The 2020 Appropriation Bill, "budget of sustainable growth and job creation", was presented by the President to the National Assembly on the 9th of October 2019 along with the draft Finance Bill (which has now been passed into law as Finance Act) which is intended to effect crucial changes to the existing fiscal laws that will enable the Federal Government increase its revenue generation capacity . The Appropriation Bill was signed into law by the National Assembly on the 5th December, 2019 and assented by the President on the 17th December 2019.

The Appropriation Act, which authorizes government expenditure for each financial year, took effect from the 1st January 2020 breaking a historical pattern of approval delays that had lasted about 2 decades (including the last 5 consecutive years) contrary to statutory budgetary calendar cycle provided in the constitution (Section 82.1).

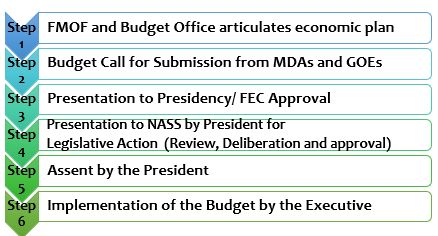

BUDGET APPROVAL PROCESS

* MDA- Ministries, Departments and agencies

* FEC- Federal Executive Council

* GOE- Government Owned Enterprises

* NASS - National Assembly

CORE OBJECTIVES OF THE BUDGET

The President in his budget presentation speech noted the underlisted as the key priorities for the Federal Government:

- Fiscal Consolidation and strengthening of the macro-economic environment;

- Invest in critical infrastructure and human capital development (especially job creation)

- Incentivize private sector investment;

- Enhance social investment programmes to deepen their impact on the poor and vulnerable.

These objectives are fairly demonstrable from the allocation of resources in the budget and the bounty of tax and other incentives in the accompanying Finance Act

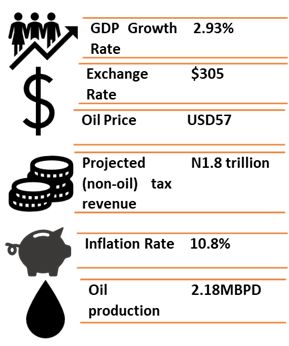

UNDERLYING ASSUMPTIONS

Historically, some of the fiscal assumptions underpinning the budget proposal fall short relative to actual performance. In 2018 for instance; the projected GDP growth rate was 3.5% whilst the actual rate achieved was 1.93%; oil production was 2.3MBPS whilst actual was 1.83MBPS. Inflation rate, exchange rate and oil benchmark rate however performed above expectation.

Many economic analysts have queried the projected GDP growth and oil production rates. We note that production reached its peak in June of 2019 with a record 2.3MBPD was at 2.3MBPD recorded in June, thereafter production declined and maintained a stable range of about 2.1MBPD for the rest of the year with relative calm in the Niger Delta region production. It is our opinion that the oil production assumptions are not overly optimistic, we also note, given the brewing crisis between Iran that the US price of brent crude may actually outperform the benchmark price. Where this is the case, many eyes will be on the Federal Government to see how it would manage/utilize the excess crude revenue.

The Finance Act

Though passed by the National Assembly in November 2019; it was only assented by the president on the 13th January 2020. Inspite of the bouquet of tax and other incentives in the Act, the increase in the VAT rate from 5% to 7.5% which seems to have received significant backlash from the citizenry given the untold hardship it will cause in an already depressed economy.

Below is a summary of the fiscal changes proposed in the Finance Act that are expected to enhance revenue collections

|

Law |

Key Changes |

|

Companies Income Tax (CIT) Act |

Non- Resident with "significant economic presence" (SEP) in Nigeria; and profit can be attributable to such activity are taxable |

|

Restriction of exemption on group reorganization provided for by CITA, for the entities who have not been part of a group for at least 365 days and for dispossession of assets that have not been held for 365days. |

|

|

Increase in monetary penalty for late filing of tax returns (N50,000 in the first month and N25,000 for each subsequent month) |

|

|

Value Added Tax (VAT) Act |

Increase in VAT rate from 5% to 7.5% |

|

Introduction of a requirement for banks to obtain Tax Identification Number (TIN) from customers before opening bank account. |

|

|

Petroleum Profits Tax Act (PPTA) |

Repeals the provision of PPTA that exempts dividends paid out of profits derived from petroleum operations from withholding tax. |

|

Stamp Duties Act (SDA) |

Legalizing the charge of NGN50 on electronic receipts or electronic transfers above NGN10,000. |

|

Expansion of definition of "receipt" to cover electronic transactions to bring them within the scope of taxable transactions. |

