Circular 59 simplifies foreign exchange procedures for foreign direct investments in China. It also relaxes certain requirements in relation to outbound investments by Chinese companies. This development may have a profound effect on inbound and outbound investments, including greenfield/brownfield projects, growth capital investments, and mergers and acquisitions.

We believe that SAFE is further relaxing foreign exchange controls because Circular 59 removed many of the approval requirements that have been put in place over the course of the last ten years. Although the changes brought by Circular 59 are predominately procedural, the elimination of such approvals has two significant effects. First, transactions can be expedited because fewer approvals are required. Second, banks in China have increased influence given its new authority under Circular 59 to review and process additional foreign exchange transactions directly without the involvement of SAFE.

In addition, we believe that Circular 59 signals a significant policy change for SAFE -- it is gradually shifting its focus from micro-administration to macro-supervision. We also view such further relaxation to be an indirect response to the notable decline in the volume of foreign direct investments into China in the past few months and the Chinese government's further promotion of outbound investments by Chinese companies.

I. KEY CHANGES UNDER CIRCULAR 59

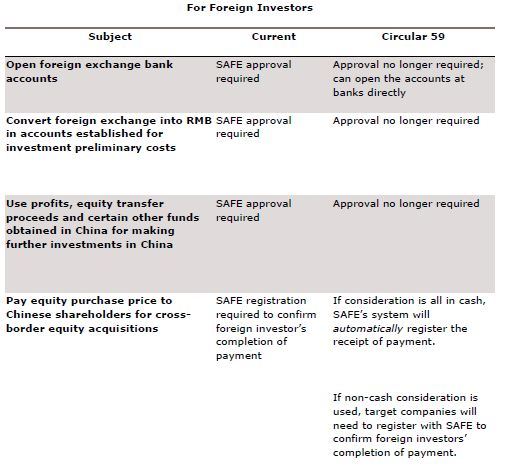

We summarize below the key changes for (i) foreign investors, (ii) foreign invested enterprises (FIEs), (iii) foreign invested holding companies (HoldCos), and (iv) domestic companies:

II. EFFECT ON CROSS-BORDER M&A

SAFE Circular 142,4 which was issued in 2008, infamously prohibits FIEs from converting their registered capital into RMB to (i) make equity investments in China (unless their business scope covers equity investments), (ii) purchase non-self-use real properties, or (iii) invest in securities (unless otherwise permitted by law). We believe that the restrictions under Circular 142 have not been lifted or relaxed by Circular 59. Therefore, for foreign investors who plan to use its existing FIEs in China to do share acquisitions, funding could still be an issue if the FIEs have not generated sufficient profits.

III. CONCLUSION

Circular 59 further relaxes China's foreign exchange controls. We believe this is a signal that SAFE is transitioning its functional role to macro-administration. The simplified procedures are certainly encouraging for foreign investors and foreign invested enterprises in China, but the effective implementation of the circular will certainly take some time.

Footnotes

* China's State Administration of Foreign Exchange (SAFE) issued the Circular Regarding Further Improvement and Adjustment of Foreign Exchange Administration Policy of Foreign Direct Investments (Circular 59) on November 21, 2012. The circular will become effective on December 17, 2012. Circular 59 includes five appendices that set forth detailed guidelines for SAFE's local branches and banks, standard application forms, schemes for data transition, and a list of rules revoked by Circular 59.

2 Under Circular 59, the rules that are applicable to HoldCos also apply to foreign invested venture capital enterprises and foreign invested equity investment enterprises.

3 This permission reiterates the rules issued by SAFE in June 2012 to promote outbound investments by private companies (i.e., the Circular on Foreign Exchange Administration Issues concerning Encouraging and Guiding the Healthy Development of Private Investment), which were not widely noted.

4 The Circular of Operation Issues Related to the Perfection of Administration of Payment-Related Settlement of FIEs' Registered Capital from Foreign Exchange to RMB.

The content of this article does not constitute legal advice and should not be relied on in that way. Specific advice should be sought about your specific circumstances.