INTRODUCTION

Non-resident investors continue to invest in Canadian renewable energies such as solar energy and, in particular, wind power. The following discussion highlights the principal tax incentives granted by the Canadian and Quebec governments. It also describes a tax efficient holding structure, which may, depending on the circumstances and place of residence of the non-resident investor, be put in place in order to minimize Canadian taxes on gains and income.

It should be noted that there are other ways for a non-resident investor to structure an investment. All options should be carefully reviewed in order to best achieve non-resident investors' tax objectives.

NON-RESIDENT INVESTORS' TAX OBJECTIVES

Non-resident investors' tax objectives when investing in a Canadian energy project normally include the following:

- Taking advantage of tax incentives that are offered.

- Minimizing Canadian taxation on income (including recapture of tax depreciation). Depending on the province in which the energy project is located, the combined (federal and provincial) income tax rates vary between 25% and 31%.

- Reducing Canadian withholding tax on interest and dividends payable to non-resident investors. Subject to the application of a tax treaty and the holding structure, the withholding tax rates with respect to interest vary from nil to 10% or 25% and, with respect to dividends, from 5% to 15% or 25%.

- Reducing (or eliminating) the Canadian tax on the gain resulting from the disposition by the non-resident investors of the investment. Generally, 50% of the gain to the non-resident investors is subject to regular income tax rates and thus the net effective tax is 12.5% (assuming no provincial tax). Certain tax treaties may exempt the gain of non-resident investors resulting from the disposition of shares of a corporation owning a Canadian energy project.

- Maximizing the ability to claim of foreign tax credit for the Canadian tax paid in the jurisdiction of residence of the non-resident investors.

FINANCING CONSIDERATIONS

Renewable energy projects require significant capital. Generally, financial institutions will provide loans to finance the construction or acquisition of the energy project. Such loans are generally non-recourse loans. The lenders will typically take a pledge on all the assets of the project. The non-resident investor is also required to invest capital in the form of equity and/or subordinated loans.

The deductibility of the interest payable on the aforementioned loans is of paramount importance as it allows the non-resident investor to reduce the Canadian income tax payable on the profits generated by the energy project.

If part of the invested capital is funded by non-resident investors in a combination of interest-bearing debt and equity, then subject to the Canadian "thin capitalization rules" (discussed below), additional interest may be deducted to further reduce the Canadian income tax payable on the profits. Depending on the structure of the investment, the interest may not be subject to tax in the non-resident investors' jurisdiction (or in the jurisdiction of residence of a blocker entity), resulting in a tax effective so-called dip financing arrangement (see Dip Strategy section).

STRUCTURING OPTION

A. Canco to Hold the Energy Project

A non-resident investor should, in most cases, put in place a corporation resident of Canada (Canco) to hold the energy project. Canco would be responsible for paying any Canadian income tax on the profits and filing all appropriate tax returns. Moreover, the non-resident investor should be able to repatriate, at any time, the initial invested capital in Canco without first triggering a dividend and without any Canadian withholding taxes.

B. Non-Resident Blocker to Hold Canco

A non-resident investor may invest directly or consider interposing a non-resident blocker, preferably resident in a jurisdiction having a favorable tax treaty with Canada, to be the shareholder of Canco (Foreign Holdco). The non-resident investor would invest capital in Foreign Holdco and then, in turn, Foreign Holdco would invest the capital in Canco. The invested capital may take the form of an interest-bearing loan and equity.

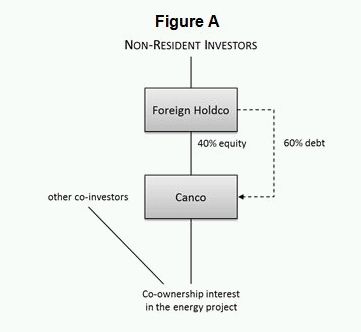

Canco, using the invested capital of the non-resident investor (either directly or indirectly if a Foreign Holdco blocker is used), and the capital from the third party lenders, would invest in the energy project alongside other co-investors.

The structure, as illustrated in Figure A, offers several advantages to the non-resident investor. The following provides a general summary of the Canadian tax consequences resulting from such a structure.

