On 15 January 2020 President Donald J. Trump and Chinese Vice Premier Liu He signed a "Phase One" agreement between the United States and China, a truce halting the escalating trade tensions between the two global trading heavyweights. The Phase One agreement follows an investigation by the Office of the United States Trade Representative (USTR) into Chinese trade practices that culminated in substantial and expansive U.S. tariffs on more than US$350 billion worth of Chinese exports to the United States. The agreement is scheduled to become effective on 14 February 2020.

The Phase One agreementincludes commitments by China, including: (1) purchasing an additional US$200 billion in U.S. goods (manufactured, agriculture, and energy) and services, compared with baseline Chinese purchases in 2017; (2) introducing sectoral reforms, including improved intellectual property protections; (3) prohibiting forced technology transfers; (4) removing barriers to U.S. agricultural imports; and (5) liberalizing financial services. The agreement also includes a commitment to cooperate on macroeconomic policy and exchange rates.

The Phase One agreement addresses certain U.S. priorities, such as trade secrets, pharmaceutical patents, forced technology transfers, market access for U.S. agricultural and financial services products, and other longstanding U.S. concerns about intellectual property rights. Notwithstanding, U.S. tariffs remain in effect on more than US$350 billion worth of Chinese goods, and several systemic issues were put off for a phase two agreement. Accordingly, while potentially significant, the Phase One deal should be viewed as a short-term truce until the parties attempt to resolve more challenging systemic issues. In addition, the deal rests heavily on China's implementation of its specific terms –in order to enforce the parties' commitments, the deal contains an innovative "dispute settlement arrangement," permitting either party to impose additional tariffs if consultations do not produce a solution.

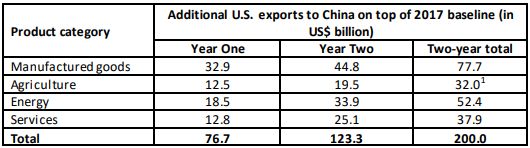

China's commitments to increase U.S. imports of U.S. goods and services by US$200 billion compared to 2017 baseline

China agreed to increase imports of U.S. goods (manufactured, agriculture, and energy ) and services, between 1 January 2020 and 31 December 2021, by at least US$200 billion as compared to a 2017 baseline. China has been wary about publicizing the specifics of its commitments, and certain enumerated targets are ambitious. The Phase One agreement includes specific sectoral commitments, as well as specific four-digit Harmonized Tariff System numbers, for articles that China has committed to purchase during the two-year period:

China agrees to implement domestic sectoral reforms

- Intellectual property (IP):China committed to provide additional protections for trade secrets, pharmaceutical patents and data exclusivity, and confidential business information. It also agreed to crack down on a host of longstanding IP rights abuses, e.g., counterfeiting, abusive trademarks registrations, and e-commerce market. China further pledged to issue an Action Planwithin 30 days of the agreement's entry into force outlining changes to its IP regulations. Specific changes include civil liability for trade secrets theft, shifting burden of proof to the defendants when there is a reasonable indication of trade secrets theft, an easier preliminary injunction process for trade secrets owners, criminal investigations and penalties enforcement, and the prohibition of trade secrets disclosure (and subsequent enforcement) by government officials. China also agreed to increase penalties and damages for IP theft. Substantive outcomes depend on China's implementation of these commitments, since U.S. companies have often faced difficulties in securing remedies in China's legal system.

- Technology transfer:China agreed to enact regulations prohibiting technology transfer as a condition for market access or advantages, and enhancing due process and transparency and preventing government pressure for such transfers. Transfers of U.S. technology and trade secrets have been one of the biggest complaints by U.S. industry with respect to trading with and operating in China. They were also a key basis for the Section 301 investigation and subsequent imposition of tariffs. Since China has argued that such transfers are "voluntary" and has made repeated commitments to previous U.S. administrations to halt the practice, whether these commitments yield substantive policy changes depends (again) on China's implementationof these commitments.

- Trade in food and agricultural products:The United States made important gains in addressing several longstanding nontariff barriers to U.S. farm products. These policy changes address barriers faced by U.S. agricultural imports entering the Chinese market. Both countries agreed that their sanitary and phytosanitary measures should be science- and riskbased in order to facilitate imports of U.S. food and agricultural products. For example, the Phase One agreement sets deadlines for the implementation of sanitary and phytosanitary measures. China also commits to addressing regulatory barriers to U.S. food and agricultural products, including dairy, infant formula, meat, poultry, rice, potatoes, nectarines, blueberries, avocadoes, barley, alfalfa pellets, hay, feed additives, dried distillers' grains with solubles, seafood, and pet food.

