August 2018 brought two major developments in the Department of Treasury's race to finalize its partnership audit reform regulations before partnerships begin in early 2019 filing tax returns for the first time under the new regime. First, on August 7, the Department of Treasury ("Treasury") issued final regulations for partnership representatives. Second, on August 13, Treasury issued new proposed regulations implementing the centralized partnership audit regime, consolidating, amending, and releasing its prior regulations issued in 2017 and early 2018. Our prior coverage of these initial regulations can be found here and here. Both sets of regulations issued in August include certain substantive changes due to comments received by the IRS.

Final Regulations for Partnership Representatives

The final regulations for partnership representatives address their scope of authority and provide procedures for their designation, resignation, revocation, and appointment of successors, including by the IRS in certain circumstances. The final regulations provide as follows:

- Designation of Partnership Representative: Partnerships subject to the partnership audit reform rules must designate a partnership representative for each taxable year on their tax return for that year.

- Required Qualifications for Partnership Representative: Any person or entity with a substantial presence in the United States, including a U.S. address and telephone number, can be appointed as partnership representative. The final regulations clarify that the partnership itself and also disregarded entities can serve as the representative. When an entity is selected, the partnership must also appoint a designated individual with substantial presence in the United States to act on behalf of that entity. That designated individual need not be an employee of the partnership representative entity.

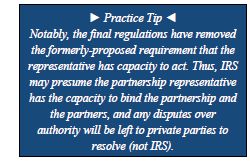

- Authority of Partnership Representative: The partnership representative (or designated individual) has sole authority to act on behalf of the partnership, but may appoint a power of attorney to act on its behalf.

- Duration of Appointment: A designation is effective until IRS determines that it was invalid or there is a proper resignation or revocation.

- Resignation of Partnership Representative: A partnership representative or designated individual may resign when IRS issues a notice of administrative proceeding ("NAP") for the partnership taxable year. If the partnership representative resigns, the partnership appoints the successor representative, not the resigning representative.

- Revocation of Partnership Representative: Any person who was a partner during the partnership taxable year and certifies that he/she has authority to do so, can revoke, on behalf of the partnership, a partnership representative or designated individual, but can only do so after IRS issues a notice of selection for examination or NAP for the partnership taxable year. A revocation must simultaneously appoint a replacement partnership representative or designated individual. A revocation based on a NAP must be made on an administrative adjustment request ("AAR").

- Effectiveness of Resignation or Revocation: Both resignations and revocations of partnership representatives and designated individuals must be done in writing and are generally effective upon receipt by IRS.

- Appointment of Successor Partnership Representative: The partnership appoints any successor representative. IRS will notify the partnership if the partnership representative or designated individual appointment is ineffective, such as because of a resignation or the invalidity of a designation. In that case, the partnership will have 30 days to appoint a successor representative.

- IRS Appointment of Successor Partnership Representative: If the partnership fails to appoint a successor representative within 30 days, or if there have been multiple revocations within a 90-day period, IRS may also appoint a successor partnership representative. In that case, IRS will ordinarily, but is not required to, consider a number of factors when appointing a successor partnership representative, including the views of majority interest holders in the partnership, general knowledge of the person in tax matters, access to book and records, whether the person has substantial presence in the United States, and the profits interest of the person.

New Proposed Regulations for Partnership Audit Regime

The new proposed regulations implementing the partnership audit regime (REG-136118-15) build on regulations issued by IRS in 2017 and early 2018, making changes, some of which are in responses to comments received to prior proposed regulations. Some significant portions of the new proposed regulations include:

- Determination of Adjustments at Partnership Level: A key component of the new partnership audit regime is that all partnership-related items will be determined at the partnership level, and incorporated into the amount of imputed underpayment that, by default, a partnership will be obligated to pay. This includes all issues associated with adjustments to partnership items, including statutes of limitations, additional tax, and penalties (with a narrow exception for partner-level defenses). The proposed regulations define a "partnership-related item" as "each item of income, gain, loss, deduction or credit attributable to a partnership," regardless of whether that item appears on a return.

- Calculation of Imputed Underpayment: As a default rule, the partnership will pay any imputed underpayment as if it were a tax and take into account any net positive adjustment in the year of the adjustment. IRS will calculate an imputed underpayment by grouping proposed adjustments into categories, including reallocations, adjustments to credits, adjustments to creditable expenditures, and other adjustments. Within each grouping, IRS will group partnership adjustments further into subgroupings based on preferences, limitations, restrictions, and conventions, such as source, character, and holding period. IRS will net items within the same grouping or subgrouping for a single taxable year to determine an imputed underpayment, or has discretion to propose multiple imputed underpayments.

- Overview of New Audit

Process:

- Notice of Adjustments. IRS will mail notices of proposed partnership adjustments ("NOPPAs") and notices of final partnership adjustment ("FPAs") to the partnership and the partnership representative, at their respective last known addresses, even if the partnership has terminated.

- Statue of Limitations. IRS may mail a NOPPA within three years of the later of three possible dates: (i) the return due date of the partnership's taxable year, (ii) the date the partnership's return was filed, or (iii) the date on which the partnership filed an Administrative Adjustment Request (AAR) for the taxable year.

- Modification Period. A partnership representative may request modification of an imputed underpayment within 270 days after receiving a NOPPA. IRS is permitted to grant extensions for the partnership to submit modification requests.

- Timing of FPAs. IRS may issue an FPA no earlier than 270 days after issuing a NOPPA. This period may be shortened by agreement of the parties.

