BACKGROUND

On 11 December 2015, a new regulation was issued by the Indonesian Financial Services Authority ("OJK") No.26/POJK.03/2015 ("POJK 26") concerning Integrated Minimum Capital Requirement for Financial Conglomerates.

POJK 26 was issued in an effort to make capital risks more transparent as the condition of the financial services sector to grow in a sustainable manner is a key prerequisite in order for the financial system to be able to support the achievement of the stability of the financial system and contribute optimally to the national economy.

Previously Financial Conglomerates (a group of financial services institutions which are connected based on ownership and/or control) did not have aggregate capital requirements. Capital is a source of financial support in the implementation of the Financial Conglomerates' activity, cushion to absorb the unexpected losses, and the safety net in crisis situation. Capital adequacy could increase the confidence of stakeholders that support the condition and stability of the financial conglomerates.

The amount of capital that must be provided by Financial Conglomerates relies heavily on the encountered risks. Therefore, in order to maintain public confidence and improve the overall condition of its business, Financial Conglomerates shall have adequate systems to identify, measure, monitor, and control the risks arising from Financial Conglomerates' business activities, as well as provide adequate capital to anticipate such risks.

KEY CHANGES

This note is intended to give an overview only on the key highlights in POJK 26. Below are the important highlights:

1. Ratio of Integrated Minimum Capital Requirement

A Financial Conglomerate is required to have an integrated minimum capital of, at least, 100% (one hundred percent) of the Aggregate Regulatory Capital Requirement of such Financial Conglomerate. Such adequacy shall be conducted by calculating the ratio of Integrated Minimum Capital Requirement. The OJK has the authority to determine the integrated minimum capital greater than the minimum capital as required under Article 2 of POJK 26, if OJK determines that a Financial Conglomerate is facing risks that requires greater capital adequacy.

In order to calculate the ratio of Integrated Minimum Capital Requirement, the Main Entity shall calculate the Aggregate Net Equity and the Aggregate Regulatory Capital Requirement.

Aggregate Net Equity

Aggregate Net Equity is calculated by summing the nominal value of the actual capital of each Financial Services Institution ("FSI") on an individual basis and/or on a consolidated basis with the Subsidiaries in the Financial Conglomerate based on regulations applicable to each financial service sector. To calculate such Aggregate Net Equity, there are several reduction factors such as:

- Capital injection of one FSI in other FSI in a Financial Conglomerate; and/or

- Placement of FSI funds to other FSI in a Financial Conglomerate recognized as modal instrument by other referred FSI, as long as such placement is not yet calculated in the capital's calculation or not yet calculated as a reduction factor in each financial sector.

For example:

Assume that a Financial Conglomerate consists of FSI 1, FSI A, FSI B, and FSI C. The Aggregate Net Equity of Financial Conglomerate is the Aggregate Net Equity of FSI 1, FSI A, FSI B, and FSI C. However, in case FSI 1 has provisions that stipulate the capital calculation consolidated with its Subsidiaries, the Aggregate Net Equity is the actual capital of FSI 1 consolidated with FSI A, FSI B, and FSI C.

Aggregate Regulatory Capital Requirement

The Aggregate Regulatory Capital Requirement is calculated by summing the nominal value of the minimum capital of each FSI on an individual basis and/or consolidated basis. In the event that the minimum capital of an FSI is consolidated with its Subsidiaries, the minimum capital is the total minimum consolidated capital of the FSI and the subsidiaries.

For example:

A Financial Conglomerate consists of FSI 1, FSI A, FSI B, and FSI C. The Aggregate Regulatory Capital Requirement of Financial Conglomerate is the Aggregate Regulatory Capital Requirement of FSI 1, FSI A, FSI B, and FSI C. However, if FSI 1 has provisions that stipulate the minimum capital calculation consolidated with its Subsidiaries, the Aggregate Regulatory Capital Requirement is the Aggregate Regulatory Capital Requirement of FSI 1 consolidated with FSI A, FSI B, and FSI C.

Ratio of Integrated Minimum Capital

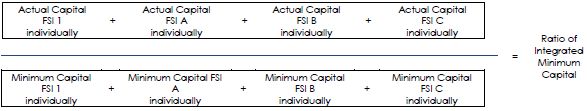

The calculation of the Ratio of Integrated Minimum Capital is obtained by way of dividing the Aggregate Net Equity with the Aggregate Regulatory Capital Requirement as described below:

2. Integrated Capital Management

Financial Conglomerates are obliged to implement the Integrated Capital Management comprehensively and effectively. Such implementation must be conducted by the Main Entity, Board of Director of the Main Entity, and Board of Commissioners of the Main Entity which must cover, at least, preparing the policy and procedure of integrated capital management, assessment of capital adequacy, monitoring and submission of the integrated capital reports, adequate system of internal control, and review of the implementation of integrated capital management on a regular basis.

3. Report

The Main Entity is obliged to draft the Adequacy Report of Integrated Capital every semester in the end of June and December. The report shall contain actual capital, Aggregate Net Equity, minimum capital, total minimum capital, details of funds placement of one FSI to another FSI in the Financial Conglomerate; and ratio of integrated minimum capital and the details of capital inclusion among FSIs within the Financial Conglomerate.

4. Sanctions

Please note that the sanctions stipulated in Articles 19 and 20 will come into force on:

- 1 January 2019 for Main Entities, which are Commercial Banks, based on Business Activities 4;

- 1 July 2019 for non-bank Main Entities and Main Entities such as banks, other than the Commercial Banks based on Business Activities 4;

- 1 January 2018, for Main Entities, which are Commercial Banks based on Business Activities 4; and

- 1 July 2018, for non-bank Main Entities and Main Entities such as banks, other than the Commercial Banks based on Business Activities 4;

HOW DOES IT AFFECT YOU?

- Previously Financial Conglomerates did not have aggregate capital requirements. Although currently each of the FSIs within a Financial Conglomerate will still follow the applicable capital requirements to the relevant FSIs, POJK 26 requires the Financial Conglomerates as a group to maintain an Aggregate Regulatory Capital Requirement.

- In order for the Financial Conglomerate to meet the Aggregate Regulatory Capital Requirement, each FSIs within the Financial Conglomerate must not conduct any actions that may cause the Aggregate Regulatory Capital Requirement of the Financial Conglomerate not fulfilled.

- The Main Entity, BOD of the Main Entity, and BOC of the Main Entity are the ones responsible to manage the Aggregate Regulatory Capital of the Financial Conglomerate by implementing integrated strategy, policy and procedures.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.