When Chapter 7 of the Corporations Act, 2001 (Cth) (Corporations Act) was first introduced, the government announced that the reforms were intended to have flexibility to evolve with the development of financial products and financial services. In less than a decade the flexibility of the financial services laws has been well tested.

Over the next months the FSR regime will be extended to margin lending, rating agencies and research houses. But the release of the Rudd government's draft Carbon Pollution Reduction Scheme demonstrates just how diverse the area of financial products is and will continue to be.

The proposed Carbon Pollution Reduction Scheme Act 2009 will amend the Corporations Act by adding S764A(1)(k) to make Australian emission units and eligible international emission units financial products. By making emission units financial products, the reforms will extend the financial services laws to activities such as advice and dealing in emission units as well as trading in these units and making a market for emission units. Restrictions will however be placed on the sale and transfer of Australian emission units to international markets during the first five years of the scheme.

The trading of emission units on exchanges, such as the Australian Climate Exchange, by brokers will require brokers to be licensed. The reforms anticipate that ASIC will be the regulator for the financial products and services although most Australian emission units will be issued by way of auction and the Carbon Pollution Reduction Scheme will be administered by the Australian Climate Change Regulatory (Authority).

How the FSR licensing and disclosure regime will sit alongside the rest of the scheme is still unclear as the issuer of Australian emission units will be the Authority through the auction system. It is proposed that Australian emission units be personal property and that transfers of such units will be required to take place through the registry to be maintained by the Authority. The registry will also record Kyoto units being transferred as international transactions as well as non-Kyoto international units.

Carbon credit sales already occur at international level with emission reduction purchase agreements, based on templates developed by the International Emissions Trading Association (IETA).

DRAFT LEGISLATION & SENATE INQUIRIES

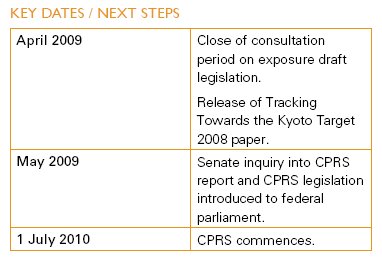

The exposure draft legislation comprises the Carbon Pollution Reduction Scheme Bill 2009, the Carbon Pollution Reduction Scheme (Consequential Amendments) Bill 2009, the Australian Climate Change Regulatory Authority Bill 2009, the Carbon Pollution Reduction Scheme (Charges - General) Bill 2009, the Carbon Pollution Reduction Scheme (Charges - Excise) Bill 2009 and the Carbon Pollution Reduction Scheme (Charges - Customs) Bill 2009. The exposure draft legislation will be referred to the Senate Standing Committee on Economics for review. Submissions on the draft legislation for the CPRS must be lodged by 14 April 2009.

ENERGY DERIVATIVES AND 'OTHER FINANCIAL RISK' PRODUCTS

While at first glance defining emission units as financial products may be unexpected for some, the provision of financial services associated with energy related financial products have been provided for several years in Australia and New Zealand.

The National Electricity Market (NEM) is the wholesale market for electricity supply in the Australian Capital Territory and the states of Queensland, New South Wales, Victoria, Tasmania and South Australia. Wholesale trading in electricity is conducted as a spot market where supply and demand are instantaneously matched in realtime through a centrally coordinated dispatch process. Generators offer to supply the market with specific amounts of electricity at particular prices. Offers are submitted every five minutes of every day.

The National Electricity Market Management Company Limited (NEMMCO) administers and manages the NEM. From all offers submitted, NEMMCO's systems determine the generators required to produce electricity based on the principle of meeting demand. NEMMCO then dispatches these generators into production. A dispatch price is determined every five minutes, and six dispatch prices are averaged every half-hour to determine the spot price for each trading interval for each of the regions of the NEM.

NEMMCO uses the spot price as the basis for the settlement of financial transactions for all energy traded in the NEM. To manage the risks associated with the spot market, electricity generators have traditionally used a variety of tools including interest rate swaps, caps or floors as well as dealing in spot and/or forward foreign exchange contracts in order to manage the generator entities' foreign exchange risks.

The over-the-counter electricity derivatives market, including base, peak and off-peak electricity swaps and caps are used extensively in the energy markets especially by generators which have various liquidity and volatility risks associated with trading on the national markets. The type of derivatives involved include electricity off take agreements, buying or selling base, peak and off peak futures, base, peak and off peak electricity swaps and caps, forward foreign exchange contracts, spot contracts and interest rate derivatives.

To service this, market specialist Australian financial services (AFS) licensees have acted as intermediaries in the arranging of the required risk transfer products on behalf of the generators. There are also a number of energy producers who have an AFS licence to deal in derivatives and foreign exchange.

In 2008, DLA Phillips Fox assisted Meridian Energy Australia Ltd (Meridian), a wholly owned subsidiary in the Meridian Energy Limited (MEL) group of companies, to acquire an AFS licence with authorisations to assist it to operate in an increasingly complex world. MEL is a New Zealand state owned enterprise which is a wholesale generator of renewable energy. Meridian has been trading carbon credits for some time and was one of the first companies to complete Verified Emission Reductions (VER) sales to international companies looking to offset corporate carbon emissions.

Meridian is now authorised in Australia to make a market in derivatives as well as dealing in non cash payments (such as renewable energy certificates and carbon emission certificates), derivatives (for derivative contracts associated with energy type products) and foreign exchange (for all the hedging required for the National electricity market spot prices every six minutes).

DLA PHILLIPS FOX EXPERTISE

Since the original reforms were made to Chapter 7 of the Corporations Act we have been helping clients prepare and obtain AFS licences and to comply with these licenses. In fact, the first AFS licence in Australia was issued to one of our clients. We have also been assisting with the preparation of clear and concise disclosure documents for AFS licencees and their distributors during that period.

The AFS licensing regime is highly regulated and 'principle' based. The onus is on the applicant to prepare an application that details the processes which will be in place to ensure the financial services business is conducted in accordance with the Corporations Act and the terms of the licence. The applicant also has to submit and have ASIC approve at least one senior person as the responsible manager for the purposes of the licence. In addition to licensing, the appointment of representatives in an FSR environment is also challenging.

The impact of operating in an FSR environment should not be underestimated. Nearly a decade after it was first introduced, financial product issuers and service providers are still negotiating refinements to the legislation and modifications to laws and regulations that have unintended consequences.

We have advised both issuers and representatives across a diverse range of financial products and services including on products which were not obviously financial ones. We have an insight into the practical problems of FSR implementation and our approach is both commercial and legally focused.

Phillips Fox has changed its name to DLA Phillips Fox because the firm entered into an exclusive alliance with DLA Piper, one of the largest legal services organisations in the world. We will retain our offices in every major commercial centre in Australia and New Zealand, with no operational change to your relationship with the firm. DLA Phillips Fox can now take your business one step further − by connecting you to a global network of legal experience, talent and knowledge.

This publication is intended as a first point of reference and should not be relied on as a substitute for professional advice. Specialist legal advice should always be sought in relation to any particular circumstances and no liability will be accepted for any losses incurred by those relying solely on this publication.