Disposition of Canco Shares

The gain on the disposition of Canco shares held by the non-resident investor can result in a taxable gain in Canada if the shares are considered to be taxable Canadian property (as defined in the federal Income Tax Act (ITA)). Shares are considered taxable Canadian property when more than 50% of their value is derived directly or indirectly from Canadian real property, timber resource property or Canadian resource property (such as an energy project). With respect to Canco shares, this test would normally be met.

However, the gain on the disposition of the Canco shares held by Foreign Holdco (as illustrated in Figure A) or held by the non-resident investor directly, if no Foreign Holdco blocker is used, may be exempt under the Canadian treaty with the jurisdiction of residence of the holder of the Canco shares. Such an exemption may be available if the real property (e.g. wind farm installations), from which Canco shares derive their value, is an immovable property in which Canco carries on business. Such treaty exemption is found in a number of Canadian tax treaties (e.g. Luxembourg, Switzerland, France, United Kingdom, Germany, Belgium).

If no treaty exemption applies, the taxable gain on the disposition of the Canco shares may be reduced if, prior to the disposition, Canco implements a dividend strategy. The dividend or deemed dividend (pursuant to the ITA), resulting from the dividend strategy, would reduce the taxable gain on the Canco shares and would be subject to a Canadian withholding tax which under the applicable treaty may be significantly lower than the Canadian tax otherwise applicable on the taxable gain.

The ability for the non-resident investors to claim a foreign tax credit for the Canadian tax paid in the jurisdiction of residence of the non-resident investor would also have to be carefully considered.

Deductibility of Interest – Thin Cap Rule

The Canadian "thin capitalization" rules should be considered in order to determine the appropriate combination of debt and equity that should be invested in Canco. The ITA denies a deduction of interest paid to a non-resident shareholder (i.e. the non-resident investor) by a Canadian corporation (i.e. Canco) if the aggregate amount of debt owed to a "specified non-resident shareholder" (as defined in the ITA) exceeds the equity contributed by such "specified non-resident shareholder" by a 1.5 : 1 ratio.

A "specified non-resident shareholder" includes a "specified shareholder" (as defined under the ITA) of a corporation (i.e. Canco) who is, at that particular time, a non-resident person. With respect to Canco, a "specified shareholder" would generally be a person who, either alone or together with persons with whom the person does not deal at arm's length, owns shares representing 25% or more of the votes attached to, or the fair market value of, the issued and outstanding shares of Canco.

Foreign Holdco (as illustrated in Figure A) would be considered a "specified non-resident shareholder" of Canco and as such, in order to meet the 1.5 : 1 debt to equity ratio, no more than 60% of the invested capital should be invested in the form of interest-bearing debt from Foreign Holdco. An interest-bearing loan directly from a non-resident investor may also not be subject to the thin capitalization restrictions depending on the non-resident investor's share ownership (together with persons with whom the non-resident investor does not deal at arm's length) in Canco. Canadian transfer pricing rules may also apply in certain circumstances to deny a portion of the interest if the loan from the non-resident investors (or from Foreign Holdco) is not considered to have been made at arm's length terms.

The loans made by non-resident third party lenders would generally not be subject to the thin capitalization restrictions.

Dip Strategy

A dip financing arrangement between Canco and the non-resident investor (or Foreign Holdco) may be considered (subject to the thin capitalization restrictions mentioned above). Under such an arrangement, the interest payable by Canco on the loan to the non-resident investor (or Foreign Holdco) would be deductible by Canco. However, the non-resident investor (or Foreign Holdco), depending on the structure, may not be subject to foreign income taxation on the interest from Canco, which results in a tax-efficient dip financing.

As explained below, however, the interest payments made by Canco may be subject to Canadian withholding tax.

