In late 2010 and early 2011 the situation in the Ukrainian banking sector finally stabilized and most of the banks recommenced their lending activity. To "correct mistakes" made by the banks within the period of the financial crisis, as well as to induce consolidation in the Ukrainian banking sector and, therefore, to bring it closer to international standards, the National Bank of Ukraine (the NBU) set out new regulatory capital requirements (i.e. the minimum amount of the regulatory capital must constitute no less than UAH 120 million by the end of 2011 — in contrast to the current minimum of UAH 75 million). In such new financial realities a wave of mergers in the Ukrainian banking sector is looming on the horizon.

Reasons for Consolidation

Consolidation in the banking sector is expected to: (1) increase the regulatory capital to meet the NBU requirements, (2) create a single banking structure, (3) simplify and optimize the management system, (4) improve liquidity, (5) reduce operational expenses, (6) strengthen the brand, (7) raise competitive ability of banking services, (8) expand the network of branches and outlets.

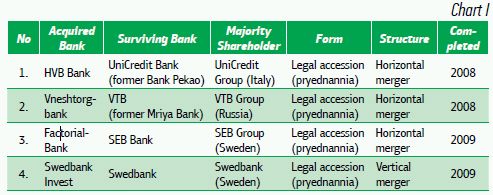

Due to a rather complicated and cumbersome procedure of banks' mergers provided for by Ukrainian legislation, mergers of related banks, which are banks owned by a single ultimate majority shareholder, occurred predominantly in Ukraine to date. The key completed mergers are described in Chart I.

However, in view of the expected consolidation in the Ukrainian banking sector, a number of non-related bank mergers is likely to take place within a couple of the following years, subject to certain improvements ofcurrently underdeveloped legislation, which has so far been a major obstacle for the mergers of banks owned by non-related shareholders.

Structural Considerations

Given that a "classical" merger leads to termination of both banks and, therefore, in fact obtaining a new banking license, the recommended and most efficient option of a merger would be implementation of legal accession ("pryendnannia"), which supposes continuity of the surviving bank holding a valid banking license, with the acquired bank's assets and liabilities being transferred to the surviving bank.

Generally, accession transactions, subject to proper structuring thereof and implementation of all necessary steps on a day-to-day basis, lead to a synergetic effect for the merged bank, as the latter extends its lending possibilities, strengthens the brand and reduces operational expenses compared to those existing in the two banks operating separately prior to their merger.

However, taking into account that banking merger transactions are insufficiently regulated by Ukrainian laws, which, in particular, contain a number of vague and controversial provisions governing the merger procedure, and even lack any guidelines as to certain issues arising within the course of the merger, involvement of professional participants (i.e. experienced legal, financial, IT and HR advisors) in the transaction, as well as establishment of a close communication with the NBU and the State Securities Commission (the SEC) would facilitate the process enormously.

Key Legal Considerations

Regulatory Approvals

A merger of two Ukrainian banks through legal accession requires obtaining the following regulatory approvals: (i) a preliminary permit for reorganization from the NBU, and (ii) a merger clearance from the Antimonopoly Committee of Ukraine (the AMCU) — for both of them a joint application of the acquired bank and the surviving bank has to be filed. It should also be noted that no merger clearance is required if the controlling shareholder has in due course obtained the AMCU's merger clearance for acquisition of control over each participating bank. However, for the purposes of the NBU permit, participating banks must confirm that such AMCU clearance was indeed not required by way of filing the respective AMCU opinion — so-called "preliminary conclusions" (which assumes the need for a limited filing and information disclosure to the AMCU anyway).

Share Conversion

Given the lack of any guidelines as to the share conversion ratio in the applicable laws and regulations, conversion of shares of the acquired bank into the shares of the surviving bank (merged) appears to be one of the major difficulties within the course of the legal accession. According to the SEC regulations and approach, conversion of the acquired bank's shares must be carried out to an equal amount of the surviving Bank's share stake (at the par value of shares only, i.e. regardless of the fair market value of the shares of both banks). It should also be noted that denomination of shares of the banks concerned would be required if the par value of the acquired bank's shares makes it impossible to convert them into the shares of the surviving bank. In addition, the applicable legislation contains no methods of calculation and recovery of losses suffered by the bank's shareholders (due to the reduction in the value of the bank's net assets per share as a result of the share conversion), though shareholders are entitled to require recovery of such losses from the surviving bank and ultimately from its majority shareholder.

Rights of Minority Shareholders

The following risks related to minority shareholders' rights within the course of accession transaction should be observed: (i) non-attendance by the shareholders of the general shareholders meeting related to accession and approval of the Accession Agreement may impede adoption of the said resolutions (if the number of votes held by a controlling shareholder is less than 60%), (ii) delay in completion of the transaction (by filing an appeal to the court in relation to any circumstances associated with the convocation, holding and adoption of resolutions at general shareholders meetings).

The shareholders of either the acquired bank or the surviving bank who voted against the merger of the banks at general shareholders meetings are entitled to require the surviving bank to buy-out their shares at their fair market value.

Creditors' Rights

Within the merger process, the creditors of the acquired bank are entitled to require pre-mature performance of the acquired bank's obligations towards them within 2 (two) months from the date when they are notified on the forthcoming merger through the publication to be made in the official media of the Ukrainian Parliament, the Cabinet of Ministers of Ukraine or the State Securities Commission, and the state registrar. Any and all persons who have rights of claim to the acquired bank are considered to be its creditors (e.g. trade creditors, lenders and depositors). Therefore, within the process of handling creditors claims it would be advisable to suggest that all/certain creditors should not require pre-mature performance of the acquired bank's undertakings, their performance to be assured on the maturity date by the merged bank, which will become the full legal successor of the acquired bank.

Assets and Liabilities Transfer

To mitigate the risks associated with the transfer of the assets and liabilities by the acquired bank to the surviving bank, the following issues should be taken care of within the process of such transfer:

- mandatory notification of the acquired bank's borrowers regarding the assignment of the loan claims to the surviving bank has to be made prior to approval of the transfer balance sheet by the general shareholders meeting of the banks participating in the merger;

- the surviving bank is to be provided with all documents and information supporting the assigned assets and liabilities of the acquired bank;

- transfer of tangible assets and equipment to the surviving bank must be made under the transfer-acceptance protocols;

- establishment of the new branches and outlets of the surviving bank on the basis of the acquired bank's divisions (including the head office) should be arranged to ensure continuity (i.e. to prevent any breaks in ongoing banking activity).

Vasil Kisil & Partners

Through relentless focus on client success, the Vasil Kisil & Partners team delivers integrated legal solutions to complex business issues. In Ukraine, the Vasil Kisil & Partners brand is synonymous with great depth and breadth of legal expertise and experience, which has created superior value for our clients since 1992.

Vasil Kisil & Partners is a Ukrainian law firm that delivers integrated business law, dispute resolution services, tax law, energy and natural resources law, intellectual property law, international trade law, labour and employment law, real estate and construction law, as well as public private partnership, concessions & infrastructure law.

The firm serves international and domestic companies, as well as private individuals, dealing in agriculture, banking, chemical, construction, financial, energy, high-tech, general commodities, insurance, IT, media, metallurgy, pharmaceutical, real estate, shipbuilding, telecommunication, trading, transport, and other industries and economy sectors.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.