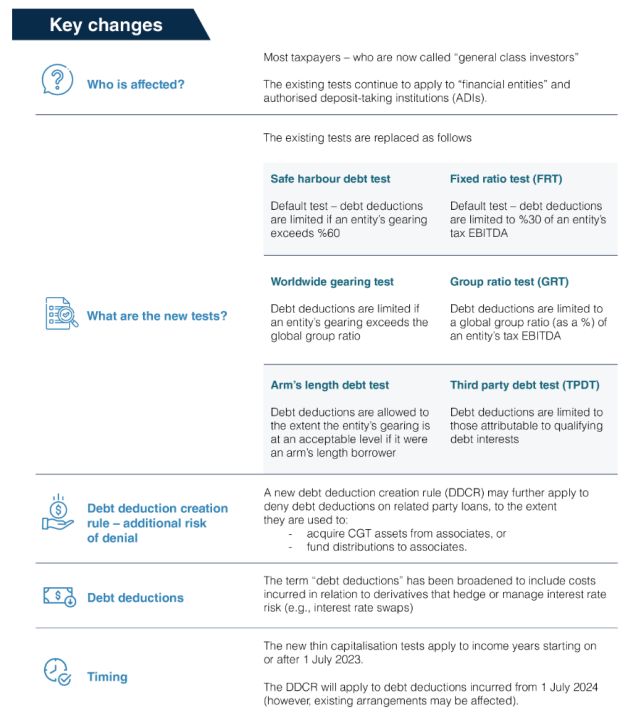

This A&M Tax Brief summarises the current state of play for the new Australian thin cap rules, noting that the most recent amendments (circulated by the Government in November 2023) were approved by the senate committee and recommended to be passed as-is.

The new rules are already in effect, although they have not been formally passed by parliament – that is, for taxpayers whose income years have commenced on or since 1 July 2023.

Our analysis below reflects the state of the new thin cap rules, including the latest Government amendments.

A&M Perspective

Under the rules (as drafted), a key issue including for corporate Merger & Acquisition (M&A) transactions will be the DDCR, which is a targeted new rule that can deny deductions on many kinds of common commercial arrangements between related parties, such as:

- Acquiring property from an associated developer for long-term holding purposes (even where both seller and buyer are in Australia);

- Acquiring trading stock from an associate for use in the ordinary course of business, but leaving a related party payable outstanding;

- Using a mixture of common funds to pay a dividend to an offshore parent that has provided shareholder debt;

- Paying an associated entity under a distribution rights agreement with the use of shareholder debt.

What is unclear and how can A&M help you navigate these new rules?

Do taxpayers now need to "trace" funds from related party debt (or other sources) to their ultimate use, to determine whether the DDCR is triggered?

Will the restructuring of existing related party debt arrangements be subject to Australian Taxation Office (ATO) scrutiny, or allowed a transitional period to ensure compliance with the new rules?

Overall, the DDCR could have a significant compliance burden and may require substantial planning to ensure ordinary commercial dealings do not trigger unwanted consequences.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.