Significant changes to the Aged Care system were made on 1 July 2014.

These changes can make a great impact on your income and assets. It is therefore critical to obtain advice from an aged care financial specialist to ensure that your assets are structured effectively to minimise residential care fees and understand the corresponding Centrelink benefits, tax and estate planning issues.

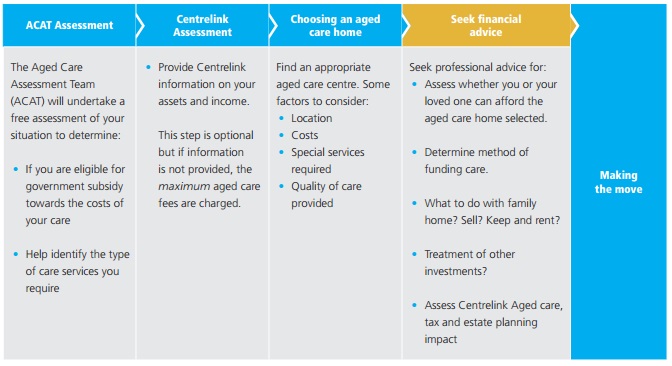

The Process of Entering Residential Care

Below is an overview of the process for entering an aged care home.

The initial steps are rushed through on most occasions and the step to seek financial advice from an expert who specialises in this area is skipped altogether. This step is even more critical now in light of the recent changes, made by the Government, to the aged care system, which became effective from 1 July this year.

The Fees from 1 July 2014

Moving into a residential aged care home requires you to come up with an initial payment that can range from around $200,000 up to $550,000 in most cases (sometimes higher) depending on the aged care home selected. Like real estate, the location of the aged care home plays a vital part in how the prices are set.

Under the new aged care system, this upfront payment (formerly known as an Accommodation Bond) is known as a Refundable Accommodation Deposit (RAD). As its name suggests, the payment is refundable back to the resident or their family in full when they leave the aged care home.

A resident has the option to make this payment in full as a lump sum or as "rental-like" payments, known as a Daily Accommodation Payment (DAP). The upfront payment can also be made as a combination of a lump sum (i.e. RAD) and ongoing daily payments (i.e. DAPs).

It is worth noting that, while a RAD is fully refundable, a DAP, like rent is dead money. The Government has also put in a restriction on the aged care providers preventing them from charging a RAD that leaves a resident with less than $45,0001 in assets after paying it.

In addition to the initial cost, every resident must also pay the Basic Daily Fee of $46.501 . This is an ongoing fee payable during the residency period.

There may also be an additional daily fee depending on the level of a resident's assets and income, aptly known as the Means Tested Fee (MTF). The rationale behind the MTF is similar to the Aged Pension entitlement where an individual who has the means will receive fewer subsidies from the Government and required to make a greater level of financial contribution towards their own aged care stay.

The MTFs are capped annually so that a resident does not pay more than $25,0001 in a year. There is also a lifetime cap whereby if a resident has paid a total of $60,0001 in MTFs, then they won't have to pay this fee ever again regardless of their assets and income. However, the Basic Daily Fee continues to apply.

Now let's look at a case study of a typical couple.

A Case Study

To assist John & Ingrid with their decision-making, an analysis of two scenarios is undertaken. One scenario assumes they sell the family home while the other scenario sees them keeping the property and renting it out. In each of the scenario, we will look at:

- How John & Ingrid could fund the accommodation payment should they sell their home or not?

- How will it impact their Centrelink Age Pension?

- How will it impact their income and expenditure?

- How will it impact their net asset position over a five year period?

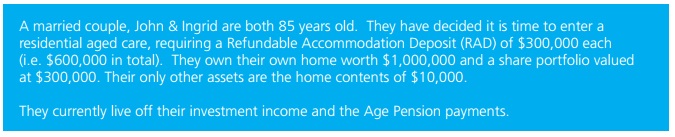

- Funding the Accommodation Payment

Scenario 1 – Sell the family home

In this scenario, John & Ingrid pay the aged care provider total Refundable Accommodation Deposits (RADs) of $600,000 by selling the family home which netted them with $975,000 (after costs of sale).

Scenario 2 – Keep the family home and rent it out

Here, the RADs of $600,000 are partially funded by the proceeds from selling the share portfolio for $300,000 (ignoring tax and fees for simplicity). This leaves John & Ingrid with a shortfall of $300,000.

