INTRODUCTION

A key issue for project sponsors at the outset of any project is to decide the type of contracting structure which will be used to deliver the project.

This paper provides a summary of the key features of some alternative contracting structures and then sets out a diagram of each structure together with a list of advantages and disadvantages.

ALTERNATIVE STRUCTURES

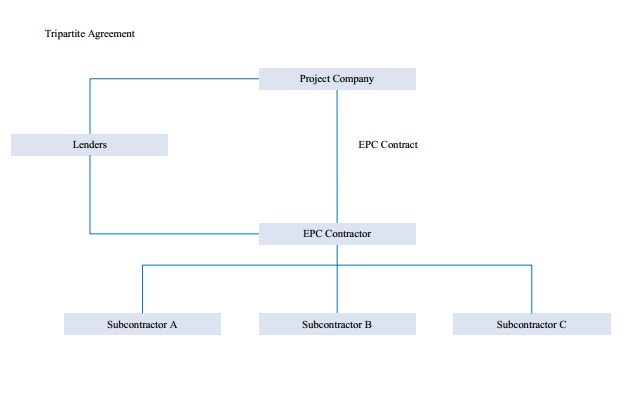

Alternative 1 – EPC structure

The EPC structure will be most familiar to project sponsors. Under this structure, the project company enters into a contract with the EPC contractor which will then enter into various subcontracts with its sub-contractors for performance of discrete portions of work. The EPC contractor provides the project company with a single point of responsibility for ensuring the project is completed on time and meets the performance requirements.

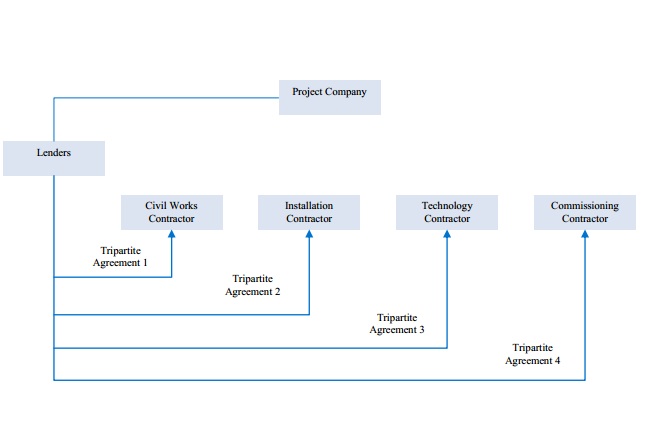

Alternative 2 – work packages structure

Under the work packages structure, the project company enters into separate contracts with expert contractors for each type of work or package. This structure allows the project company to have more involvement and greater control over performance of the works than under the EPC structure. For this reason, it is most appropriate when it is necessary for the project company to closely monitor or control at least one critical part of the works.

It is common for the contractors to be minority equity participants in the project company but it is rare for majority shareholders to also be a contractor.

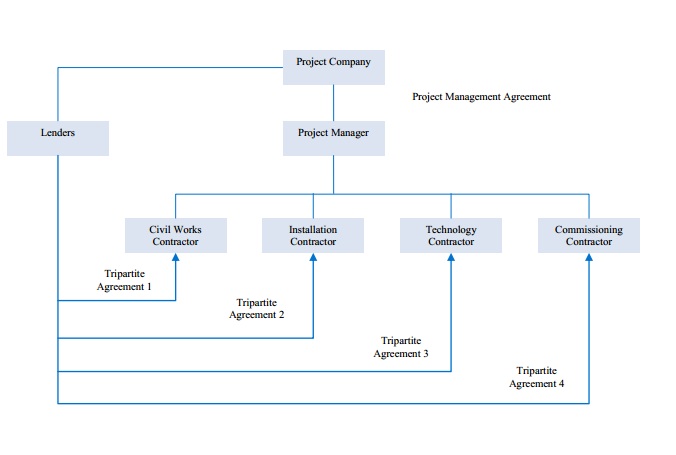

Alternative 3 – project management structure

The project management structure is a compromise between the EPC structure and the work packages structure. Under this structure, the project company can take advantage of the expertise of each contractor while making the project manager responsible for much of the risk. The role of project manager is to negotiate and let contracts and manage the performance of the works. If the project manager assumes an appropriate level of risk this structure is probably more bankable than the work packages structure.

This structure may be adopted in complex projects with easily definable parts. It is important to consider the identity of the project managers – selecting equity partners as the project manager may make the lenders more comfortable.

