The Reserved Alternative Investment Fund ("RAIF"), was introduced by Luxembourg law on 23 July 2016 (the "RAIF Law").

The RAIF combines the characteristics and structuring flexibilities of Luxembourg regulated Specialised Investment Funds (SIFs) and investment companies in risk capital (SICARs), however, the RAIF is not subject to Commission de Surveillance du Secteur Financier(CSSF) approval before it is launched, nor is it subject to CSSF supervision once launched. This feature allows for a significantly reduced time-to-market for new fund launches.

The RAIF regime is reserved for AIFs which appoint a duly authorised AIFM (in Luxembourg or in any other EU Member State) as their external AIFM. The RAIF itself is therefore indirectly supervised via its authorised AIFM. A RAIF, cannot be self-managed.

At the time of its introduction, the RAIF was eagerly anticipated by participants in the Luxembourg fund industry. The reputation of the Luxembourg fund centre, which already offered many attractive fund vehicles, has sometimes suffered due to the lengthy approval process of regulated funds. Further, with the implementation of AIFMD, the SIF and SICAR vehicles managed by an authorised AIFM are subject to a double layer of supervision. The vehicles are directly supervised by the CSSF as well as indirectly, via the supervision of the AIFM. The RAIF, not being subject to the prudential supervision of the CSSF means that the fund can be launched, as well as perform updates to key documents throughout its life-cycle without prior regulatory approval, thus providing a useful addition to the Luxembourg tool kit.

It was anticipated that the RAIF would become the fund vehicle of choice for many alternative managers launching funds managed by an authorised AIFM.

The RAIF has now been around for a year and it is interesting to see that the new vehicle is already a success.

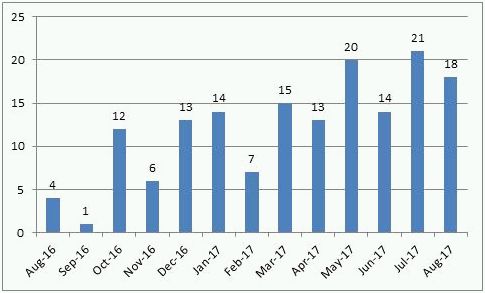

Following the introduction, the immediate uptake was modest, with around 15 RAIFs filed with the register of commerce during the first three months. The following 10 months however have seen a steady flow, with an average of just over 10 new funds being registered per month. As of 31 August this year, 158 RAIF structures have been setup and registered with the Luxembourg Trade Register.

The number of RAIFs registered per month during the first year since the introduction of the new law

The RAIFs launched to date comprise a broad range of alternative investment strategies including private equity, real estate, private debt as well as infrastructure funds. Nevertheless, Luxembourg still sees funds applying these strategies launched as SIFs and Sicars, and it appears that the introduction of the RAIF has not significantly reduced the demand for these well-established fund vehicles. The total number of SIFs and SICARs has remained relatively consistent with approximately 1,500-1,600 SIFs and 280-290 SICARS between 2014 and July 2017. Although there are many similarities between the RAIF and these regulated vehicles, there are certain differentiators, which may cause mangers to choose another structure type.

The decision to opt for a SIF or SICAR, rather than a RAIF, despite the more cumbersome approval process, is influenced by the nature of the investors which a fund manager is targeting. Certain institutional investors, such as, for example, pension funds and insurance companies, may require a fully regulated and supervised investment structure to invest in. In addition to this, the requirement for the fund to be manged by an authorised AIFM, may cause managers to choose a SIF or a SICAR structure, should the size of the fund not require it to fall in full scope of the AIFM directive. In this case the AIF is usually structured as self-managed AIF that only needs to be registered and therefore does not need to apply the full scope of the AIFMD rules, providing that no passport is needed.

From the number of funds established in the first year, one can conclude that the arrival of this innovative investment structure has indeed proved a welcome addition to asset managers looking to set-up investment vehicles in Luxembourg. It has not replaced the use of the pre-existing structures, but rather complemented the Luxembourg toolbox, enabling managers to choose a fund vehicle tailored to their specific needs. As such, the RAIF contributes to make Luxembourg a more dynamic and competitive marketplace.

At Intertrust, we experience increasing client interest in the new vehicle and are involved in a number of RAIF projects. The time to market is a feature frequently mentioned by our clients as the rational for choosing the vehicle, as well as the fact that it combines the corporate flexibility for unregulated structures such as limited partnerships, with the fund attributes previously only available for regulated funds, such as for example the ability to set up umbrella structures with compartments.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.