LEGISLATIVE AMENDMENTS TO BUDGET PROPOSAL

The National Assembly, in the exercise of its oversight powers (under the constitution Section 81 and Section 18 (1)the Fiscal Responsibility Act effected a few statutory amendments to the budget (including a NGN3Billion increase to its own expenditure allocation) to cater for additional interventions in national security, road infrastructure, health and social welfare.

|

FROM |

TO |

|

|

Aggregate Expenditure |

NGN10.33 Trillion |

10.59Trillion |

|

Aggregate Revenue |

NGN8.15Trillion |

8.31 Trillion |

|

Statutory Transfers |

NGN556.7Billion |

560.4Billion |

|

Debt Service |

NGN2.45Trillion |

2.725Trillion |

|

Recurrent (Non-Debt) |

NGN4.88Trillion |

4.43Trillion |

|

Dev Fund for Capex |

NGN2.14Trillion |

2.465Trillion |

|

NASS Expenditure |

NGN125Billion |

128Billion |

Key Elements of the Budget

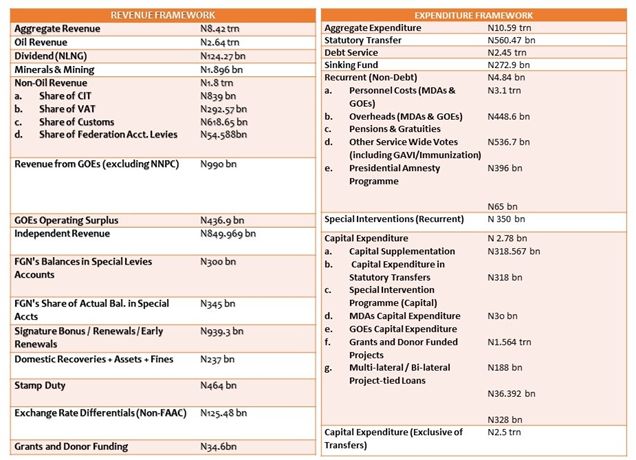

The budget has an aggregate expenditure of N10.59 trillion shared primarily into debt servicing, recurrent expenditure, capital expenditure and statutory transfers. The budget (revenue and expenditure) framework is as follows:

FUNDING OF DEFICIT

Based on the projected revenue framework the budget has a deficit of N2.28Trillion. This projection is based on a best case scenario assuming that revenue assumption parameters are accurate. Historically we have always recorded shortfalls in projected revenue which will materially balloon the deficit. The main revenue streams elucidated in the budget include; Oil revenue which is to generate N2.64 trillion, Non-Oil tax revenue which is estimated at N1.8 trillion and other revenue estimated at N3.6 trillion. The Minister of Finance, Budget and National Development, Zainab Ahmed, has noted the deficit would be funded with domestic and foreign debt. Whilst a detailed borrowing plan is yet to be submitted to the National Assembly for consideration and approval; the Minister has hinted the intention to seek only concessionary foreign debt at not commercial lending rate.

Budget Performance: Critical Success factors

The early passage of the 2020 Appropriation Act is very impressive and has set the Government on a path to efficiency in fiscal management. Nonetheless, the early passage alone will not guarantee the successful implementation of the Budget. The Federal Government needs to:

- take immediate plans to finalize its Borrowing Plans and present same for legislative approval (it is worth mentioning that the 2016 – 2018 medium term external borrowing plan resubmitted to the National Assembly by the President in November 2019 was not approved).

- facilitate the implementation of the Finance Act; as it remains core to the Government's policy drive entrench transparency and accountability within the MDAs and the GOEs to ensure fiscal discipline.

- ensure prioritization and timely commencement of the capital projects which have been appropriated.

- demonstrate capacity to realize its projected revenue. Toward the end of 2019, Moody (a global credit rating agency) downgraded its outlook on Nigeria from stable to negative on grounds of the perceived risk to the Government's fiscal strength and external position.