One solution to address the capital shortfall would be for John & Ingrid to combine the RAD payments with ongoing daily payments (i.e. as DAPs), totalling approximately $55 per day (i.e. $20,068 per annum)

Funding Accommodation Payment

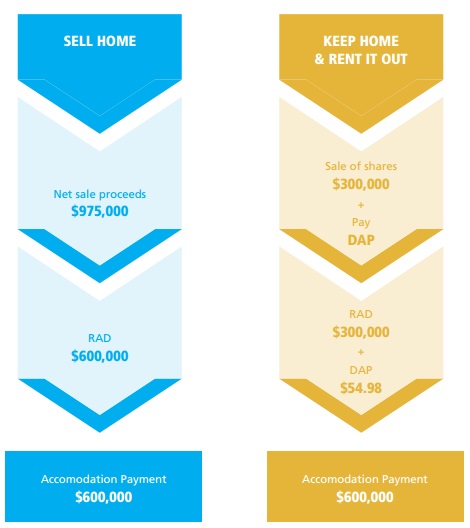

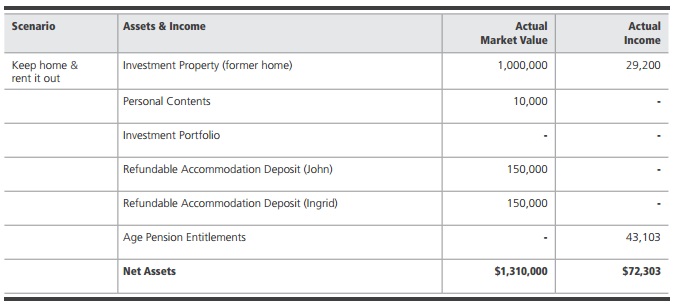

- Treatment of Assets & Income for Centrelink & Aged Care purposes

Scenario 1 - Sell the family home

After payment of the RADs, they have surplus funds of $375,000, which are invested to generate additional income. Therefore, they now have in total $675,000 worth of investments, $600,000 in RADs, $10,000 of personal effects but no property.

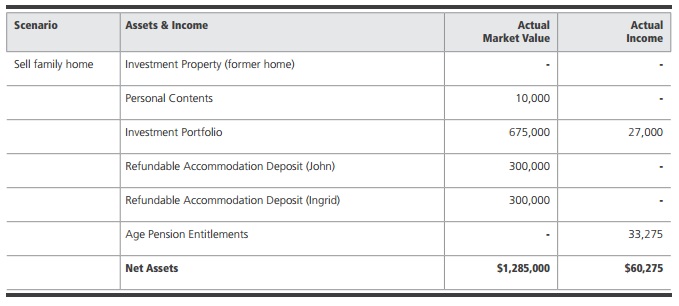

Scenario 2 - Keep the family home and rent it out

After payment of the RADs, their remaining assets are the family home which is converted to an investment property and personal effects of $10,000.

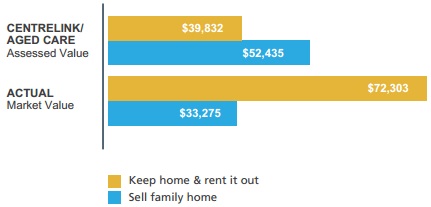

The graphs below depict the treatment of John & Ingrid's assets and income from both the Centrelink and Aged Care perspective. It reveals:

- The actual valuation of one's assets and the income that flow from it are often different to how they are assessed for Centrelink and Aged Care purposes.

- Therefore, structuring assets effectively can make a difference to how much Age Pension entitlements you receive and the level of ongoing aged care fees you have to pay.

- In this case study, selling the family home results in a significantly higher level of, both, assets and income being counted for Centrelink and Aged Care purposes. This translates into lower Age Pension entitlements and higher ongoing aged care fees. Conversely, keeping the family home and renting it out results in favourable treatment from both the Centrelink and Aged Care perspective.

Centrelink & Aged Care Treatment of ASSETS

Centrelink & Aged Care Treatment of INCOME

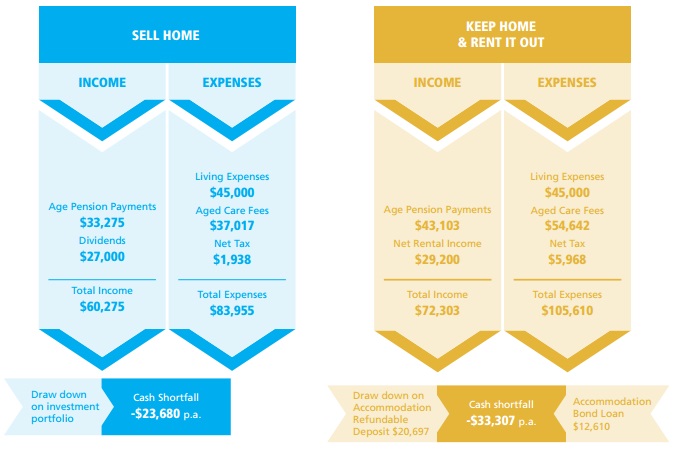

- Cashflow Management

Scenario 1 – Sell the family home

John & Ingrid's daily expenses have increased as a result of entering the aged care home. They now have a shortfall in their cashflow. To cover this deficit, they need to draw down on their investment portfolio.

