The intensely debated 'tax revolution' of November 20171, which, among other things, transferred liability to pay social contributions to the employee, had disadvantages for employment relationships that have not so far been taken into account. This applies, for example, to employees that are exempt from income tax, part-time employees, and employees taking sick leave, as from 1st January 2018.

As a remediation measure, Emergency Ordinance 3/2018 has now been adopted.

Part-time employees

As from July 2017, all part-time employees whose salary is below the national minimum salary still have to pay social contributions based on the minimum salary (1,900 RON, from 2018). Up to December 2017, these increased social contributions were borne by the employer, but from January 2018, liability to pay these contributions have been transferred to the employee. Obviously, this could lead to a negative net salary for certain part-time employees.

To avoid such situations, the tax law has been changed by the new EO2, so that part-time employees now have to pay pension and health insurance contributions based on their actual salary; the difference based on the minimum salary will be paid by the employer on behalf of the employee.

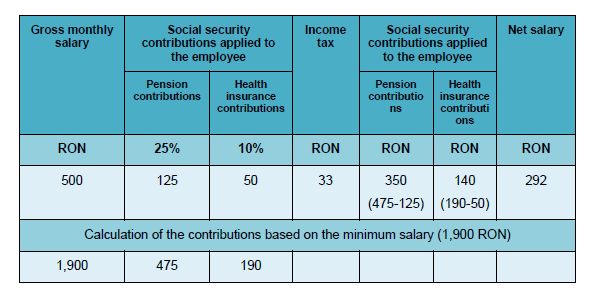

The following table shows an example of a part-time employee with an actual salary of 500 RON and working 2 hours a day.

Without the amendments of EO 3/2018, all social contributions (in this example 475+190=665) would be payable by the employee, which would result in a negative net salary (-165 RON).

Sick leave

EO 3/2018 also amends the rules for calculating pension contributions for sick leave payment. Up to the end of 2017, the calculation basis consisted of 35% of the national average salary (3,131 RON), calculated according to the number of sick leave days. Of this, 10.5% was paid as a pension contribution for the period of sick leave.

From January 2018, the calculation is no longer based on 35% of the average salary, but on the actual sick leave payment. The increased pension contribution of 25% is applied to this. For the employee, this leads to a decrease of the paid net remuneration for the sick leave period.

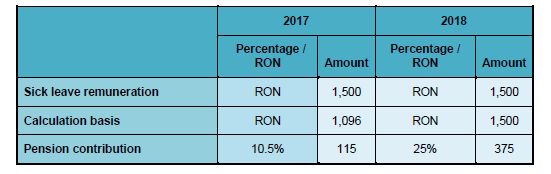

You can see below an example of an employee with sick leave payment of 1,500 RON:

In this example, there is a significant reduction of the sick leave remuneration resulting from the pension contribution increased by 260 RON (about 17% of the sick leave remuneration). Such a reduction applies also to maternity leave.

To adjust these effects, the government adopted another EO3 on 22nd February 2018, which provides a ceiling for the pension contribution of 10.5% from the basis amount of 35% of 3,131 RON, according to the number of sick leave days. This ceiling runs for 6 months, between 1 January and 30 June 2018. In effect, this means a return to the 2017 situation, implying a pension contribution of 115 RON.

Since this EO was published only after companies had finalised their accounts for January 2018 and had already submitted tax statement 112, this EO also contains measures for adapting and adjusting the payments and statements for January.

Conclusion

The transfer of liability for social contributions from the employer to the employee was made without an exact analysis and projection of all possible situations that might be found in practice.

The adjustment measures needed were made belatedly (publication of EO 3/2018 only on 8th February 2018). So the administrative costs to adjust for disadvantaged groups of employees needed to be borne, as usual, by their employers.

Footnotes

1 Government Emergency Ordinance 79/2017

2 Government Emergency Ordinance 3/2018

3 Government Emergency Ordinance 8/2018

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.