Both self-employed and employed healthcare professionals, including medical residents, may be able to deduct automobile expenses in their personal or corporate income tax returns, but only if certain criteria are met and adequate supporting records are kept.

Basic criteria and calculation

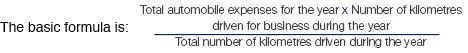

The basic guideline is that automobile expenses can only be deducted to the extent that they relate to business use.

Kilometres driven for business purposes

The Canada Revenue Agency ("CRA") has specific guidance regarding the number of kilometres driven for business purposes during the year. For example, travel to and from a taxpayer's home to his or her principal place of business (the main location where income is earned) would usually be excluded, as the CRA considers these kilometres to be personal. Only travel to other places of business should be included. For example, travel from the principal place of business to a different clinic or hospital, to a patient (e.g., house calls), to a meeting, or to a convention.

Principal place of business

In certain circumstances, a room or area in the taxpayer's home (house, condo or apartment) could be considered his or her principal place of business. In case law, the principal place of business has been defined as the place where secretarial, accounting, and communication functions are performed. For example, this could be where the mail is received, where patient appointments are arranged, where charting is undertaken and where accounting, bookkeeping and cash reconciling is performed.

Furthermore, a room or area in the taxpayer's home could still qualify as his or her principal place of business even if income-generating activities are performed at a different location (i.e. hospital, clinic or office), and the room or area is not used exclusively for business purposes. That being said, healthcare professionals have had difficulty in the past convincing the CRA that their home qualifies as their principal place of business, so consult with your tax professional regarding your specific situation.

Types of automobile expenses

Assuming the individual or corporate taxpayer is eligible to deduct automobile expenses, the types of expenses which may be claimed include: fuel, maintenance and repairs (e.g., car wash, service, brake replacement, etc.), insurance, licence and registration fees, interest paid on a loan used to buy the vehicle, and lease payments or capital cost allowance (i.e. tax depreciation). The capital cost allowance, interest paid, and lease payment amounts that can be claimed are restricted by specific tax provisions. Your tax professional should be consulted to determine the deductible amount. Also note that parking and speeding tickets as well as other fines and penalties are never deductible.

Supporting documentation

In the case of a CRA audit or review of vehicle expenses, and they are becoming much more frequent, the taxpayer needs to ensure that appropriate supporting documentation is kept, specifically receipts or invoices for all expenses claimed. Credit card statements are not considered sufficient evidence by the CRA. Furthermore, the kilometres driven for business purposes should be tracked in a logbook which specifies the date, the destination from and to, the business purpose of the visit, and the number of kilometres driven for each trip. Alternatively, a taxpayer can choose to keep a logbook for a year to establish a "base year". In subsequent years, only a three month logbook will be required to be kept so long as the usage is within 10% of the "base year". The total kilometres driven during the year can be determined by recording the odometer readings on January 1st and December 31st (or the start and end of your specific fiscal year).

Employees and Form T2200

In order for an employee, including medical residents and incorporated medical professionals, to claim motor vehicle expenses in his or her personal income tax return, his or her employer must complete and sign "Form T2200 – Declaration of Conditions of Employment". This form must specify that the employee is required to use a motor vehicle for travel as part of his or her employment. As an example, the Toronto Hospital's Postgraduate Payroll Association generally provides this form to its medical residents.

Automobile expenses may be deducted by healthcare professionals and should be considered to minimize taxes owing. However, taxpayers should ensure that they adhere to the CRA's definition of kilometres driven for business purposes and that sufficient supporting documentation is kept. We cannot stress enough that the CRA has made the claim for automobile expenses an area of audit and review focus. So if you decide to deduct these expenses, your claim must be reasonable and supportable.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.