Canadian Withholding Tax on Interest Payments

Canada does not impose withholding tax on interest paid on arm's length loans (provided that the interest is not a "participating debt interest"). However, Canadian withholding tax will generally apply to interest paid to a non-arm's length non-resident shareholder. Under such circumstances, a 25% withholding tax would apply on the payment of interest, unless the interest is paid to a resident of a country with a tax treaty with Canada. Under most tax treaties, the withholding tax rate applicable to the interest payment from Canco would be reduced to 10%. Note, however, that in the Canada-United States Income Tax Convention, the withholding tax on interest paid to a non-arm's length non-resident shareholder would be reduced to 0% provided that treaty benefits are not denied under the applicable treaty's limitation of benefits provision (and provided that the interest is not a "participating debt interest").

Withholding Tax on Dividends

Canada imposes a 25% withholding tax on the payment of dividends to non-residents unless the rate is reduced by a tax treaty. Under most of Canada's tax treaties, the withholding tax is reduced to either 15% or 5% if the beneficial owner of the dividends is a company that meets a certain ownership threshold (generally 10%) with respect to the voting shares of the Canadian company (i.e. Canco).

C. Joint Venture – Co-ownership of the Energy Project with other Canadian Investors

If the energy project is structured as a co-ownership (see Figure A) between Canco and other co-investors, each co-owner needs to apply, for Canadian income tax purposes, the income computation rules to its proportionate share of the income from the project as though it were, regarding that share, a sole undivided owner. Although the third party financing may be more complex to arrange, this may be the simplest ownership structure from a tax standpoint if other Canadian co-investors are participating in the energy project.

D. Partnership to Hold the Energy Project

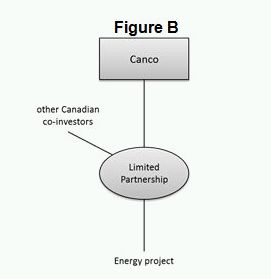

Renewable energy projects are often held through a partnership (see Figure B). In that case, Canco and other Canadian entities would be partners of the partnership that hold the energy project.

Although the rules and effects are quite similar to those applicable to direct ownership or co-ownership, the following differences from a tax perspective are noteworthy:

- The ITA, as a general rule with respect to partnerships in Canada, requires a computation of income (or loss) at the partnership level and an allocation of the income (or loss) to the partners of the partnership.

- Upon the disposition of its partnership interest, a partner will generally realize a capital gain (or capital loss).

- A partnership interest is a separate property in itself. It is therefore distinct from the underlying property (e.g. the energy project, wind farms). Consequently, a partnership structure may offer more opportunity when trying to put in place a reorganization of holdings on a tax-free basis. The use of a partnership can however trigger specific rules (discussed below) that may undermine Canadian tax efficiency.

Negative Adjusted Cost Base

If the renewable energy project is held through a partnership (see Figure B), particular attention should be given to the negative adjusted cost base (ACB) rule related to the partner's partnership interest when cash is repatriated from the partnership to the partner. Broadly speaking, the ACB of a partner's partnership interest is equal to the cost of such property plus any expenses incurred to acquire it (e.g. commissions and legal fees), plus the partner's share of income and additional contributions minus the partner's share of the loss and draws. This punitive rule provides that a partner, who qualifies as a "specified member" in a partnership, will be deemed to realize a gain from the deemed disposition of his partnership interest at the end of the fiscal period of the partnership if the ACB of his partnership interest is negative at that time. A "specified member" can be broadly defined as a partner who is a limited partner, as defined in the ITA, a partner that is not actively engaged in the activities of the partnership business (such as management and daily activities) on a regular, continuous and substantial basis or a partner not carrying on a similar business as that carried on by the partnership. Loans to partners, as opposed to capital distributions, may be considered in order to avoid negative ACB issues.

