On December 30, 2022, the Decree No. 11.321/2022 reduced the Additional Rate on Freight for Renovation of the Merchant Marine (AFRMM), establishing a discount of 50% on its rates.

Such Decree came into force on the date of its publication, taking effects from January 1, 2023, so that the tax reduction should be observed by taxpayers as early as the first day of 2023.

However, on January 2, 2023, the Decree No. 11,374/2023 revoked the Decree No. 11,321/2022, extinguishing the discount of 50% and reestablishing the rates previously in force, with effects on the date of its publication.

Nevertheless, this new tax increase offends the Federal Constitution and may be questioned before the Judiciary, given that the increase of the AFRMM, qualified as a Contribution for Interference in the Economic Order (CIDE), should respect the constitutional principles of Annual Anteriority, according to which the increase could only be charged in the year following its publication, and 90-Day Anteriority, according to which the increase could only be demanded after 90 days of the publication of Decree No. 11.374/2023.

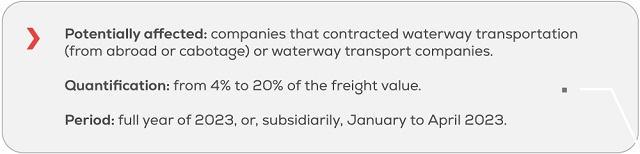

Therefore, we understand that it is worth evaluating the relevance of filing a judicial measure to discuss the matter and guarantee the right to pay the AFRMM at the rates lowered by Decree No. 11,321/2022, until December 2023.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.