As the 2019 year comes to a close, it's important to note how our clients may be impacted by the current estate and gift tax exemptions, the rules around annual exclusion gifts, and the changes to charitable donation treatments. We have outlined these below.

The Current State of the Wealth Transfer Tax System

The Tax Cuts and Jobs Act (the "Jobs Act"), signed into law about two years ago (Tax Cuts and Jobs Act, Pub. L. No. 115-97, 12/22/17), altered many provisions of the Internal Revenue Code, which resulted in substantial changes to the calculation of personal and entity-level income taxes. In addition to various income tax changes, the Jobs Act nearly doubled the wealth that individuals can transfer without incurring a wealth transfer tax (known as the basic exclusion amount) from a historic high of $5,490,000 to $11,400,000 in 2019, indexed for a cost of living inflation adjustment ($11,580,000 in 2020). The exemption levels will be cut in half on January 1st, 2026, when many provisions of the Jobs Act expire, or perhaps even sooner if a new administration legislates preemptively. Although even fewer individuals are now affected by the wealth transfer tax, many have significant opportunities for making lifetime gifts and should take an interest in wealth transfer planning in anticipation of a reversion to previous estate and gift tax exemption levels.

It's important to also note that New York imposes an estate tax on individuals with taxable estates in excess of a basic exclusion amount, which is $5,740,000 for 2019 and will increase to $5,850,000 for 2020. The tax is imposed on both New York residents and also on non-residents with real or tangible property located in New York. Unlike the federal estate tax, which only applies to amounts in excess of the federal basic exclusion amount, individuals with estates which exceed the New York basic exclusion amount by more than 5% must pay New York estate tax on the entirety of their estates. While New York has no gift tax, gifts made within 3 years of death are added back in determining a New York taxable estate. In view of the maximum New York estate tax rate of 16%, careful planning must be considered.

Make Year-End Annual Exclusion Gifts

As year-end approaches, it is an ideal time to make gifts, as many individuals know both their financial picture for the year and how much they can afford to give. The first $15,000 of gifts ($30,000 for married couples who split gifts) made by a donor to each donee in calendar year 2019 is excluded from the amount of the donor's taxable gifts. Making use of the annual exclusion can save estate tax because the cash or other assets comprising the gifts and the post-transfer appreciation in their value are removed from the donor's estate at no transfer tax cost. It is important to note that married couples who want to split gifts must file federal gift tax returns and make a gift-splitting election to maximize treatment.

Expanded Educational Gifts. Annual exclusion gifts may also be made to a 529 qualified tuition plan on behalf of a designated beneficiary. The earnings on the contributions build up tax-free. Additionally, rather than only making a single year's worth of annual exclusion gifts to a 529 plan each year, one may "front-load" $75,000 to each of one's beneficiaries through the end of 2019, utilizing the next 5 years of annual exclusion gifts for such beneficiary all at once. If you front-load a 529 account, please note that: (1) you will have to file a gift tax return, and (2) you will not be able to make any additional annual exclusion gifts to that beneficiary for five years, other than to account for inflation adjustments to the annual exclusion (if any).

The Jobs Act made some changes to the 529 plan rules (which took effect for 529 plan distributions after 2017), which qualified tuition for elementary or secondary public, private, or religious schools as an higher education expense. But there is a limit to how much of a distribution can be taken from a 529 plan for these types of expenses, which totals $10,000 per single beneficiary during any tax year for elementary school and secondary school tuition incurred during the tax year.

Use It or Lose It. An individual can't carry over any unused gift tax annual exclusions to a subsequent tax year. Thus, an individual who plans to take advantage of the annual exclusion to make a gift to one or more individuals this year must make sure that he or she "completes" the gift this year. This can be a problem where a gift is made by check. Generally, a gift to a donee that is made by check is complete on the date on which the donee deposits the check or presents the check for payment, if it is established that the check was deposited, cashed, or presented in the calendar year for which completed gift treatment is sought and within a reasonable time of issuance.

Those individuals making gifts by check near the end of 2019 with the desire to take advantage of this year's annual exclusion should remind the gift recipients to deposit the checks before year-end to eliminate any doubt as to when the gift was made.

Tax Free Gifts for Tuition and Medical Expenses. Making a direct payment of a family member's tuition or medical expenses to the educational institution or health care provider is not a taxable gift, and therefore doesn't count against one's annual exclusion or gift tax exemption.

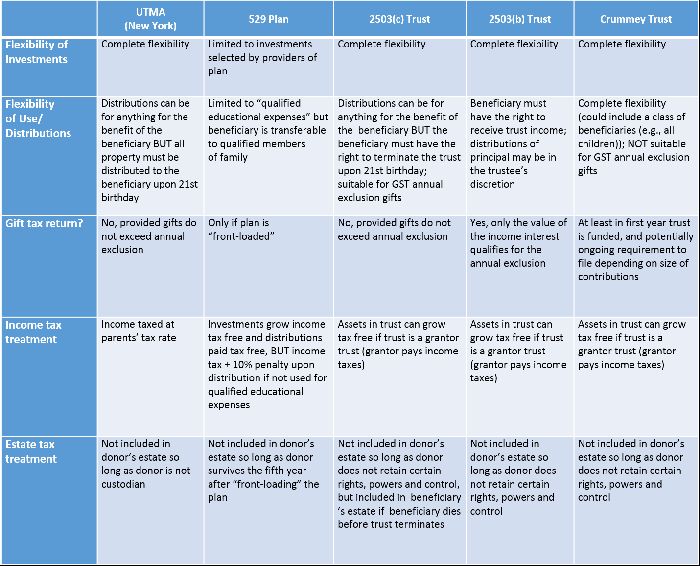

Annual Exclusion Gifts to Minors. When making an annual exclusion gift to an adult, one would think that simply writing the beneficiary a check is a viable option. But when the beneficiary of an annual exclusion gift is a minor, there are a limited number of means to complete the gift – each with its own set of technical requirements. The table below highlights some of the differences between the most common "targets" of annual exclusion gifts to minors.

Charitable Donations

- Year-end is a great time to make donations to qualified charities. Generally, cash donations to public charities are fully deductible up to 60% of adjusted gross income ("AGI") and gifts of appreciated property or gifts for use by public charities are deductible up to 30% of AGI. This benefit only applies if you itemize deductions. For donations made during the year, be sure to get acknowledgement letters from qualified charities for both cash and property (including stock donations) over $250. If you are not certain if a particular charity is qualified, you can consult the IRS website and search for the organization in question.

- Consider bunching donations into alternating years if your total itemized deductions on those years would then surpass your standard deduction.

- Donate appreciated stock held for more than one year to charity and get a fair market value deduction. By doing so, you avoid paying capital gains tax you would otherwise incur by selling the stock.

- Sell depreciated stock and donate the cash proceeds to charity. You will receive a charitable deduction as well as a capital loss benefit on the sale of stock. Capital losses offset capital gains, and any resulting net loss in future years offsets a maximum of $3,000 in ordinary income for a married filing joint taxpayer ($1,500 for all other taxpayers).

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.