Turkey from abroad by the parent company. There is no minimum capital requirement for establishing liaison offices. The necessary funding amount will depend on the estimated expenditures of the liaison office.

- FIGD does not permit repatriation of liaison office's funds except as a result of the closure and/or liquidation of the liaison office.

- FIGD approval to establish a liaison

office can be granted for a maximum initial term of three (3)

years. This three-year term is extendable at FIGD's discretion

upon application. The extension depends on the past operations,

future business plans and targets of the liaison office and the

number of personnel employed.

- FIGD can extend the permitted term of the liaison office by a maximum period of five (5) years, except for liaison offices that are set up for regional hub operations for which an extension may be granted up to ten (10) years.

- FIGD does not extend terms of liaison offices set up for market research and marketing of parent's goods and services.

- The liaison office's activities must be reported annually to FIGD no later than end of May of the following year. Documents evidencing that all expenditures of the liaison office have been funded from outside of Turkey must be attached to this form.

Taxation of Liaison Offices

- No corporate tax or indirect tax liabilities such as VAT as liaison offices cannot carry out any commercial activity.

- Although liaison offices are not liable for direct or indirect taxes, they are obliged to withhold income tax from certain payments such as payments to independent professional service providers, individual landlords and certain salary payments (in Turkish Lira).

- The salary payments made to the liaison office employees in foreign currency are exempt from income tax.

- Liaison offices are obliged to withhold social security contribution of employees and pay it to the Social Security Institution.

(2) CONTRACTUAL JOINT VENTURE ("JV")

- The contractual JVs do not have a legal entity and deemed as simple partnerships.

- The JV partners have unlimited joint and several liabilities for the operations and transactions of the JV.

- No approval or registration required for establishment.

- No formal requirement for the JV agreement. However, notarized contract is recommended for evidence and enforcement purposes, as well as being eligible for certain public tenders.

- No minimum capital requirement.

Taxation of Contractual JV

- VAT liability.

- Withholding tax liability on certain payments (e.g. payments to independent professional service providers, individual landlords and certain salary payments).

- No requirement for corporate tax liability. The profit can be taxed through JV partners. However, Turkish Corporate Tax Law provides an option to set up separate corporate tax liability on behalf of the contractual JV.

(3) BRANCH

- A branch of a foreign company can be established by registering to the relevant trade registry where the branch is located (e.g. Istanbul Trade Registry). A registration application (along with a list of documents) would need to be filed to the registry.

- The branch does not have a separate legal entity and the parent has direct liability for all transactions of the branch irrespective of the capital allocated to the branch itself.

- No minimum capital requirement but allocation of at least TL 100k is recommended for the operations of the branch.

- A branch representative with unlimited authority must be appointed.

- The branch representative must be a Turkish resident.

- Following the establishment of a branch by a foreign parent, the branch must authorize a representative for E-TUYS and file a notification to FIGD.

- The branch's activities must be reported annually to FIGD through E-TUYS no later than end of May of the following year.

- Taxation of Branches: Same as companies. Please see the relevant paragraph for companies in Section 4 below.

(4) COMPANY

Is the incorporation of a Turkish company subject to approval?

- General Rule: The incorporation of a joint stock company (Aktiengesellschaft, société anonyme) or a limited liability company (GmbH, société à responsibilité limitée) is not subject to approval of any administrative body. Registration to the relevant trade registry (e.g. Istanbul Trade Registry) is sufficient.

- Exception: The

incorporation of joint stock companies engaged in certain

industries such as the following are subject to the

approval of the Ministry of Trade prior to

registering to the trade registry:

- banks, financial leasing companies and factoring companies,

- consumer finance and card services companies,

- asset management companies,

- insurance companies,

- holding companies incorporated as joint stock companies, and

- public companies.

- Incorporation of companies in regulated industries such as banking, financial services, insurance or civil aviation may require the additional approval of the relevant regulatory body (e.g. Banking Regulation and Supervision Authority for companies engaged in banking and financial services industry, the Treasury for insurance companies, Civil Aviation General Directorate for companies engaged in the civil aviation industry).

- Following the incorporation of a company by a foreign shareholder, the company must authorize a representative for E-TUYS and file a notification to FIGD.

Taxation of Joint Stock and Limited Liability Companies

- Incorporation Payment (Competition Authority Fund Payment): 4/10,000 of the capital commitment in company incorporations and capital increases must be deposited to the trade registry for the Competition Authority fund before the registration.

- Corporate Tax: The

corporate income tax rate is 20% (the rate has been increased to

22% for the years 2018, 2019 and 2020).

- Corporate tax is payable by the end of the fourth month following the relevant financial year (i.e. if the calendar year is accepted as the accounting year - end of April each year).

- Tax losses can be carried forward up to five (5) years. Tax losses which are not offset in the following five-years expire.

- Companies are also required to pay a 20% advance corporate tax (22% for the years 2018, 2019 and 2020) based on their quarterly profits by the end of the second month following each quarter. Advance corporate taxes paid during the tax year are offset against the final corporate income tax liability of the company. Excess is refunded or offset against other tax liabilities.

