In our PPS law reform Update - August 2008, we included an easy to use navigation tool and flow chart (PPS Navigator) to assist you in assessing the impact of the draft PPS legislation on your business.

As mentioned in our PPS law reform Update - November 2008, a revised draft of the Personal Property Securities Bill (Revised Bill) was released by the Federal Attorney- General in November 2008 and has been referred to the Senate Standing Committee on Legal and Constitutional Affairs (Committee) for comment. As a result, we have updated the PPS Navigator to account for the new section numbering contained in the Revised Bill and for some of the new concepts introduced by the Revised Bill.

We hope the following updated PPS Navigator is of assistance to you in assessing the impact of the Revised Bill on your business. The changes that have been made to the original version are marked in bold.

Status Of The Reform

The submissions received by the Committee indicate that although there is broad community support for the proposal for a uniform registration system for securities over personal property, there are potentially a significant number of elements of the Revised Bill which require further consideration and amendment.

As a result, there are calls for delay in introducing this substantial law reform to ensure that adequate consideration is given to the reform (particularly in view of the substantial changes proposed to long established legal principles) and that it provides for a system which deals with the multiple laws which currently apply, in a way which is practical, less complex and is embraced by the financial community.

Our submission to the Committee deals with some of the issues which we believe require further consideration. You can visit the Committee's website at www.aph.gov.au/Senate/committee/legcon_ctte to see our submisson and the other submissions that have been lodged.

Commitee Hearings

The Committee is currently conducting hearings in relation to the Revised Bill. DLA Phillips Fox gave evidence at the hearing on 22 January 2009. In presenting to the Committee we raised the possibility of excluding from the scope of the Revised Bill charges granted by companies and registered foreign bodies.

In our view, this would achieve a number of benefits, particularly:

- Significantly reduced compliance costs for those institutions involved in providing finance which does not involve obtaining security over personal property from natural persons or other entities not subject to the charge provisions in the Corporations Act. Examples of this type of finance include commercial property, construction and development finance, project finance and financing of infrastructure as well as big ticket leasing.

- Continuing the use of a long standing and understood national register, being the Charges Register maintained by the Australian Securities and Investments Commission.

- Avoiding uncertainty and inconsistency arising from possible overlaps between the operation of the Revised Bill and existing laws, particularly in relation to priorities, enforcement and insolvency.

- Reducing the complexity of the Revised Bill and enabling it to focus on security interests which are currently problematic for financiers and involve potentially multiple laws. We note that under the Corporations Act, registration of a charge granted by a company or registered foreign body is deemed to satisfy the registration requirements of a number of state based laws.

Although the maintenance of the charges provision of the Corporations Act (and the exclusion of companies and registered foreign bodies from the operation of the Revised Bill) will result in an additional register which extends to personal property securities, we do not believe, given the above benefits, that is a significant disadvantage, particularly as they would apply to separate and distinct matters

Conclusion

We will continue to update you with the progress of these reforms. The next step in the reform process will be the report of the Committee on the Revised Bill (due 24 February 2009), which we will review with interest.

PERSONAL PROPERTY SECURITIES BILL 2008 (BILL)

PPS Basic Navigator

|

Question |

Consequences |

|

Does the arrangement create a security interest in personal property?1 |

The Bill applies to arrangements that, in substance, create a security interest over personal property. Subject to the following question and consequences, if no security interest is created, the PPS Bill does not apply to the transaction. |

|

Is the proposed arrangement: |

Importantly, the Bill extends to these types of arrangements even though they are not traditionally regarded as security interests. |

|

Is the security agreement evidenced in writing and signed by the security provider?3 |

In the absence of writing signed by the grantor, a security agreement will not be enforceable against a third party (see section 63(2)(b)) unless the personal property is in the possession of the security party or, in respect of controllable property, in the possession or control of the secured party. Writing includes electronic recording of the agreement. |

|

Should the security interest be registered under the Act?4 |

Failure to register a security interest may result in the security being void against a liquidator or administrator (see section 233). |

|

Does the proposed arrangement create a purchase money security interest (PMSI)?5 |

These types of security interests provide the secured party with 'super priority' in certain circumstances (see sections 108-112). |

|

Is the secured party to have possession of the property that is subject to the security interest?6 |

If secured party has possession of personal property, a security agreement is enforceable against third parties (subject to priority, extinguishment and other rules in the Bill). |

|

Is the secured party to have control over the property the subject of the security interest?7 |

See below but note certain advantages are limited to 'controllable property'. |

|

Is the personal property over which a security interest is to be created 'controllable property'?8 |

If a security interest is over controllable property, then perfection by possession or control is available which also provides priority advantages (see section 100(3)) and reduces the risk of extinguishment. See also section 113. |

|

Are the assets over which the security interest is to be created inventory and consumer property?9 |

There are different rules relating to control and priorities depending on which type of personal property is involved. There are also other differences throughout the Bill depending upon the nature of the collateral. |

|

Does the proposed security interest contemplate the provider of the security being entitled to transfer the property free of the security interests or is the property a current asset?10 |

