Gibraltar - a footprint in Europe for Swiss Asset Managers.

Gibraltar is in the EU. As such, Gibraltar Investment Firms have access to a pan European passport, and are able to passport their services across the EU. A firm required to be licensed in Switzerland under the Swiss Collective Investment Schemes Act (CISA or LPCC) is not guaranteed to have such a passport. A Gibraltar based fund manager (AIFM) will have the passporting capability under the new European Directive applicable to fund managers (the Alternative Investment Fund Managers Directive, 'AIFMD'). Gibraltar is part of the OECD 'white list' and was listed in the recent Global Financial Centres Index 12 above centres such as Monaco, Malta, Mauritius, Rome and Moscow.1

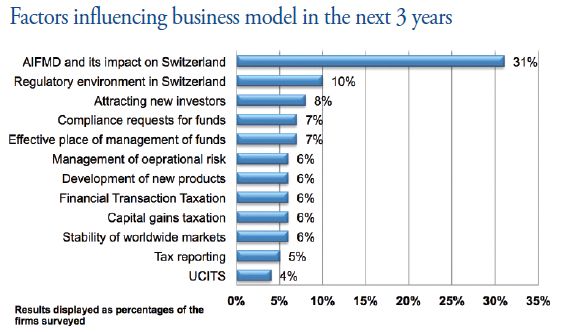

The Regulatory landscape is changing and as the figures from a recent PWC market survey2 show, Swiss managers feel that their business activities will be heavily influenced by regulation over the next 3 years.

Gibraltar as a domicile for your Fund

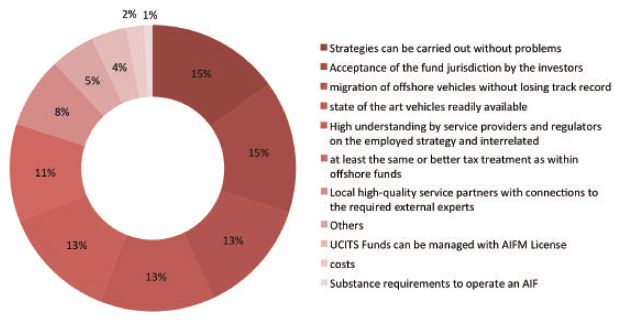

This survey of 92 Alternative Investment Fund Managers (AIFM's) showed that passporting options are also the main driver for Swiss managers in 'onshoring' funds.3

Switzerland is generally not considered a realistic option for onshoring Alternative Investment Funds (AIF's) as the Swiss Fund would still be considered to be a 'third country' fund for EU and EEA investors. Gibraltar offers the possibility of a flexible European Fund Domicile, and a European footprint through a number of options. Also, although it is generally expected that larger AIFM's will apply for FINMA licensing, smaller managers are evaluating other options for their management company/advisor, such as registering under de minimis rules, or relocating to other jurisdictions, generally in the EU, such as Gibraltar.

Ticking all the boxes

Gibraltar is able to facilitate all of the expectations of Swiss Managers as a European re-domiciliation destination for investment funds, and has in fact recently introduced changes to its Experienced Investor Fund regime to facilitate some of the factors set out below, considered to be the main expectations for Swiss Managers when re-domiciling funds.

Each of these are well catered for within the Gibraltar framework and Gibraltar offers a full range of Fund vehicles including UCITS, non-Retail UCITS, Experienced Investor Funds, Private Funds and the establishment of closed end collective investment scheme undertakings that comply with the Prospectus Directive.

Gibraltar as a European Domicile for your financial services business

One of the key findings of the PWC report referenced in this newsletter was that a surprisingly large number of Swiss AIFM's are evaluating alternatives to a FINMA license application. Swiss based managers consider AIFMD and the desire, or requirement for a European passport as a potentially significant factor over the next few years. This is likely to lead to consideration of the rules on delegation (and sub-delegation) of AIFM functions under AIFMD, especially insofar as the European based manager is able to delegate core functions such as portfolio management to a Swiss regulated entity. This could potentially create a number of options for Swiss managers who might consider establishing their own entity in Gibraltar or using the services of a platform provider in the jurisdiction.

Gibraltar - Innovation and development

- Changes to Gibraltar's experienced investor funds regime has helped to facilitate re-domiciliation of investment funds into the EU territory, widened the definition of an Experienced Investor, and maintains 'prior approval' regulatory process that is now unique in Europe following the recent discontinuation of this feature in Luxembourg last year. The changes to the Regulations also allow for non-Gibraltar fund administrators to administer Gibraltar Funds subject to their being approved.

- From traditional 'long only' to complex alternative strategies, Gibraltar offers tried and tested solutions, and innovative and flexible products catering to most investment strategies.

- Gibraltar's Fund industry reacts quickly and adapts to regulatory developments efficiently while maintaining a strong and robust regulatory framework.

Gibraltar Funds Industry - a complete platform through ISOLAS

- Gibraltar is home to a wide breadth of world-class service providers for all aspects of fund servicing including depositary/custody, brokerage, fund administration, product, legal, tax and audit. ISOLAS advises and assists clients either directly or through introductions to local partners and providers for a complete suite of fund related services that include:

- Fund establishment, set up and structuring

- Advising on registration, licensing and reporting

- Fund administration services from local providers that includes

1. Valuations

2. Shareholder register, filing and return requirements

3. Subscriptions and redemptions

4. Distributions of dividends and income

5. Settlements

6. Record keeping and regulatory returns

7. Administration of any special purpose vehicles

- Compliance and risk management

- Tax, audit and legal

- Depositary and custodian/trustee services

- Platform solutions, and service providers

- Corporate governance support and advisory services

- Corporate secretarial services

- Independent Gibraltar resident, qualified and licensed directors

- Technology services and business solutions

- Brokerage services and service providers

ISOLAS will act as your local contact point in relation to the introduction and engagement of all necessary counterparties, and in advising you of the best solution for the specific needs of your business model.

Gibraltar - Did you know that?

- Gibraltar is a fast developing centre for European Fund domiciliation outside of the 'classic' fund centres. The below chart shows the developing momentum of the industry4.

- There are full passporting rights for financial services businesses registered in Gibraltar, who may then conduct business in any other EU member state without requirement for further licensing.

- A manager based in Gibraltar would be subject to the flat 10% rate of corporate tax applied across all Gibraltar companies on an accrued in, or derived from basis. This is one of the lowest corporate tax rates in Europe.

- Higher Executives Possessing specialist skills (HEPSS) within these companies may apply for this tax status, and have only the first £120,000 of income assessable to tax. This would cap income tax to under £30,000 per annum.

- There is no VAT in Gibraltar, which is highly relevant for international service providers offering services from Gibraltar, no Capital gains tax, wealth tax (for any fund or its investors) no inheritance tax and no withholding tax on dividends paid out of Gibraltar. There is no annual subscription tax, and the Gibraltar fund products offer the best possible outcome for the fund and its investors.

There are a full range of investment fund products available. From Experienced Investor Funds geared towards qualifying, sophisticated, experienced investors to UCITS retail products.

Footnotes

1. http://www.zyen.com/activities/gfci.html

4. Source: Gibraltar Funds & Investments Association (GFIA) www.gfia.gi

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.