Welcome to the first edition of Blakes upRound, a

regular publication from the Blakes Emerging Companies &

Venture Capital (EC&VC) group that highlights legal

developments relevant to venture investors and emerging companies

and provides concise insights on recent trends and market

developments.

The Blakes EC&VC group is a nationwide practice with lawyers in

Toronto, Calgary, Vancouver and Montréal providing

transactional and ongoing legal assistance to some of the most

dynamic emerging companies in Canada and venture investors from

Canada, the United States and beyond. As a full-service business

law firm, Blakes provides advice on all aspects of Canadian law

relevant to our clients. Our EC&VC practice includes Blakes

Ventures, an innovative service offering to support the entire

emerging company ecosystem, and Nitro, our legal support program

for early-stage companies and founders.

In this Edition

- The reappearance of "pay-to-play" transactions in the current financing environment

- New artificial intelligence (AI) and fintech regulations coming down the pipeline, among other need-to-know topics

- Recent financing trends across Canada

Market Insights

"Pay-to-Play" Provisions Making a Return in Venture Financing — In recent months, we have begun to see venture financing rounds that include the negotiation of "pay-to-play" provisions. These provisions have been largely absent in recent years due to the buoyant financing environment. However, at times when companies face greater challenges in raising funds under their current capital structure, these powerful recapitalization tools may be deployed to encourage reinvestment and new investment into a company. "Pay-to-play" provisions can help deliver the necessary funds, but it is important that companies evaluate and implement them in a manner that anticipates and mitigates the associated risks.

In financing rounds that include some element of recapitalization, a company will seek to attract new financing by modifying the economic rights of prior investment rounds, including the priorities, liquidation preferences or valuations of one or more classes or series of preferred shares.

"Pay-to-play" provisions take different forms, but their fundamental purpose is to incentivize existing investors to continue to support the company. These terms can be presented to investors as a carrot or a stick (or both together) and may have been incorporated into a company's governance documents during a prior financing round or, as we are now seeing more frequently, introduced in the context of a new round of investment where subscriptions are falling short of the company's needs. Read more in our Blakes Bulletin: "Pay-to-Play" Provisions Making a Return in Venture Financing.

Legal Update

Founders and investors may find the following insights from our Blakes colleagues helpful and instructive:

- Artificial Intelligence and Data Act (AIDA) — Similar to a recent proposal in the EU, the Canadian federal government introduced legislation to regulate "high-impact" AI systems. The proposed legislation leaves the definition of "high-impact" to regulations. However, the Government of Canada recently published guidance which suggests that it intends to regulate systems that evidence "risks of harm to health and safety, or a risk of adverse impact on human rights, based on both the intended purpose and potential unintended consequences" of use. Companies that design, develop, make available for use, or manage the operation of AI systems likely to be considered "high-impact" should consider whether there are any steps they can take now to make future compliance easier, such as establishing measures to identify, assess, mitigate and monitor the risk of harm or biased output that could result from the use of the system. See our Blakes Bulletin: Federal Government Proposes New Law to Regulate Artificial Intelligence Systems for a summary of the proposed legislation.

- FinTech and Payments Regulation — The Canadian government released regulations to the Retail Payment Activities Act (RPAA) on February 10, 2023, and British Columbia introduced legislation to regulate money services businesses in the province on March 29, 2023. For companies subject to the RPAA, the legislation requires the safeguarding of end-user funds, incident reporting and the implementation of a comprehensive and prescriptive operational risk management regime. To learn more, watch a recording of our FinTech Commercial and Regulatory Update webinar (a Blakes Business Class account is required) and read our Five Under 5: The State of FinTech: Commercial and Regulatory Update for key highlights from the presentation.

- Generative AI — New generative artificial intelligence systems raise interesting questions about copyright infringement and the application of the Canadian fair dealing doctrine. See our Blakes Bulletin: Does Generative AI Need to Infringe Copyright to Create? about this rapidly evolving area.

- Corporate Transparency — Starting January 1, 2023, private corporations governed by Ontario's Business Corporations Act are required to maintain a register of individuals with significant control (ISC). For more information on how to comply, see our Blakes Bulletin: Upcoming Changes to Ontario and Federal Corporate Transparency Requirements. Other provinces, including Nova Scotia, Quebec and Saskatchewan, have also recently adopted new transparency requirements, and both the federal and British Columbia governments have separately introduced proposed amendments to the Canada Business Corporations Act (CBCA) and B.C. Business Corporations Act (BCBCA), respectively, that would make public certain information from the ISC register for private CBCA and BCBCA corporations.

Deal Monitor

Data sourced from PitchBook.

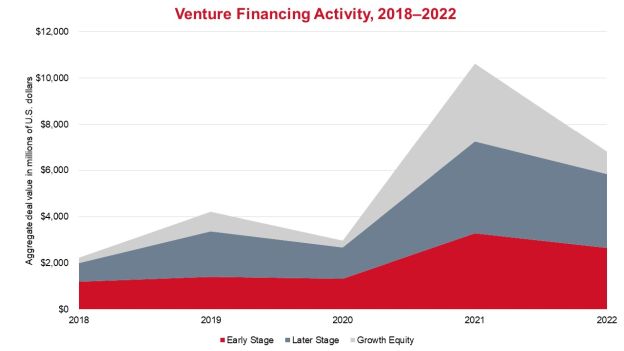

- After a record-breaking year in 2021, the aggregate value of

venture capital deals in Canada in 2022 fell by 23%. However, 2022

deal value remained significantly higher than the pre-pandemic

years of 2018 and 2019. Data from Q1 2023 suggest a continuation of

the slow-down, with the aggregate value of venture capital deals in

Canada for 2023 on pace to match levels from 2018.

- Venture investments in consumer products and services in 2022 fell by 50% from the prior year, but that followed a 161% increase between 2020 and 2021. This rise and subsequent drop are perhaps explained by the effect of government stimulus policies in response to COVID-19 and the relaxation of lockdown.

- While the value of early-stage (seed or series A) and late-stage (series B or C) deals fell by 20% between 2021 and 2022, growth equity (series D or later) deal value fell by a dramatic 72%, suggesting a closer correlation to public capital markets. Given the time a seed-stage company needs to mature, the relatively smaller funding rounds of seed-stage companies and the fact that VCs still have capital to deploy, it stands to reason that seed-stage companies have seen a much smaller drop in funding.

- In our recent transactions, we have seen increased reliance on structured equity rounds and convertible notes intended to provide bridge financing. In this environment, companies are taking steps to conserve cash and delay their need to seek additional financing.

For permission to reprint articles, please contact the Blakes Marketing Department.

© 2020 Blake, Cassels & Graydon LLP.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.