The Australian Prudential Regulation Authority ("APRA") has recently released its latest quarterly property exposure data for domestic and foreign Authorised Deposit-taking Institutions ("ADI's").

Key takeaways...

Overall exposure to property

- Aggregate lender exposure to all property increased by just over 2.0% for the quarter and 7.4% compared to the June quarter 2014.

- This increase in overall exposure was driven primarily by residential lending, with overall commercial exposure declining slightly (-0.2%) since the March quarter and experiencing comparatively lower growth year-on-year (+4.4%).

Commercial Sector

- Exposure to mainstream asset classes (office, retail, industrial) declined during the quarter, with moderate growth year-on-year.

- Despite the slight decline, aggregate commercial exposure ($223.66 billion) remains within 10% of the previous peak exposure reached in March 2009 ($248.98 billion).

- Growth in exposure to development and subdivisional land (+16.5%) and other residential development (+10.9%) continued to increase significantly year on year.

- Around 17% of commercial property exposure is to assets outside Australia, in line with the long-term trend.

- Impairments on commercial lending continued to decline, to 0.6% of aggregate exposure. Notwithstanding, specific provisioning against impairments remains historically high at 36%.

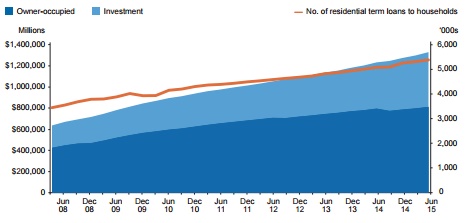

Residential sector

- The number of loans held and total exposure to the residential sector continues to increase steadily to 85% of all property exposure.

- Recent measures to dampen growth in residential investor loans have not yet generated a material impact.

- Exposure to owner-occupiers still dominates at 61% of overall residential exposure, but has declined over the last 12 months from around 65%.

- Growth in loans to investors remains significant, growing by 18.6% year on year.

- The majority of new residential loans have been in the 60% to 80% LVR segment, equating to 54% of new residential loans in the June quarter.

Change in property exposure by sector

Property exposure by lender group

Aggregate residential property exposure by type

New residential loans approved per quarter by LVR

Commercial property exposure by sector

Commercial property impairment

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.