- Financial services:China agreed to remove restrictions on U.S. financial institutions and insurance companies. For example, foreign equity limits are to be eliminated, and wholly U.S.-owned financial services companies are to be permitted to provide certain services. China also will accelerate consideration of applications by U.S. companies seeking to provide financial services, including banking, credit rating, electronic payments, financial asset and fund management, and insurance services. These commitments include reforms that will be effective beginning 1 April 2020, seven months earlier than China's previous commitment. On the other side, the United States agreed to the nondiscriminatory treatment of Chinese financial service providers in the United States and to consider expeditiously pending requests from Chinese financial services providers, including CITIC Group, China Reinsurance Group, and China International Capital Corporation. In recent years, China has signaled its interest in opening up and internationalizing its capital markets, so these reforms could offer new market opportunities in China.

- Chinese tariffs on U.S. exports:China's retaliatory tariffs on roughly US$60 billion of U.S. exports were not addressed and apparently will remain in effect. They could be waived on a case-by-case basis to facilitate U.S. purchases, as China's US$200 billion purchase commitment will be difficult to fulfill if the tariffs remain in effect.

What does China get out of the deal?

China secured U.S. commitments on certain market access issues (e.g., expeditious consideration of licenses for certain Chinese financial institutions (though the outcome of such considerations are uncertain)) and achieved some important policy goals. First, the United States agreed to drop its List 4b tariffs that were scheduled to go into effect on 15 December and would have hit several big exports –including smartphones, laptops, apparel, toys, video game consoles, etc. The United States also agreed to reduce its List 4a tariffs, which affect key exports of consumer goods, from 15 percent to 7.5 percent.

Second, the Phase One deal arrests the deterioration in U.S.-China trade relations, which were poised to become evenworse. More importantly, the deal represents a step toward shoring up business confidence, particularly for the Chinese private sector, which has borne the brunt of the trade war and remains pivotal for the country's economic growth and employment.

Finally, China has bought additional time to negotiate with the United States. Future talks are necessary to address several substantive issues not covered by the Phase One deal.

China and the United States reaffirm International Monetary Fund (IMF) commitments on monetary policy

China and the United States simultaneously affirmed their respective autonomy to implement monetary policy under their domestic laws, reaffirmed commitments to avoid currency manipulation, and agreed to the regular public disclosure of monetary policy metrics. The United States and China also agreed that failure to abide by their respective monetary policy commitments under the agreement would trigger its dispute resolution process (see below). Disputes not resolvable under the agreement will be addressed at the IMF.

Bilateral evaluation enforcement arrangement

Finally, the United States and China have agreed to implement an evaluation and dispute resolution arrangement "to ensure prompt and effective implementation" of the Phase One agreement. China and the United States committed to establishing mutual Bilateral Evaluation and Dispute Resolution Offices to be led by a Deputy U.S. Trade Representative and Vice Minister, respectively, to implement the arrangement. Furthermore, the two sides also agreed to establish a Trade Framework Group, which will be chaired by the USTR and a designated Chinese Vice Premier, to evaluate implementation of the agreement.

The agreement contemplates monthly consultations at the Assistant USTR level, quarterly consultations at the Deputy USTR/Vice Minister level, and biannual consultations at the USTR/Vice Premier level to oversee implementation. It establishes a unique dispute resolution process to resolve concerns about alleged violations of specific obligations. The process entails consultations with designated officials to be followed by an appeals process to more senior officials, including the USTR and a designated Chinese Vice Premier. If the parties cannot agree on a solution, the aggrieved party can respond by imposing higher tariffs. The other party cannot retaliate, unless it wants to take the ultimate step of terminating the agreement, which is permitted on 60 days'notice.

Lastly, the United States and China will resume regular meetings on monetary policy and other economic issues. Those discussions will be led by the U.S. Secretary of the Treasury and a designated Chinese Vice Premier.

Conclusion

The Phase One agreement reflects an important de-escalation of the 18-month old trade dispute between the United States and China. Notwithstanding, trade tensions between the two trading titans remain high as evidenced by the maintenance of U.S. tariffs on US$350billion in Chinese exports and the unclear fate of Chinese tariffs on more than US$60 billion in U.S. exports. Finally, while phase two negotiations are expected to begin in the near term, any new agreement is not expected until after the 2020 U.S. presidential election.

Footnotes

1. China will "strive" to pu rchase US$5 billion more per year than the specific agriculture commitments.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.