Target board recommendations remain key to a successful takeover bid. For the past five years, not one deal in our survey has reached 100% without a target board recommendation. However, a target board recommendation is not always enough.

Target board recommendations are clearly valuable to bidders and, in practice, are required for a successful transaction. Over the last five years, no bidder has obtained 100% without first securing a board recommendation.

A greater willingness to go hostile?

Despite the critical importance of a recommendation, in 2015 only six of the 23 takeover bids (26%) were initially 'friendly', being accompanied by an immediate recommendation by the target board to accept the bidder's offer, compared to 47% in 2014. This indicates a significantly greater willingness in 2015 for bidders to make hostile bids, but it remains to be seen whether this is just an anomaly or part of a longer term trend.

Of the six friendly bids, four ultimately got to 100%, one failed, and one (the Brookfield bid for Asciano) remains ongoing. The outcome of the 17 hostile bids was more chequered. Of the 15 completed hostile bids (two remain ongoing at the time of writing), only four (26.7%) were successful in getting to 100%, and all of these ultimately secured a target board recommendation.

In total, of the 20 completed bids, 11 (55%) had target board recommendations at the time they closed and only two of those did not reach 100%.

Even for on-market takeover bids, which are unconditional and allow target shareholders to immediately sell their shares to the bidder, no bidder was able to acquire more than 50% without a target board recommendation, even when they started with a significant pre-bid stake.*

So, regardless of how the bid starts, the clear goal for a bidder must be to secure a target board recommendation, as target shareholders continue to place great weight on the views of their directors.

How did hostile bidders achieve a target board recommendation?

Seven out of the 15 initially hostile bidders in completed bids were able to ultimately obtain a recommendation. Not surprisingly, price was the key factor for target boards – five of the six recommendations involved the bidder agreeing to increase the consideration on offer. Two bidders also agreed to declare the bid unconditional at the same time.

The only change in recommendation which was not as a result of a price increase was an unconditional, on-market bid where two major shareholders (holding 67%) accepted the bid, taking the bidder's stake to around 85%. In that case, the target board really had little choice but to recommend acceptance, as the bidder had effective control and the remaining shareholders would otherwise have been locked in to a small minority interest and an illiquid stock.

That was not a factor in the other bids (other than the CIMIC bid for Devine Ltd, where CIMIC started from above 50%), as the bidder achieved the target board recommendation from stakes ranging between around 20% and 41%, all below the 'clear control' level of 50%.

The key message for target boards is that their recommendation is a crucial factor in the success of a bid. It is highly valuable and sought after by bidders, and should not be given up lightly, particularly in the face of an initially hostile bid.

The comeback kids

Last year saw a number of bidders return with proposals which had been launched, and knocked back, in 2014.

In December 2014, Programmed Maintenance Services had approached Skilled Group with a merger of equals proposal. While both sets of shareholders would have ended up with 50% ownership in the combined group, board and management control was tilted in favour of Programmed. An announced premium of 21% and the ability to share in up to $20 million per annum of synergies were not enough to entice Skilled's board, which declined to engage with Programmed and rejected the proposal. Programmed needed to decide whether to return and, if so, whether to offer a better "social outcome" for Skilled under the merger or simply increase its price. It ultimately chose the latter path and backed the ability of its management team to deliver on its synergy estimates. Almost six months later the parties announced an agreed transaction at a 45% premium which gave Skilled's shareholders 52.4% of the combined entity.

Iron Mountain's initial approach to Recall, also in December 2014, had a number of similarities with Programmed's approach to Skilled. While Iron Mountain offered a relatively small premium, the carrot was unlocking up to $250 million of synergies from combining the two groups. Recall (like Skilled) emphatically rejected the proposal and provided the market with a detailed presentation explaining the rationale for its decision. Iron Mountain (like Programmed) took several months before agreeing to significantly increase its price to get Recall's board across the line.

However, the deal has been delayed by regulatory approvals, with the scheme meeting now expected to be held in March 2016.

By contrast, Ferrovial's offers for Transfield (later renamed Broadspectrum) were driven more by a desire for a strategic footprint in Australia than by synergies. Ferrovial proposed an offer of $1.95 per share in October 2014 and, despite increasing its offer price to $2.00 per share in December 2014, Transfield's board rejected the proposal and ceased discussions. Unlike the Skilled and Recall examples, when Ferrovial returned in December 2015 it was at a much lower price of $1.35 per share offer (reflecting the target's weakening share price during 2015), and Ferrovial did not seek to engage with the target but instead immediately launched its formal takeover offer. Time will tell whether its strategy succeeds.

Methodology

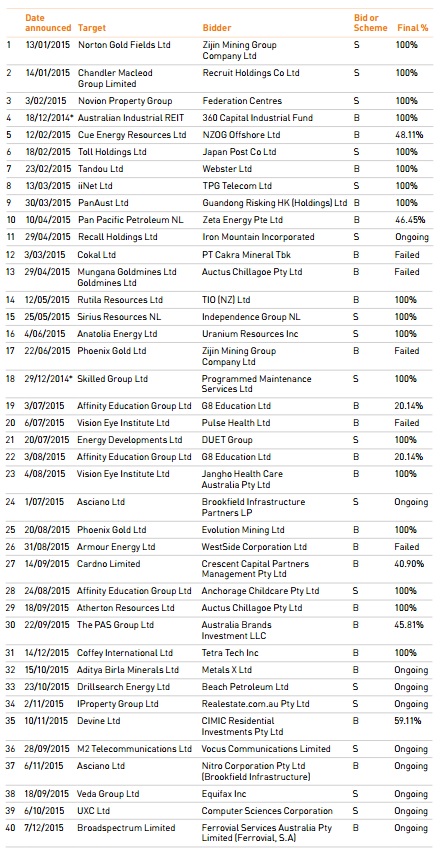

The Corrs Chambers Westgarth 2015 M&A Year in Review comprises a deal sample of:

- 40 takeover bids and schemes of arrangement involving an Australian listed target;

- announced between 1 January 2015 and 31 December 2015; and

- with a deal value over $A25 million.

A full list of all deals surveyed is set out below. Information in relation to these deals is current to mid January (unless otherwise specified 2016). As at that date, seven schemes and three takeovers from the deal sample were ongoing.

The information gathered for our survey was largely obtained from primary sources such as ASX announcements, bidder and target statements and scheme booklets. The Thomson Reuters database was also used for verification and information gathering purposes.

*Indicative non-binding proposal announced in 2014 with formal transaction announced in 2015.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

|

|

| Chambers Asia Pacific Awards 2016 Winner

– Australia Client Service Award |

Employer of Choice for Gender Equality

(WGEA) |