Earlier this year, the Guernsey Financial Services Commission (GFSC) announced the launch of the Guernsey Green Fund.

The objective of the Guernsey Green Fund is to provide a platform upon which investments into various green initiatives can be made. The Guernsey Green Fund enhances investor access to the green investment space by providing a trusted and transparent product that contributes to the internationally agreed objectives of mitigating environmental damage and climate change.

To illustrate how the Guernsey Green Fund may be of use to you or your clients, we have prepared two stylised case studies:

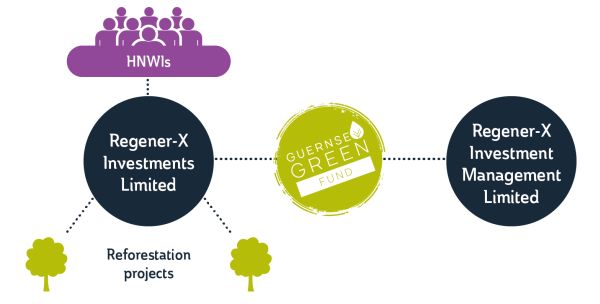

Case study 1

Mr. X is a consultant with an NGO working across Central and South America to incentivise reforestation by providing education and support for local landowners, allowing them to replant deforested areas in a way that benefits wildlife and the environment whilst providing the landowners with a return in terms of crops and/or timber. Over the years, Mr X has developed a range of contacts and realises that if he could provide funding to landowners that would generate significant returns he could participate in whilst also ensuring the reforestation work continues.

With this in mind, Mr X would like to establish an ethical, regulated structure his HNW contacts can invest into to then on-invest into the reforestation projects where he can be recognised (and remunerated) as the coordinating and managing party.

Solution

Mr X establishes Regener-X Investments Limited as a Guernsey Private Investment Fund. Regner-X Investment Management Limited (a newly formed Guernsey company wholly owned by the X family) is established in Guernsey as the manager of the Fund.

The application for the registration of the fund and licensing of the manager are submitted to the island's regulator and approval is granted the next day. To confirm the fund's green ethos the manager opts to designate the fund as a Guernsey Green Fund using route 2 (self-designation) to reduce costs. Additionally, the boards of the Fund and the Manager agree to voluntarily apply Environmental, Social and Governance ("ESG") Principles to the investment analysis and decision making processes of the fund, further enshrining the ethical intent of the project in its governance processes.

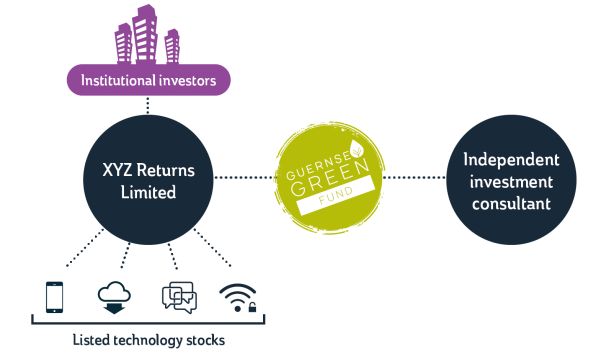

Case study 2

XYZ Capital is an investment house targeting institutional investors. It has been running an open-ended Guernsey class B scheme, XYZ Returns Limited, for many years investing in an array of listed technology entities. The issue is that certain institutional investors are under internal pressure to demonstrate their ethical bona fides and are considering allocating their funds elsewhere on the next dealing day. One of the investors has pointed out that more than 80% of XYZ Returns Limited portfolio is comprised of technologies which could be considered "green" but the fund's green messaging is weak.

Solution

XYZ Capital applies to have XYZ Returns Limited designated as a Guernsey Green Fund, providing their investors with comfort the fund meets a defined set of green criteria.

To provide further investor comfort, XYZ Capital chooses to contract with an independent environmental investment consultant to assess the portfolio and provide a Route 1 declaration that the portfolio meets the green fund criteria.

For more information about Guernsey's finance industry please visit www.weareguernsey.com.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.