Norton Rose Fulbright conducted a survey of industry leaders at the Financial Review National Infrastructure Summit held in Sydney on 15-16 June 2016. Following are the results of that survey.

- What is the most economically important infrastructure project currently in the development pipeline in Australia?

The Western Sydney airport at Badgerys Creek was voted as the most economically important project by 50% or respondents.

The Inland Rail project was nominated by 25% of respondents.

Sydney Metro was the third most common response, with 16% nominating this project.

One respondent said none of the projects were the most economically important, as "prioritising state-specific projects this way is unhelpful".

- Which infrastructure type do you expect to be most affected by technology developments in the next 5-10 years?

Perhaps unsurprisingly given the presentations from Transurban and others, road transport (45%) was the infrastructure class considered by most to be the most exposed to technology developments in the medium term, followed by energy (18%) and telecommunications (14%).

Norton Rose Fulbright is the Legal Sponsor of the Financial Review National Infrastructure Summit 2016

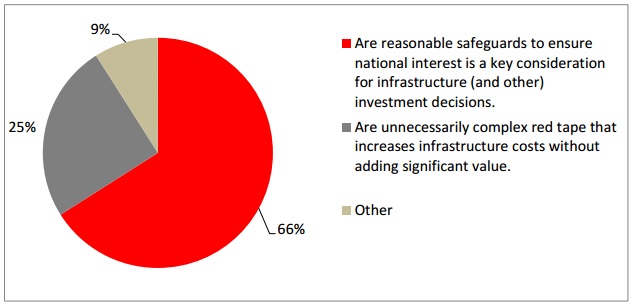

- Overall, the changes to Australia's foreign investment regime over the past six months:

The 'other' responses included comments including:

- Safeguards are not reasonable in protecting national interest

- Unnecessary, but will not significantly affect costs

- Without clear guidelines, more the latter [of the two statements], but otherwise in between the two. TransGrid, for example, had clear guidelines for transparency.

- Not as well publicised/understood as they could be.

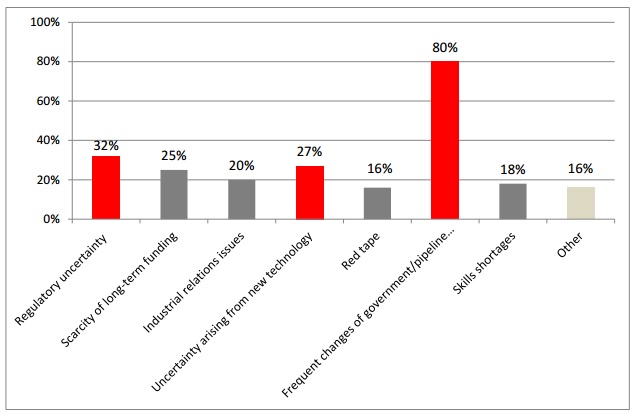

- The top three challenges for current Australian infrastructure developments.

The vast majority of respondents (80%) nominated frequent changes of government/pipeline uncertainty as the biggest challenge for current Australian infrastructure developments.

Almost a third (32%) of the industry leaders surveyed also nominated regulatory uncertainty as a top challenge and uncertainty arising from new technology was the third most commonly cited challenge (27%).

Although it missed out on making the top three, a quarter of respondents nominated scarcity of long-term funding as a top challenge (see over for the graph of the full results).

The 'other' responses to this survey question included the following comments, which echo several of the key themes arising during the discussions at the Summit:

- Structure of government and overlapping responsibilities for projects

- Project selection process deficiencies

- Structures and procurement methods attractive to the bulk of institutional investors

- High costs

- Lack of strategy and freight priority

- Single purpose interest groups

- Lack of a clear political decision making framework

Top three challenges for current Australian infrastructure developments

Respondents were able to nominate up to three challenges in response to this question, so percentages add up to more than 100%.

- Which State/Territory Government is doing the best job of delivering on the current and future infrastructure needs of its people?

The Baird State Government in New South Wales have reason to be pleased, with 84% of the infrastructure industry leaders surveyed voting them as the topperforming state/territory government in Australia.

Survey background

This survey was conducted by Norton Rose Fulbright in hard copy at the Financial Review National Infrastructure Summit in 2016, which was held in Sydney on 15-16 June 2016. Registered attendees at the Summit were invited to participate on a voluntary basis.

The 44 respondents included senior executives from utility operators, infrastructure financiers, investors, advisers, contractors, government, regulators and other industry participants. Respondents were based in all Australian states and territories, excluding Western Australia and Northern Territory.