Scenario 2 – Keep the family home and rent it out

Like under Scenario 1, John & Ingrid are also experiencing cashflow shortfalls. Their residential care fees are higher than Scenario 1 due to payments of the DAPs of $20,697 p.a. (representing interest costs on the unpaid RADs of $300,000). To help them manage their cashflow, the DAPs are to be funded by drawing down on the RADs paid. In addition, they take out an Accommodation Bond Loan against the family home and draw down on it when required to help cover the cashflow shortfalls. The interest costs are capitalised to the loan which means no repayments are required for the duration of the loan term2.

It is important to note that, while the family home does not have to be let go for now, it might need to be at a later stage in order to repay the Accommodation Bond Loan unless an alternative funding method is available.

Income and Expenditures

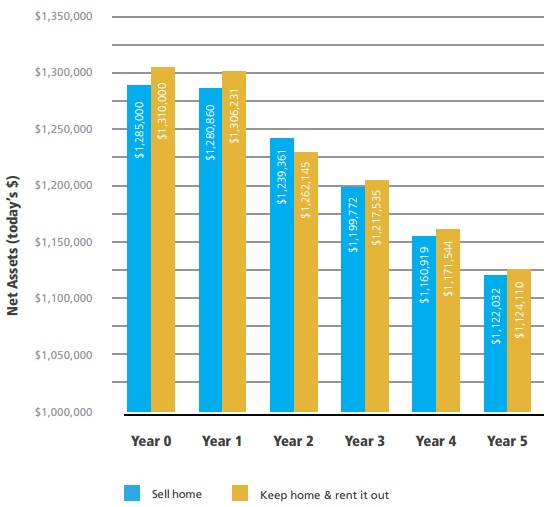

- Impact On Net Wealth

At the end of the first year, John & Ingrid would be better off by approximately $25,000 by keeping the property and renting it out as shown in the table below. This superior outcome gradually reduces over the medium term until Yr.5 when the level of net wealth is almost on par under both scenarios.

The results are graphically depicted below.

Net Assets

As you can see, the case study has illustrated how the interaction of the complex rules relating to residential aged care, Centrelink and tax can lead to different outcomes depending on how your financials are structured.

Do not hesitate to contact one of our advisers should you require advice tailored to your personal circumstances.

Assumptions used in the case study:

- Aged care thresholds are effective from 1/07/2014 and Centrelink thresholds from 20/03/2014. All thresholds are indexed by inflation rate;

- Inflation rate is 3% p.a.;

- Family home grows in line with inflation. Its gross rental yield is 4% p.a. with rental expenses of 27% of gross rental. Rental payments are indexed to inflation each year;

- Gross dividend yield on share portfolio is 4% p.a. (nil franking) and capital growth is 3% p.a.; Capital gains tax on disposal of the shares is ignored for simplicity;

- Living expenses are indexed to inflation;

- Interest rate on Accommodation Bond Loan remains constant at 6.7% p.a. It has nil ongoing fees; Application and discharge fees are ignored for simplicity.

Footnotes

1Rates are effective from 1 July 2014

2The maximum loan term of an Accommodation Bond Loan is usually 5 years. After 5 years, there is the option of rolling the loan over for another term subject to meeting certain criteria.

This publication is issued by Moore Stephens Australia Pty Limited ACN 062 181 846 (Moore Stephens Australia) exclusively for the general information of clients and staff of Moore Stephens Australia and the clients and staff of all affiliated independent accounting firms (and their related service entities) licensed to operate under the name Moore Stephens within Australia (Australian Member). The material contained in this publication is in the nature of general comment and information only and is not advice. The material should not be relied upon. Moore Stephens Australia, any Australian Member, any related entity of those persons, or any of their officers employees or representatives, will not be liable for any loss or damage arising out of or in connection with the material contained in this publication. Copyright © 2014 Moore Stephens Australia Pty Limited. All rights reserved.