On 14 September 2018, the Federal Council extended the transition period for the reporting of derivative transactions by small non-financial counterparties (NFC-) until 1 January 2024 under the Financial Market Infrastructure Act (FMIA). The amendment to the Financial Market Infrastructure Ordinance (FMIO) will enter into force on 1 January 2019. The reporting duties of other market participants are not affected by this decision.

In line with international standards, the FMIA introduced into Swiss law rules on derivatives trading including a duty to report derivatives transactions, a requirement to clear certain OTC transactions over a central counterparty (CCP), risk mitigation for noncleared OTC derivatives and an obligation to trade certain transactions over a trading venue. When the FMIA and the FMIO came into force on 1 January 2016, the regulations included extensive phasing-in periods to set up the requisite infrastructure and allow market participants to prepare themselves to meet their obligations.

Since then, and in line with international developments, these deadlines have been extended several times, most recently on 14 September 2018 regarding the obligation to report trades.

Extended Phasing-in for Reporting Obligation

With its amendment of 14 September 2018, the Federal Council extended the deadline for NFC- to report trades in OTC derivatives from 1 January 2019 to 1 January 2024. Initially, this duty should have been phased in within a period of six to twelve months depending on the categorization of the counterparties from 1 April 2017, the date of the first authorization or recognition of a trade repository by the Swiss Financial Market Supervisory Authority (FINMA). In October 2017, the Federal Council had already extended the deadline for NFC- to 1 January 2019. The latest change pushes the deadline back by a further five years until 1 January 2024.

This decision will primarily benefit NFC- dealings with foreign counterparties, including counterparties in the EU or the USA. Indeed, Swiss law provides for a "one-way" reporting duty and NFC- are, therefore, subject to reporting obligations when dealing with a financial counterparty (FC) or a large non-financial counterparty (NFC+), only if their counterparty does not report the transaction, e.g., because it is a foreign counterparty which is not subject to reporting obligations under Swiss law.

Therefore, this extension will primarily benefit NFC-, which enter into derivative transactions with foreign counterparties such as banks and securities dealers in foreign financial centres. Other Swiss market participants, including Swiss FC and Swiss NFC+, do not benefit from this exemption and continue to be subject to the reporting obligations, which have already entered into force.

Further Deadlines

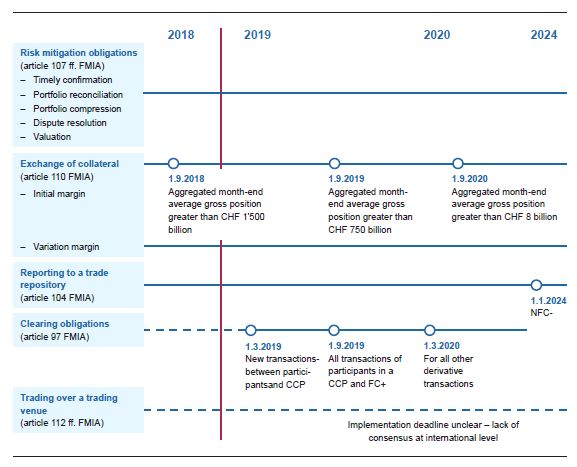

While the risk mitigation duties regarding timely confirmation, portfolio reconciliation and compression, dispute resolution, as well as the obligation to exchange variation margin are now fully in force, other duties are still being phased in. In particular, the duty to collect and post initial margin is being phased in gradually. Moreover, FINMA has designated certain OTC interest-rate and credit derivatives as being sufficiently standardized to warrant the duty to clear them through a central counterparty. This designation came into force on 1 September 2018 and triggered the phasing-in of the duty to clear derivatives transactions via authorized or recognized central counterparties in line with the following calendar:

Finally, the obligation to trade derivatives over a trading venue is formally in force. However, FINMA has not yet designated derivatives as being in scope and thus has not yet triggered the phasing-in of this obligation.

Market participants need to ensure that they will be in a position to comply with their obligations in due course and must consequently, review and if necessary adjust their procedures for trading in derivatives.

Outlook: Revision of the FMIA in 2019

The Federal Council's decision to extend the phasing- in period must be seen as linked to an upcoming review of the FMIA in light of international developments in particular in the context of the European Market Infrastructure Regulation (EMIR) in the EU, for which the European Commission has proposed various amendments, as part of its Regulatory Fitness and Performance (REFIT) Programme. The main goal of the programme is to address disproportionate compliance costs, transparency issues and insufficient access to clearing for certain counterparties.

The Federal Department of Finance (FDF) will start its review of the FMIA in 2019. It is expected that Switzerland will follow the EU and amend the Swiss regulations in connection with derivatives trading to ensure compliance with EMIR.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.