A Quick and Easy Guide

Introduction

Recently, a number of significant and complex proposed changes to Canada's tax legislation were announced, which could result in many privately held corporations becoming redundant. This may trigger a need or a desire to amalgamate and restructure redundant corporations. An amalgamation has the effect of integrating the assets and liabilities of two or more corporations, and to provide for their continuance as a single corporate entity. The continuing corporation continues to be liable for the obligations of each of the predecessor entities after the amalgamation, and the property of each predecessor becomes the property of the amalgamated company. While the reasons for amalgamating may differ in various circumstances, the legal requirements and procedures for amalgamations also differ, depending on the corporate structure involved.

Part XIV of The Corporations Act (Manitoba) (the "Act") sets out the requirements and procedures for the amalgamation of two or more Manitoba corporations. This article briefly sets out the various forms of amalgamation, how they apply and in which circumstances.

Types of Amalgamation

1. Short-Form Amalgamation Procedures

Short-Form Amalgamations are designed for non-arm's length entities. There are two types of Short-Form Amalgamations: Vertical and Horizontal.

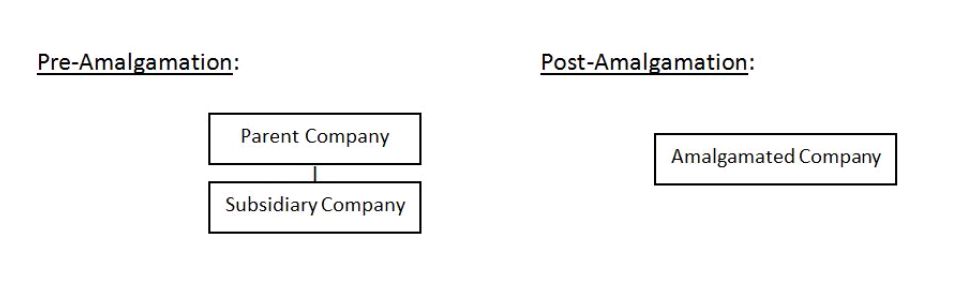

a. Vertical

When the corporations that are to be amalgamated have a parent-subsidiary relationship, a "vertical" short-form amalgamation ought to take place (i.e., a holding corporation and one or more of its wholly-owned subsidiaries).

In this instance, the shares of each amalgamating subsidiary must be cancelled and the articles of the parent corporation must become the articles of amalgamation for the amalgamated company.

The Act requires that resolutions of the directors of each amalgamating corporation approve the amalgamation and provide that the shares of each amalgamating corporation be cancelled. The articles of amalgamation will be the articles of incorporation of the amalgamating holding company and no securities shall be issued by the amalgamated corporation in connection with the amalgamation.

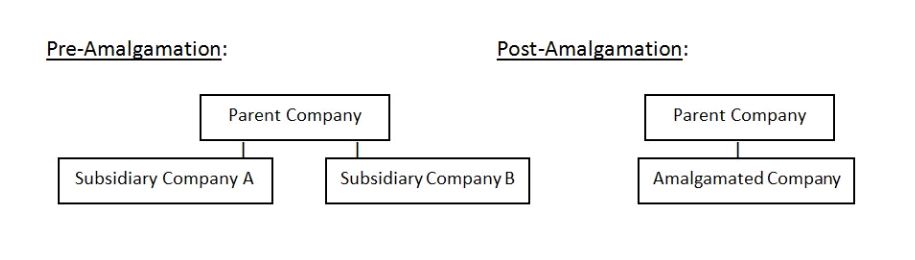

b. Horizontal

When the corporations that are to be amalgamated have a "sister" relationship, a "horizontal" short-form amalgamation ought to take place (i.e., two or more whole-owned subsidiary corporations that have the same parent holding company).

In this instance, the shares of all but one of the predecessors must be cancelled and the articles of incorporation of the predecessor whose shares are not cancelled must become the articles of amalgamation for the amalgamated company.

The Act requires that resolutions of the directors of each amalgamating corporation approve the amalgamation and provide that the shares of all but one of the amalgamating corporations are cancelled. The articles of amalgamation will be the articles of incorporation of the amalgamated company whose shares are not cancelled and the stated capital of the amalgamating corporation whose shares are cancelled are added to the stated capital of the amalgamating subsidiary corporation whose shares are not cancelled.

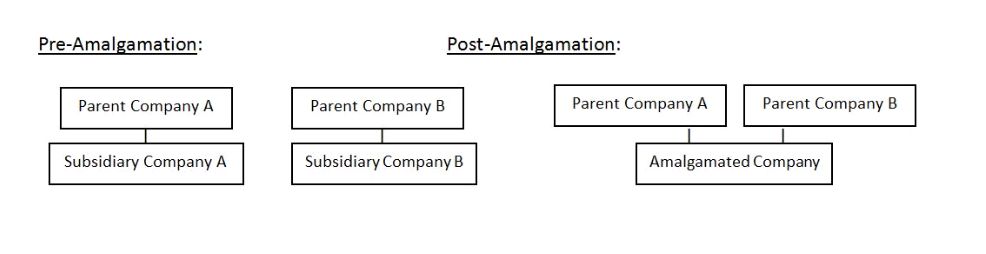

2. Long-Form Amalgamation Procedures

Long-Form Amalgamations are designed for arm's length entities and apply to a number of circumstances. Most often, this applies to situations where two (or sometimes more) parent companies each have a subsidiary company. Neither the parents, or the subsidiaries are related. The effect of the amalgamation is to merge the two subsidiary companies, which will be owned by the two parent companies, equally.

With a Long-Form Amalgamation, the corporations to amalgamate must enter into an agreement prescribing the terms and conditions of the amalgamation. The amalgamation agreement must then be approved by a special resolution of the shareholders of each of the amalgamating companies.

In all instances, whether short-form or long-form amalgamation, articles of amalgamation must be completed in the prescribed form and submitted to the Companies Office of Manitoba for filing. The cost for filing articles of amalgamation with the Companies Office is $350 for regular service, and $550 for expedited service (48-hour turnaround). If a new name needs to be reserved for the amalgamated corporation, there will be additional cost involved to reserve the business name ($45, regular service) and to register the business name ($60, regular service).

The articles of amalgamation must attach a statutory declaration of any director or officer of each amalgamating corporation that establishes that there are reasonable grounds for believing that each amalgamating corporation is and the amalgamated corporation will be able to pay its liabilities as they become due, that the realizable value of the amalgamated corporation's assets will not be less than the aggregate of its liabilities and stated capital of all classes and that no creditor will be prejudiced by the amalgamation.

The prescribed form of articles of amalgamation can be found on the Companies Office website, along with a sample Statutory Declaration, for ease.

Effects of Amalgamation

For all intents and purposes, the effective date of the amalgamation is the date set forth on the certificate of amalgamation issued by the Companies Office of Manitoba. The articles of amalgamation are deemed to be the articles of incorporation of the amalgamated corporation.

It is not necessary to have a conveyancing of the assets of the amalgamating corporations. By law, the amalgamated corporation possesses all of the property and is subject to all of the liabilities of each of the amalgamating parties.

Once the amalgamation takes effect, the corporate records of the amalgamated company should be updated to reflect who the current directors and officers will be, confirm the by-laws, issue new share certificates, and make any other required changes.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.