These concepts replace the use of 'floating charges' (as is currently used in security arrangements). They are relevant in determining the continuation of the security interest in the asset or its proceeds after transfer. |

|

Has the security interest attached to the collateral?11 |

In order to obtain a priority position, a security interest needs to be perfected. In order to be perfected it must first attach to the collateral (see section 64(1)(a)). |

|

Has the security interest been perfected?12 |

In order to obtain priority advantages, the security interest needs to be perfected. |

|

If the personal property has been dealt with by the grantor of the security, does the person who has acquired the interest in the personal property take it free of the existing security interest created by the secured agreement?13 |

In certain circumstances, a third party can obtain an interest in personal property free from the security interest (even if the dealing with the property is in contravention of specific restrictions contained in the security agreement). |

|

What is the priority position of the security interest?14 |

The Bill contains specific priority rules which, in some cases, differ from the current law. Relevant factors include the timing of attachment, the type of perfection and the nature of the collateral and the security agreement. |

|

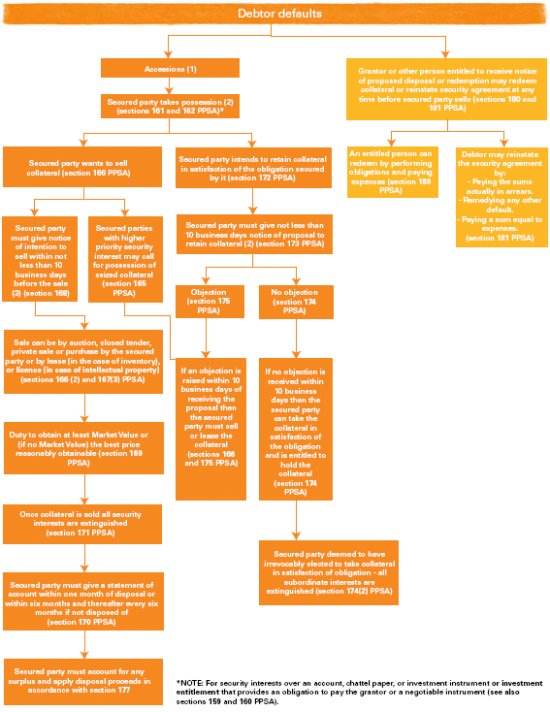

What steps must be taken to enforce the security interest?15 |

See flow chart in Annexure A. |

|

NOTE: Under section 154, a large number of provisions can be contracted out of if the collateral is not consumer property. |

|

Footnotes

Please refer to the following sections of the draft Bill in considering the above questions.

1. Section 26 definitions of collateral, personal property and security interest, section 28 and exclusions in sections 6 and 29.

2. Section 26 definitions of account, chattel paper, commercial consignment and PPS Lease, section 28(3), section 31, section 35 and section 36.

3. Section 63 (particularly sub-section (3)).

4. Sections 189-195.

5. Sections 32 and 33.

6. Section 26 definition of possession and sections 43, 44 and 63.

7. Section 26 definition of control, sections 45-49, and sections 52 and 53.

8. Section 26 definition of controllable property, and definitions of ADI Account, ADI investment instrument, investment entitlement and negotiable instrument.

9. Section 26 definitions of consumer property and inventory.

10. Section 51.

11. Sections 61 and 62.

12. Section 64 and sections 67-71.

13. Division 1 of Part 2.3 of the Act (commencing at section 84), and the section 26 definition of knowledge and sections 55-57. See also Division 2 of Part 2.3 (sections 98 and 99).

14. Sections 100-123 inclusive.

15. Sections 141-182 inclusive.

Footnotes

(1) Accessions: If the secured party has a security interest in tangible property (accession) which is installed in, or affixed to, other tangible property (improved property) and the secured party does not have security interest in the improved property, enforcement against the accession is to comply with sections 144-148.

(2) Apparent possession can be taken if the collateral is of a kind that cannot be readily removed or easily stored. The secured party can dispose of the collateral on the premises, but can't cause the person in possession of the premises any greater inconvenience than is necessary (section 164(1) and (2) PPSA).

(3) Notice must be given to:

- The grantor of the security interest.

- Anyone who has registration in the collateral at the

time of giving the notice.

- Any person who, at the time the secured party gives

notice, the secured party knows has an interest in the

collateral.

- Any person who has given the secured party notice that the person claims interest in the collateral.

NOTE: Under section 154, a large number of provisions can be contracted out of if not consumer property.

Phillips Fox has changed its name to DLA Phillips Fox because the firm entered into an exclusive alliance with DLA Piper, one of the largest legal services organisations in the world. We will retain our offices in every major commercial centre in Australia and New Zealand, with no operational change to your relationship with the firm. DLA Phillips Fox can now take your business one step further − by connecting you to a global network of legal experience, talent and knowledge.

This publication is intended as a first point of reference and should not be relied on as a substitute for professional advice. Specialist legal advice should always be sought in relation to any particular circumstances and no liability will be accepted for any losses incurred by those relying solely on this publication.