On 11 November 2009 the Australian Taxation Office (ATO) issued tax assessments for A$452.2 million on two affiliates of Texas Pacific Group (TPG), the global private equity firm behind the recent listing of the Myer retail group (Myer) on the Australian Securities Exchange (ASX)

The action by the ATO has given rise to much confusion in Australia and overseas, and raises the question of whether the ATO's practices in relation to the taxation of foreign entities is coming into conflict with the Australian government's policy on the issue. Most private equity groups will be disturbed by the suggestion that the profits from the disposal of their holdings can be characterised as income, as much of their tax analysis internationally is based on the premise that they are capital rather than income in nature. This allows them to take advantage in many jurisdictions of either a lower rate of tax (or no tax at all, if the gain is made by a non-resident) or a participation exemption that would not apply to income profits.

Given the role tax plays in attracting capital flows, the fact that the ATO is seeking to tax profits generated by foreign private equity investments in Australia will have the consequence of greatly reducing Australia's attractiveness as a destination for foreign investment. Taxing imported capital not only makes such capital more expensive but also provides a disincentive to foreign investors, such as private equity funds, who are likely to postpone any planned investment in Australia or direct capital elsewhere, and also delay realisation of any investments already made, until there is greater clarity on the Australian tax position. All of this means that fewer projects can be funded in Australia.

ATO takes action against TPG: Background

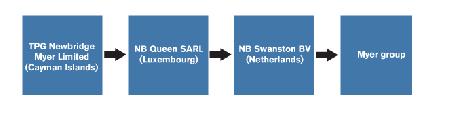

In 2006, a consortium of investors, including TPG, acquired the shares in Myer for approximately A$1.4 billion. TPG had structured its holding in Myer in the following way:

The shares in Myer were then offered for sale under an initial public offering (IPO) in September 2009. As a result of the IPO, TPG – as ultimate holding company – was understood to have realised a gain of approximately A$1.5 billion.

Following the IPO, the ATO issued tax assessments in the alternative against NB Queen SARL (the Luxembourg company) and TPG Newbridge Myer Limited (the Cayman Islands company), both for A$452.2 million, as well as penalty assessments for A$226.1 million. Counsel for the Commissioner explained that penalties such as this could be applied under the general anti-avoidance provisions contained in Part IVA of the Income Tax Assessment Act 1936 (Cth). The ATO also sought orders from the Victorian Supreme Court to freeze various bank accounts in Australia in order to stop the profits realised from the IPO from leaving Australia. Although these freezing orders were granted, the Court dismissed the freezing order proceedings the next day when it was discovered that there was only $45 remaining in TPG's Australian bank account.

Why does this come as a surprise?

Successive Australian governments have sought to increase Australia's attractiveness as a destination for foreign capital by relaxing tax burdens on foreign investors. In 2006, overseas investors were exempted from paying capital gains tax on sales of most Australian assets unless the assets comprised Australian real property, or the asset disposed of was an interest in an entity that was "land-rich"; that is, where at least 50% of the market value of the entity's assets are attributable to Australian real property; or the asset was used by the overseas investor in carrying on business through an Australian permanent establishment. These amendments to Australia's tax law and policy were in line with general global principles that income and capital gains should be taxed in the investor's place of residence.

Statements by the Australian government after the ATO's move against TPG indicate that the government itself is still committed to a taxation policy which promotes Australia as a financial services hub.

Given foreign entities, such as TPG, who invest in Australia generally do not pay any Australian tax on capital gains, what is surprising about this situation is that it appears the ATO is attempting to characterise TPG's profit as ordinary income derived from an Australian source. The reasoning behind this characterisation is that TPG's business is effectively the purchase of assets – such as shares in Myer - with the intention to later resell them at a profit – in this case through the IPO. The profit realised from the IPO appears to have been classified by the ATO as "income" which is liable to be taxed at the corporate tax rate of 30%.

However, if Australia has entered into a double tax treaty with the country in which the foreign investor resides, then generally any income or capital gains sourced in Australia by that foreign investor will be taxed in the investor's home country. What TPG's structure has allowed it to do is move its profits from the IPO in Australia to the Netherlands – a tax treaty partner country – and from there to Luxembourg, and then to the Cayman Islands. The dividends paid by the Netherlands company were tax free in the hands of the Luxembourg parent. TPG has not been required to pay tax on the profits from the IPO in Australia, the Netherlands, Luxembourg or the Cayman Islands.

Under general anti-avoidance provisions in Australia's tax laws, arrangements which utilise tax treaty jurisdictions to avoid Australian taxation may be subject to challenge, because those general anti-avoidance provisions override tax treaties to which Australia is a party.

Public discussion of the issue

The Australian media is divided. On the one hand the ATO's actions have been variously described as a "botched tax raid" which has created a "fiasco" of Australia's taxation policy on foreign investment. Some publications support the role of private equity in Australia's economic development, pointing out the dangers of the ATO's apparent policy shift.

Other media appear to be using the situation as an opportunity to play on public concern over foreign private equity activities in Australia. Stories run from this angle have inaccurately described structures used by private equity to minimise tax as mechanisms to evade taxation entirely.

The Australian Government's response

The Australian government has maintained its commitment to promote Australia as a financial services hub,1 however it has declined to comment further on the issue. One wonders whether reports of a 23% drop in tax revenue in the 3 months ending 30 September 2009 have somewhat dampened this commitment.

The ATO response

The ATO issued two draft Taxation Determinations on 16 December 2009:

TD2009/D17 which poses the question: "Income tax: treaty shopping – can Part IVA of the Income Tax Assessment Act 1936 apply to arrangements designed to alter the intended effect of Australia's International Tax Agreements network?" The ATO answers this question: Yes, but states that it will depend whether a taxpayer derived a tax benefit

TD2009/D18 which poses the question: "Income Tax: can a private equity entity make an income gain from the disposal of the target assets it has acquired?" The ATO predictably also answers this question: Yes, but states that it will depend on all the circumstances of the particular case.

Neither of the draft determinations provide clear guidelines and have not clarified the position for private equity groups considering an investment in Australian assets. The effect of the ATO actions is to cloud the issues. The draft determinations call for comments to be made by 29 January 2010. Deacons will be making submissions to seek clarification of a number of issues raised

Action you should take - how we can assist

We are able to assist international and domestic clients manage the implications of the ATO's stance on the use of tax neutral jurisdictions or other tax structures. Our services include:

- Review of proposed deals;

- Advice on structuring new deals;

- Evaluating current deals to ascertain tax risk

1 See, for example, comments by Assistant Treasurer Senator the Hon Nick Sherry on 12 November 2009 and 18 November 2009.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.