We are now beginning the second decade of the private equity (PE) bull market in Canada. The surge of PE investment in the last 10 years has shifted the ground of Canadian and global corporate finance.

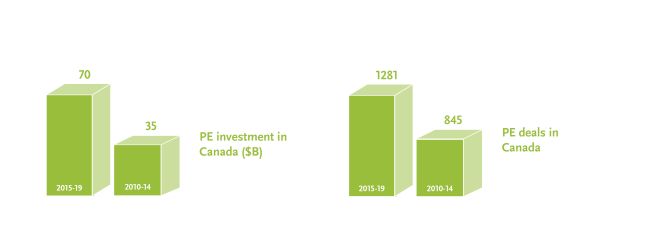

Private equity funds invested $70 billion in Canada in 1,281 deals from 2015-19. From 2010-14, $35 billion of PE was invested in 845 deals. Canada's experience follows similar investment trends in the United States and Western Europe. According to PitchBook Data, $2.7 trillion of private equity was deployed around the world in the past five years—up from $1.5 trillion between 2010-14.

(Source: PitchBook Data Inc.)

As this remarkable story continues, three key trends are shaping the future of the private equity market in Canada:

- family offices adding to private equity;

- the private equity/IPO dichotomy; and

- more specialized and sophisticated private equity funds.

Here's a closer look at these important developments and what they mean for funds, companies and investors.

Family Offices Adding to Private Equity

Family offices grew their assets under management (AUM) to $5.9 trillion in 2019. This is up from $4 trillion in 2017, according to Campden Research. Family offices are bringing in seasoned private equity professionals to manage these growing portfolios.

The size and complexity of family office deals is increasing as well. This includes traditional investment models where family offices are effecting transactions with emerging private companies in various industries. Family offices are able to invest with longer-term horizons than many traditional PE funds—an approach that is similar to the direct investment arms of Canadian pension funds.

UBS's latest Global Family Office Report says family offices continue to allocate sizeable shares of their portfolios to private equity. Families tend to be enthusiastic about investing in the area and PE fared the best of all asset classes in 2019. UBS says in 2020, direct private equity is the top area family offices plan to allocate more capital to.

The Private Equity/IPO Dichotomy

The number and value of IPOs has not shown much movement in Canada in the last 10 years. Capital IQ data says that from 2015-19 there were 292 successful IPOs worth $10.2 billion. Between 2010-14 there were 228 deals worth $10.7 billion. Globally, the value of IPOs is less in 2019 ($235 billion) than it was in 2010 ($296 billion).

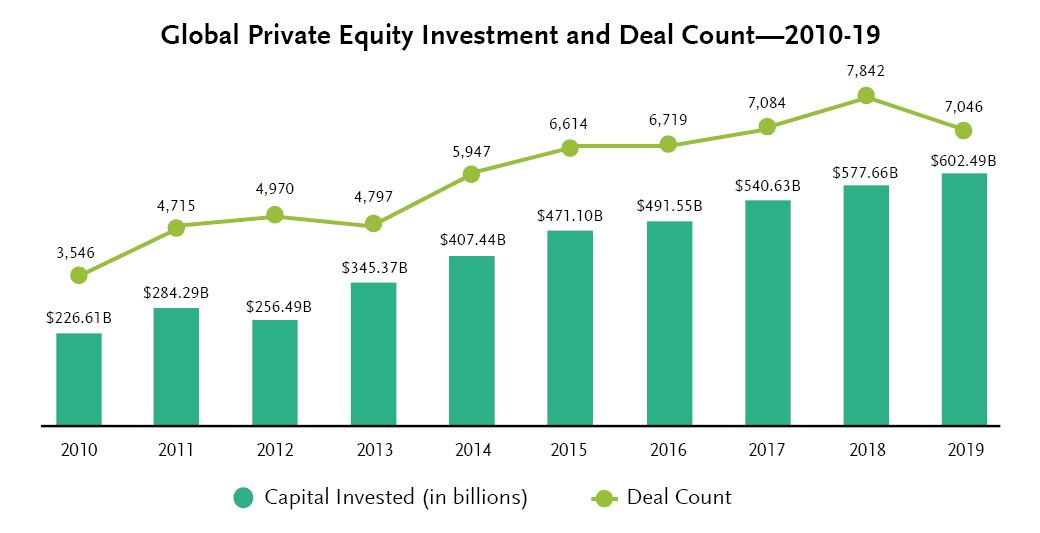

It has been a far different story for private equity. PitchBook states there was $23.1 billion of PE raised in Canada from 2015-19, compared to $13.8 billion from 2010-14. On a global level, there was $470 billion of private equity raised in 2019, up from $126 billion in 2010.

So what accounts for this private equity/IPO dichotomy?

- Market participants have commented there have generally been higher multiples in PE deals, pushing values higher and making private investment more attractive.

- IPOs involve pricing and market risk. During the time it takes to prepare an IPO, market conditions and investor interest can change quickly (as we have seen vividly in recent days). Private equity deals generally involve lower competition risk and greater transaction certainty.

- There has been a surge in dual track processes to effect liquidity, where companies pursue an IPO and run a concurrent M&A process at the same time. PE has consistently been coming out on top in these situations in the past decade.

(Source: PitchBook Data Inc.)

More Specialized and Sophisticated Private Equity Funds

The private equity bull market has resulted in funds that invest in almost everything. Funds are increasingly specialized, sophisticated and focused on particular sectors—such as infrastructure (and near infrastructure), credit funds, health care, industrial and technology. PitchBook states that the increase in private investment in IT technology in Canada jumped from $3.5 billion between 2010-14 to $11.2 billion between 2015-19. The largest Canadian pension funds have been increasingly active in the technology space in the past 10 years, with a recent focus on fintech, AI and disruptive technologies.

The work that PE firms do with credit funds keeps growing. For example, Blackstone reported that total AUM in its credit segment increased 13 percent to a record $144.3 billion in 2019. Total AUM in global credit at The Carlyle Group increased 11 percent from one year ago. At Apollo, total AUM in credit increased to $216 billion in 2019.

As Environmental, Social and Governance (ESG) shapes investment decisions around the world, private equity is responding. KKR just closed its $1.3-billion Global Impact Fund, which will invest in business models that provide commercial solutions to an environmental or social challenge. In 2019, PE funds including KKR, Neuberger Berman Group and TPG became signatories to the IFC Operating Principles for Impact Management. This new market standard provides greater discipline and transparency in impact investing.

Looking Ahead to the Second Decade

The first decade of the private equity bull market in Canada was marked by phenomenal growth in funds raised and deployed and a shift in the attractiveness of public versus private investment. The next decade in Canada is likely to be more nuanced, with more capital and greater competition for deal flow, specialization and industry expertise of funds, and the expected availability of low-rate credit to support private equity transactions.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.