Foreign bidders continue to outnumber domestic acquisitions in public M&A and the growing appetite for foreign scrip has extended beyond resources. While changes to Australia's foreign investment regulations prompted some concern over the potential effect on foreign investment, we do not expect that these changes will limit the attraction of investment in Australia to overseas bidders and investors.

Foreign bidders in public M&A

- While 2014 saw a much higher proportion of foreign bidders than Australian bidders (62%), foreign bidders only comprised 52.5% of bidders in our 2015 deal sample. Foreign and Australian bidders also had an almost equal share in the "mega-deals" (over $1 billion), with 55% and 45% respectively.

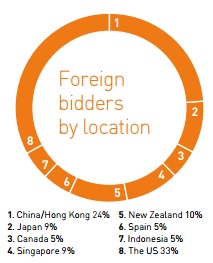

- Unlike previous years, PRC acquirers did not represent the largest proportion of foreign bidders in the Australian market (comprising only 23.8% of foreign bidders in 2015). Instead, US bidders led the charge at 33%. However, interest from Asia overall was high with bidders from the PRC, Japan and South-East Asia together comprising 47.6% of foreign bidders in our deal sample.

- Continuing a trend observed in 2013 and 2014, foreign bidders still preferred to proceed by way of a takeover bid (62% in 2015 compared to 53% in 2014 and 71% in 2013). Foreign acquirers have a stronger preference on this point than Australian bidders who marginally preferred a takeover to a scheme at 52.6%.

- While the preference for cash continued with foreign bidders (76% of foreign bidders offered all cash – the same as in 2014), the incidence of foreign scrip deals also remained notably high, comprising almost a quarter of all foreign deals. Previously, most offerings of foreign scrip consideration have occurred in the resource sector. However, 2015 saw offers of foreign scrip in not only resources, but also consumer services and transportation deals. While there appears to be an increased comfort on the part of bidders to offer foreign scrip across a range of sectors, whether this is reciprocated in an increased shareholder appetite for accepting foreign scrip remains to be seen – at the time of writing, only one deal offering foreign scrip had successfully completed.

- Once again, foreign bidders out-paid Australian bidders, offering average premiums of 53%, compared to average premiums by Australian bidders of 29%.

FIRB changes - much ado about very little

In 2015, the Australian Government introduced changes to Australia's foreign investment regime. While the new legislation package represents the most substantive changes to the framework since its introduction, most (other than the changes to agribusiness) clarify rather than radically change the law.

While the changes have prompted some concern over the potential effects on foreign investment, the clear message from the government is that Australia welcomes foreign investment. We do not expect the changes to the regime will limit the amount of foreign investment in Australia.

The key changes to the foreign investment regime include:

- Increase in the substantial interest threshold – the substantial interest threshold for a single foreign person has been increased from 15% to 20% to align with the 20% rule under the takeovers regime.

- Investments in the agriculture sector – specific rules for the acquisition of direct interests3 in an agribusiness. An Australian entity will be considered an 'agribusiness' where the value of the assets used to carry on the agribusiness or the EDBIT (earnings before interest and tax) of the entity derived from the agribusiness exceed 25% of the total business assets or earnings.

- Agribusiness is defined broadly, and includes agriculture, forestry and fishery businesses and certain first stage downstream manufacturing and processing businesses.

- Accidental foreigner – the introduction of an exemption for Australian listed companies which would otherwise be foreign under the regime, so that interests of foreign persons in a listed company which are less than 5% will not count towards determining the aggregate 40% threshold.

- Fees – for the first time, fees are to be levied for foreign investment applications. The fees payable range from $1000 to $100,000. Importantly, the clock for the statutory timeline (which remains 30 days) that applies to FIRB decisions does not start until the fees for the application have been paid.

- Penalties – the introduction of civil penalties. Under the previous regime only divestment order and criminal penalties applied for a breach of the foreign investment regime. The amendments have introduced civil penalties and are accordingly subject to a lower burden of proof than applies to criminal penalties.

Footnote

3 'Direct interest' means an interest of 10%, or 5% if:

- the person has a legal arrangement with the entity (for example an off-take agreement); or

- the acquisition of any interest if the foreign person is in a position to participate or influence the central management and control of the company; or influence, participate or determine the policy of the company.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

|

|

| Chambers Asia Pacific Awards 2016 Winner

– Australia Client Service Award |

Employer of Choice for Gender Equality

(WGEA) |