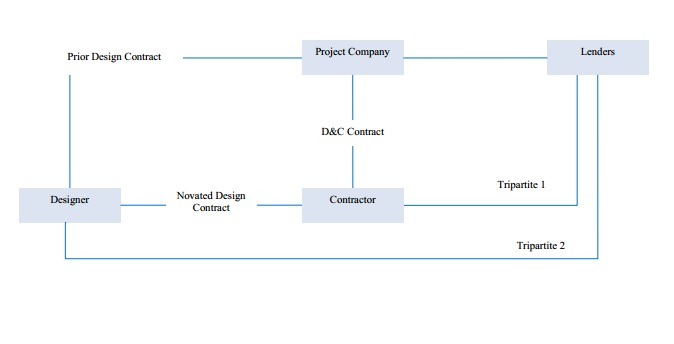

Alternative 4 – novated structure

Under the novated structure, the project company initially enters into a design contract with a specialist design contractor. When the construction contractor is appointed, the design contract is novated so that the construction contractor replaces the project company as the contracting party in the design contract.

From the perspective of the project company, the construction contractor becomes totally responsible for design as under the EPC structure.

This structure is particularly useful if the project company needs to commence the works quickly. However, it is probably only applicable for simpler, non-operating projects ie hospitals and road projects.

ALTERNATIVE 1 – EPC STRUCTURE

Advantages

- Single point of responsibility for performance of the works

- Bankable as lenders are familiar with the contract structure

- Guaranteed completion date and fixed contract price

- Clear division of obligations and liabilities

- Easier to assess creditworthiness of the EPC contractor

Disadvantages

- Contract price may be inflated as the EPC contractor is assuming most of the risk

- Limited ability of project company to be involved in the performance of the works

- Inefficient use of resources because no pooling of knowledge and skills

- Risks may be placed on those unable to influence or manage them

ALTERNATIVE 2 – WORK PACKAGES STRUCTURE

Advantages

- Expert contractors engaged for each part of the works

- Greater ability of the project company to control the progress of the works

- Contingencies charged by contractors may be reduced because scope of work is more familiar to each contractor

- Overall capital expenditure may be less than under the EPC structure

Disadvantages

- No single point of responsibility for performance of the works

- Project company will be responsible for performance and interfacing between the various work packages (which will involve coordinating the design process)

- Lenders not as familiar with structure as it is not typical market practice

- Complexity of structure may mean higher financing charges

- Technology provider and licensor not ultimately responsible for performance

ALTERNATIVE 3 – PROJECT MANAGEMENT STRUCTURE

Advantages

- Equity participants with relevant experience responsible for coordinating works

- Project managers can be incentivised to bring the project in on time, on budget and with the required level of performance

- Project more bankable if project manager assumes an appropriate level of risk

Disadvantages

- No single point of responsibility for performance of the works

- Lenders may require greater sponsor support if the project manager is not an equity participant

- Probably no performance liquidated damages (depends on the works package)

- Documentation complexity - potential gaps in risk allocation

- Potentially higher transaction costs given the number of parties and contracts and more complex lenders due diligence

ALTERNATIVE 4 – NOVATED STRUCTURE

*This may not be required depending on when financing is obtained.

Advantages

- Project company has more control over the design and is able to ensure it meets its functional requirements

- May produce a more competitive price

- Design can be done fairly quickly which may be useful if the time frame for completing the project is particularly tight

- Other advantages of the EPC structure are also applicable

Disadvantages

- Involves two sets of negotiations which may not be practical in the time frame

- Potential for project company to have residual design risk

- Some contractors may not accept this structure

- Other disadvantages of the EPC structure are also applicable

CONCLUSION

The suitability of each of the above contractual structures will depend on the nature of the project, the parties involved and commercial, practical and bankability considerations.

This paper has only considered some possible alternative contracting structures for delivery of a project. There are obviously other contracting structures that may be used. For example, another alternative form of contracting is alliancing under which the participants enter into a relationship (alliance) to formally align their commercial interests. The next paper will consider the nature and features of alliancing and when alliancing should be used by the project sponsors.

© DLA Piper

This publication is intended as a general overview and discussion of the subjects dealt with. It is not intended to be, and should not used as, a substitute for taking legal advice in any specific situation. DLA Piper Australia will accept no responsibility for any actions taken or not taken on the basis of this publication.

DLA Piper Australia is part of DLA Piper, a global law firm, operating through various separate and distinct legal entities. For further information, please refer to www.dlapiper.com