At-risk Rule

The at-risk rule is a rule that applies with respect to a partnership and provides that a limited partner, as defined in the ITA, of such a partnership will have to compute an at-risk amount in order to determine the amount of loss deductible at a particular time from the partnership. A limited partner's at-risk amount is calculated using the ACB to the limited partner of the partner's partnership interest. However, where the limited partner has not acquired the partnership interest from the partnership itself, the limited partner's ACB is limited to the vendor's ACB, thereby ensuring that the at-risk amount is not increased unless additional capital is contributed to the partnership. Subject to other adjustments, the at-risk amount is reduced by any amounts or benefits to which the partner is entitled, either immediately or in the future, and that are granted or may be granted, in order to protect the partner from a loss in respect of the investment in the partnership. A limited partner may only deduct losses from the partnership up to the at-risk amount of the partner's interest in the partnership. Such a rule may, in certain circumstances, reduce the Canadian tax efficiency if limited partnership losses (as defined in the ITA) that could otherwise be used to reduce income from other projects are in excess of the limited partner's at-risk amount in one particular project held through a partnership (see Figure B). Any limited partnership losses that have been restricted through the at-risk rule will be lost on the sale by the limited partner of the partnership interest. As such, the limited partnership losses cannot be used to offset the taxable gain resulting from the disposition of the partnership interest by a limited partner.

CANADIAN TAX INCENTIVES FOR RENEWABLE ENERGY PROJECTS

A. Accelerated Capital Cost Allowance Deduction

One of the most important Canadian tax incentives available to project owner (i.e. Canco) of renewable energy project is the accelerated capital cost allowance (ACCA) deduction. Certain properties (e.g., electrical generating equipment, wind turbines or transmission equipment) are subject to an ACCA deduction rate of 30% or 50% (for most such properties acquired after February 22, 2005 and before 2020) computed on a declining balance basis. Such rates are far more generous than what is generally available for similar properties and may cause a significant deferral of Canadian income tax payable on the profits.

As a general rule, in order for a property to qualify for this incentive, it must be acquired, used and located in Canada. Subject to specific exceptions, used (as opposed to new) or reconditioned property may not qualify for this ACCA deduction. However, such used qualifying property may, in certain circumstances, be transferred to a new owner if it is acquired within five years after it became available for use by the previous owner and that such property remains at the same site.

B. Canadian Renewable and Conservation Expense

The other major Canadian tax incentive for a developer of a renewable energy project is the Canadian Renewable and Conservation Expense (CRCE). CRCEs are expenses generally incurred in the pre-production development phase of a renewable energy project, where it is reasonable to expect that at least 50% of the capital cost of the depreciable property to be used in the project would qualify for the ACCA deduction. Moreover, in order to qualify as a CRCE, an expense needs to be payable to a person or partnership with whom the developer is dealing at arm's length. Generally, CRCEs include expenses related to certain service connected to a project for the transmission of electricity, the construction of a temporary access road to the project site, right of access, process engineering, and certain test wind turbines if these turbines are, among other criteria, installed primarily for the purpose of testing the level of electrical energy available on prospective wind farm sites. Administrative fees, legal fees, insurance and management costs, as well as other similar expenses, do not qualify as a CRCE. As well, expenses payable to a non-resident person or to a partnership other than a Canadian partnership (as defined in the ITA) (other than an expense for certain test wind turbines) do not qualify.

Once an expense qualifies as a CRCE, it can be fully deducted from the developer's income in the year it is incurred or carried forward indefinitely and deducted in later years.

If the energy project is held through a partnership, CRCEs incurred by the partnership will not be deducted when computing the income of the partnership. Instead, each partner's share of CRCEs incurred by the partnership in a fiscal period will, if the particular partner was a member of the partnership at the end of its fiscal period, be allocated to the partner according to the applicable reasonable sharing ratio. The amount so allocated will also reduce the ACB of the partnership interest.

LIMITATIONS ON FEDERAL TAX INCENTIVES

A. The Specified Energy Property Rule

The principal limitation regarding the ACCA deduction that may be claimed by a renewable energy project owner is the "specified energy property" (SEP) rule. A SEP is generally a property for which ACCA deduction is allowed. However, when a property qualifies as a SEP, the amount of CCA that may be claimed in a given taxation year, with respect to the property, is limited to the lesser of:

- the amount of CCA otherwise determined for such a property, and

- the owner's net income (after deducting all expenses, other than CCA, related to earning such income) from all SEP of the owner.

In other words, ACCA deductions may not be used by owners to shelter other sources of income. Nonetheless, this restriction does not apply to SEP owned by a corporation (or a partnership) that satisfies the principal business test (discussed below) on an annual basis.

Principal Business Test

Qualifying principal businesses for the purposes of this test include, inter alia, the sale, distribution or production of electricity.