- ensure that its social intervention schemes have a broad and far reaching impact on the citizens given the growing unemployment rate and poverty index; priority must be given to alleviating the suffering of the poor and vulnerable and improving the living standards of the citizenry generally

- Efforts should also be made to reduce the cost of governance The Recurrent (Non-Debt) Expenditure is almost twice the size of its projected capital Expenditure for the year (N2.465 trillion). The implication of this is that even the rise in VAT rate to 7.5% may still not be sufficient to raise non-oil revenue which has been underperforming for the past five years.

WHAT INVESTORS AND BUSINESSES SHOULD EXPECT

- Positive Impact of the Early Passage of the Budget:

It is proven that budget delays come at the cost of loss of Foreign Direct Investment and domestic investment lethargy. Record of slow economic and investment activities prior to passage of the budget underpin the importance of timely budget passage to economic activities. It is therefore visibly noticeable that unlike previous years many enterprises hit the road running in 2020 having sufficient information to chart the course of Government's economic plan, fiscal and monetary policy drive, from the budget. In comparable terms we expect the Gross Domestic Product growth rate in Q1 to outperform preceding years.

- Aggressive Revenue Drive:

Given the Non-Oil Tax revenue assumptions of N1.8 trillion in the budget, it is expected that the Federal Government will pursue aggressively collection of tax income Principally VAT, Stamp duties and Company Income Tax by putting in place appropriate framework to harness the anticipated benefits of the Finance Act.

- Active Monitoring of Revenue Performance Of MDAs And GOEs:

The Federal Government has indicated the revenue performance of Government Owned Enterprises and MDAs will come under heavy performance scrutiny as it will form a significant source of revenue generation outside oil In the presentation of the Budget, the President talked tough about the implementation of a new performance management framework that would regulate cost to revenue ratios for GOEs and MDAs noting further that there would be severe consequences for failure to achieve revenue target.

- Penalty for Tax Defaulters:

It is expected that the Federal Inland Revenue Service (FIRS), in turn with the pressure from the Federal Government to meet up with its revenue target will come heavy on tax offenders whilst incentivizing early tax remittance as provided for in the Finance Act. The new FIRS Boss, Muhamman M Mani, who took over from Mr. Tunde Fowler following the expiration of his tenure, noted in his acceptance speech that his mandate remains to Facilitate economic recovery through increased revenue generation".

- Government Borrowing

To finance the budget deficit of N2.2trillion, the Federal Government has indicated that it intends to borrow a total of N1.92 trillion from the domestic and foreign debt market. It is expected that a total of N745Billion will be raised locally. The nations debt profile which stood at N25.7 Trillion as at half year 2019 is expected to grow to about N27.62 Trillion (recording a 128% increase in 5years). Despite concerns about the Nations debt profile, the Debt Management Office as assured that the Nation's debt to GDP ratio remains within permissible threshold.

It is expected that there will be a very conservative approach to the pricing of debt to be sourced by the Federal Government. Having stated clearly that the Federal Government will be seeking concessionary rates for its foreign borrowing it will not also be the usual for investors who may be taking positions to participate from local borrowings. Given the optics from the monetary policy rate it is expected that the rate of Government Bonds and Treasury bills to hit an all time low.

- Full Draw on Recurrent Expenditure:

It is expected that there will be a full draw on recurrent expenditure whether or not government revenue projections are realized. This reflects adversely on the performance of capital expenditure which represents just 13% of the expenditure. As at December 2019, the capital expenditure spent was N1.2 trillion out of the budgeted N2.1 trillion which shows a performance of circa 55%. With the deficit and a history of not meeting revenue targets, the government may be faced yet again with having to fully draw on recurrent expenditure and leave the capital expenditure under-performed.

The projected oil production rate of 2.18 million barrels per day at the price of USD57 per barrel may be attainable especially considering recent tensions in the Middle East. However, the oil market remains very volatile and once relative peace returns to the region the current price escalation may revert. The Organization of Petroleum Exporting Countries (OPEC) in its December 2019 report projected that there would be a temporary glut in the oil market in the beginning of this year; where the current Iranian crisis abates therefore, we may experience a climb down in oil prices.

This Article was written by the research/market intelligence team at DealHQ Partners.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.