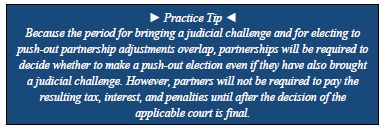

- Judicial Review. The partnership has 90 days from the FPA mailing to petition the Tax Court, Federal District Court or Court of Federal Claims for readjustment of the FPA. In order to petition for readjustment in District Court or the Court of Federal Claims, the partnership must first deposit the imputed underpayment under dispute, plus penalties and interest with IRS.

- Push-Out Elections. The partnership has 45 days after receiving an FPA to make a push-out election under Section 6226.

- Requirement to Report Consistently: Partners must report partnership-related items consistently with their partnership or file an election for inconsistent treatment. If they do not, IRS can collect any amount owed as a result of inconsistent reporting in the same manner that it collects tax associated with mathematical errors.

- Permitted Modifications

to Imputed Underpayment Amounts. The proposed

regulations list seven types of modifications IRS will consider,

IRS may also consider alternative modifications not listed.

- Modifications based on partners' amended returns. Modification may be requested by providing affidavits from each relevant partner showing that the partner filed amended returns for the reviewed year and made appropriate payments. (In the case of a reallocation adjustment, all partners affected by that adjustment must file amended returns related to that adjustment.) If IRS approves the modification request based on partners' amended returns, the partners need IRS consent to file further amended returns for the modification years with respect to the relevant items. This consent should not affect partners' ability to file subsequent amended returns relating to a different partnership or a different taxable year.

- Modification based on tax-exempt and foreign partners. Modification may be requested based on tax-exempt partners, to the extent the partnership demonstrates each tax-exempt partner would not have been subject to tax with respect to the adjustment allocable to the partner for the reviewed year. A partnership may also request modification based on partners entitled to benefits under a tax treaty, which allows modification if a relevant partner would have qualified for a reduction or exemption from tax with respect to a particular item under a tax treaty with the United States. The Treasury and IRS have specifically requested comments on the modification based on foreign partners.

- Modification of tax rate. A partnership may request modification by changing the tax rate applied to the portion of the total netted partnership adjustment allocable to a C corporation or an individual with respect to capital gains and qualified dividends, based on a valuation analysis. Such lower rate, however, will be the highest rate applicable to the partner with respect to the type of income in question.

- Modification based on passive losses of publicly traded partnerships. Publicly traded partnerships, as defined in Section 469(k)(2) ("PTPs"), may request modification in the case of a net decrease in a specified passive activity loss for specified partners. This modification is available both to partnerships that are PTPs and with respect to partners (and indirect partners) that are PTPs.

- Three other bases for modifications. IRS also proposed three additional methods of modification not included in the BBA Rules. First, a partnership may request modification of the number and composition of imputed underpayments. Second, a special modification is allowed for partners that are RICs and REITs where they can show that they have followed the procedures for deficiency dividends laid out in Section 860. Third, the IRS will allow an appropriate modification based on the contents of a closing agreement entered into under Section 7121.

- Adjustments Not Resulting in an Imputed Underpayment: Adjustments not resulting in an imputed underpayment are taken into account by the partnership in the adjustment year as either an increase to partnership loss or a decrease to partnership income. In general, any such adjustment will affect non-separately stated loss or income, respectively. However, if the adjusted item is an item that would have otherwise been required to be separately stated under Section 702, then the adjustment will instead increase or decrease the applicable separately stated items of loss or income, respectively.

- Pushing-Out Partnership

Adjustments to Partners: Instead of paying

adjustments at the partnership level, a partnership may choose to

"push-out" the adjustments to partners from the reviewed

year, by making a "Section 6226 Election." This decision

must be made within 45 days of the date IRS mailed the final

partnership adjustment. If the partnership pushes-out the

adjustment, it must give statements to each affected partner within

60 days of the determination of the partnership adjustment, and

also file these statements with the IRS. (Statement errors

discovered within the 60-day period may be corrected; errors

discovered afterwards require IRS consent for correction.) The

partners must then include the adjustments in their own returns.

The proposed regulations allow partners to offset such correction

amounts across tax years and against any other taxes owed. However,

offsets are not permitted for calculating interest on the

correction amounts; interest accrues from the due date of the tax

return being adjusted.

If a partnership pushes the adjustment out to its partners, IRS may not collect the taxes owed from the partnership, unless the Section 6226 Election is invalid. A Section 6226 Election is valid if all the provisions in the regulations are followed, and all information within statements is correct. The election is considered valid until IRS determines it is invalid. If the election is invalid, the Partnership is required to pay the imputed underpayment in lieu of pushing-out the imputed underpayment to its partners.

Pass-through partners in a tiered partnership structure may, in turn, push-out adjustments to the ultimate taxpayers, using the same mechanism. "Pass-through partners" are partnerships, S corporations, and certain trusts and estates.

- Administrative Adjustment Requests ("AARs"): Partnerships may make AARs to adjust "partnership related items" including income, gain, loss, deduction, or credit of the partnership on a prior year partnership return. An AAR may not be filed after a NAP has been mailed, unless IRS withdraws the NAP. If a partner is required to account for corrections noted in the AAR, then the partnership must furnish such statements to its partners. Pass-through partners that receive such statements are required to furnish statements to its own partners, pursuant to the mechanisms for the Section 6226 Election.

- Partner-level Penalty Defenses. The former proposed regulation provided that partners could request a modification by raising a reasonable cause with an amended return. The new proposed regulations remove partner-level defenses from the modification process, and instead provide that such partner-level defenses should be raised through a claim for refund, submitted outside of the modification process. Effectively, this forecloses partners' ability to litigate partner-level defenses in Tax Court before paying the respective penalty.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.