By using Canco to hold the renewable energy project (see Figure A), this test is easily met, as Canco's only business would be related to the renewable energy project.

It is also important to note that if the renewable energy project is owned by a partnership (see Figure B), each member of the partnership must be a corporation that qualifies under the test (or a partnership that qualifies under the test).

B. Tax Shelter Investment

Under the ITA, a "property" (e.g., the wind turbines held by a partnership or the interest of a partner in a partnership that owns the wind turbines) can be regarded as a "tax shelter" if it can be reasonably considered, having regard to statements or representations made in connection with such a property, that if a person were to acquire an interest in the property, at the end of a particular taxation year that ends within four years after the day on which the interest is acquired, the cumulative amount of deductions in computing income, taxable income or tax payable (including losses in the case of a partnership interest) for the particular year or any preceding taxation year in respect of the interest in the property, would exceed the cost (subject to certain adjustments) to the person of the interest in the property. For this purposes, the cost can often be reduced by the project financing. A non-resident investor should be careful not to receive or communicate any tax information with respect to the project. It is important to note that the representations or statements do not need to be particular, specific or well developed. A simple exchange of emails or financial models that reflect tax calculations could be sufficient to trigger the tax shelter rules.

If the tax shelter rules apply, the "promoter" must register the investment with the relevant tax authorities or face significant penalties. This would also include the deferral of tax benefits for investors such as the deferral of CCA, which could accelerate the payment of Canadian income taxes on the projects.

QUEBEC TAX TREATMENT

A. CRCE Credit

Quebec legislation provides a refundable tax credit of 30% of any "eligible expenses" (basically a CRCE as described above) of a "qualified corporation" (the CRCE Credit) in a given year. A qualified corporation is defined as a corporation (other than a tax exempt corporation or the shares of which are flow-through shares) that, in a given year, carries on a business in Quebec and has an establishment in Quebec or a corporation that is a member of a partnership that, if it were a corporation, would be a qualified corporation. The eligible expense needs to be incurred in respect of work carried on by the corporation on a renewable energy project located in Quebec.

B. Public Utility Tax

The Public Utility Tax (PUT) is calculated on the net value of the assets that are part of an energy project. More precisely, the assets subject to the PUT are immovables used in a system of production, transmission or distribution of electric power.

The calculation of the net value of these assets would be based on the financial statements prepared by Canco. The PUT, payable at a rate of 0.20% or 0.55% (depending on the net value of the assets), is calculated on this total value. Careful consideration is required if a partnership structure is to be used to hold the project in order to avoid inadvertently becoming subject to the highest rate through the application of the income tax rules of association with other partners.

TREATY SHOPPING CONSULTATION

The 2013 federal budget announced the Canadian government's intention to counter "treaty shopping" by non-resident investors by making changes to domestic legislation, rather than through treaties. Although the Canadian government is still undertaking consultation and has not yet published the draft legislation, it is expected that a general approach rule will be adopted through a legislative change whereby treaty benefits would be denied where one of the main purposes for entering into a transaction is to obtain the treaty benefits in question. Treaty shopping occurs when a resident of one country (Residence Country), who is the non-resident investor, derives income or capital gains from Canada and accesses a tax treaty between Canada and a third country that offers a more generous tax treatment than the tax treatment otherwise applicable. For example, the Residence Country of the non-resident investor may not have a tax treaty with Canada, or the treaty between the Residence Country of the non-resident investor and Canada may offer less generous tax treatment than the tax treaty between Canada and a third country. It is expected that safe harbour presumptions (that none of the main purposes was to obtain a treaty benefit) may apply in situation where a blocker entity resident in a favorable treaty jurisdiction with Canada is used to hold the Canadian investment if the non-resident investor (or a related person) carries on a substantial active business in the blocker entity's jurisdiction of residence or the blocker entity is not controlled directly or indirectly by a person or persons that would not have been entitled to similar treaty benefits. It is essential for the non-resident investors to carefully consider the potential application of such measures in their planning, and to consider the potential tax liabilities from the forthcoming legislation in their financial model, if appropriate.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.