- Dividend Distribution

Withholding Tax: 15% dividend withholding tax is

applicable to dividends distributed to individuals and foreign

corporate shareholders.

- The withholding tax rate varies according to the tax treaties signed between Turkey and the country of the shareholder. The final dividend distribution withholding tax rate must be confirmed according to the relevant tax treaty.

- Legal Reserves:

Joint stock companies and limited liability companies are required

to set aside primary and secondary legal reserves out of their

profits.

- Primary legal reserves: Companies are required to set aside 5% of their net profits each year until the legal reserves reach 20% of the paid-up capital.

- Secondary legal reserves: Companies are required to further set aside 10% of the dividend to be distributed to shareholders after the obligatory 5% dividend is distributed.

(5) LIMITED LIABILITY COMPANY AND JOINT STOCK COMPANY COMPARISON1

| LIMITED LIABILITY COMPANY ("LLC") | JOINT STOCK COMPANY ("JSC") | |

| Minimum Share Capital | TL 10,000 (c. USD

20002) minimum capital is required. The total initial share capital has to be paid within two (2) years following incorporation. No requirement to pay the share capital at the time of registration. |

TL 50,000 (c. USD

10,000) minimum capital is required. ¼ of this amount must be paid at incorporation while the remaining ¾ can be paid within two (2) years following the incorporation. |

| Regulated Industry Suitability | Certain regulated industry operations (e.g. banking, radio and television broadcasting, certain civil aviation activities etc.) cannot be performed by LLCs. | Certain regulated industries (e.g. banking, radio and television broadcasting, certain civil aviation activities) require JSCs to carry out the relevant commercial activity. |

| IPO | IPO is not possible for LLCs. LLCs must be converted to JSCs before their shares are offered to public. | Only JSC shares can be offered to public. |

| Share Transfers3 | The share transfer

document must be notarized. Unless otherwise provided in the articles of association ("Articles"), any transfer of shares in an LLC must be approved by the affirmative votes of the majority of those attending the general assembly of shareholders – approval is required for a proposed share transfer to take effect. The general assembly approval requirement may be removed in the Articles. The shareholders may reject the share transfer without any just or valid reason, unless it is provided in the Articles that the general assembly of shareholders may only reject share transfers for certain just reasons. The Articles of an LLC may forbid share transfers. General Tip: LLCs are more suitable for strict share transfer restrictions. |

No formal requirement

for the share transfer document. No shareholder approval requirement for the share transfer to take place. However, the transfer of registered shares and shareholding that is not represented by share certificates must be recorded in the company's share ledger in order to be enforceable against the JSC. A board resolution is usually passed in practice to approve the share transfer and register it to the company share ledger. Transfer of registered shares can only be restricted based on just reasons set out in the Articles or through the purchase of the shares intended for sale by the JSC on its own behalf or on behalf of other shareholders or third parties. The transfer of registered shares may be held subject to company approval in the Articles. It is more difficult to enforce share transfer restrictions in JSCs. |

|

Shareholders' Liability For Public

Debts (tax, administrative fines, social security premiums etc.) |

Shareholders are liable

for the company's unpaid public debts if the company fails to

make the required payment. The shareholders' liability is

pro rata to their shareholding percentage in the

company. The managers of an LLC also have a secondary liability for the unpaid public debts of the company. |

The shareholders are not

liable for unpaid public debts of the company, provided that they

are not in the board of directors. The liability of the directors

for unpaid public debts cannot be removed. Similar to an LLC, the directors of a joint stock company have a secondary liability for the unpaid public debts of the company. |

|

Shareholders' Liability For Private

Debts (to banks, suppliers etc.) |

Unless otherwise

provided in the Articles, shareholders' liability for private

debts is limited to their capital contribution to the

company. If the Articles or the shareholders' meeting decision passed with unanimity provide that additional contribution may be requested from shareholders, shareholders may be required to put in extra funds into the company under certain circumstances (e.g. in the event of financial difficulty). However, if the Articles of an LLC does not provide for any ancillary obligations, the shareholders' liability will be limited to their capital contribution similar to a JSC. |

Shareholders'

liability is limited to their capital contribution to the

JSC. Ancillary obligations (other than capital commitment) cannot be imposed on the JSC shareholder. |

| Management | At least one of the

shareholders must be a manager of the company. Such shareholder

must be granted representation and signature authority to represent

and bind the company. Although it is not required by the commercial code, the tax office may require at least one of the managers to be a Turkish resident. |

No requirement for

shareholders to be directors of the company. At least one of the

directors (who does not have to be a shareholder) must be granted

representation and signature authority to represent and bind the

company. Similar to an LLC, the tax office may require at least one of the directors to be a Turkish resident. |

Footnotes

1. Only major headline differences between limited liability companies and joint stock companies are listed herein. There may be other differences such as meeting quorums that may be important for the specifics of your case. We would be pleased to advise you on the best form of company according to the specifics of your case.

2. For the purposes of this guide, it is assumed that USD/TL:5.

3. The share transfer tax considerations (e.g. income tax and/or VAT) may differ in LLCs and JSCs. Please contact us to determine the better company form that suits the specifics of your case.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.