The topic of cryptocurrency has transcended niche discussion and is currently gaining mainstream interest or, at least, curiosity, turning arcane technological jargon into household buzzwords after only a few years of existence. Some have dubbed Bitcoin the "Napster of finance", i.e. a transformative technology and approach that, whether or not successful in the long term, has the potential to forever change how we view and use money.

Business leaders are entering uncharted territory as cryptocurrencies slowly permeate traditional markets. Certain retailers are facing increased pressure from consumers to accept bitcoins and other cryptocurrencies as forms of payment. Venture capital firms and investment funds are speculating on cryptocurrency start-ups and related rapid-growth businesses. As with many other technologies, this is all happening faster than regulators are able to adapt. Is it possible for businesses to strike a balance between protecting themselves from the legal risks associated with cryptocurrencies — particularly from a tax and securities perspective — and not miss the boat on this new technology?

Bitcoin vs. bitcoins?

So what are bitcoins? Since the Bitcoin (capital B) platform with its unit, the bitcoin (lowercase b), constitutes the most well-known and widely accepted cryptocurrency, it often serves as the common ground in the discussion of cryptocurrencies.

From a legal perspective, there are two main ways to look at Bitcoin. First, bitcoins are created through a process called mining, wherein a party devotes computing power to solve increasingly complex mathematical equations, which serves to verify anonymous bitcoin transactions in a decentralized manner. As an incentive for dedicating computing power to the network, the software protocol automatically rewards miners with newly minted bitcoins. Second, bitcoins are bought and sold through exchanges and transferred in day-to-day transactions in exchange for goods and services.

Tax considerations

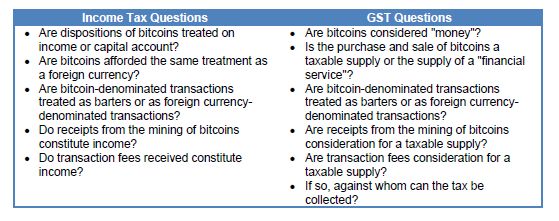

The main tax questions that arise when dealing with bitcoin-denominated transactions are the following:

The Canada Revenue Agency (the "CRA") recently published certain technical interpretations on bitcoins. The CRA has confirmed that transactions conducted with bitcoins would be treated as barter transactions for income tax purposes (meaning that each party would be considered to transact based on the fair market value of the consideration they paid) and that general principles would apply in determining whether a transaction is on capital or income account. Thus, the CRA does not treat bitcoins as money, but as one type of property that may be used as a means of exchange for another type of property. Moreover, the CRA suggested that income from the mining of bitcoins could constitute "business" income, and that proper reporting would be required in all cases.

For GST purposes, bitcoins exchanged in the supply of goods and services are treated by the CRA as barter transactions as well, meaning that a GST-registrant merchant would be required to charge GST on the fair market value of the goods or services sold. One key question that is not yet explicitly answered by the CRA is whether the acquisition of bitcoins for, say, Canadian dollars, constitutes a "financial service" (which, like all purchases of money, is not subject to GST).

While bitcoins are not generally considered a currency in Canada since they are not legal tender in any country, it remains to be seen whether they could be considered "money" for GST purposes since, under the relevant legislation, "money" is defined only as including a currency. Moreover, if any country were to adopt bitcoins as a currency, same would be deemed to be "money" for GST purposes. If bitcoins do not constitute "money" for GST purposes, then a consumer paying in bitcoins may be required to pay GST twice: first on the acquisition of bitcoins and, second, on the purchase of goods and services with said bitcoins.

Another important practical GST issue is that services can be rendered within the Bitcoin network, such as supplying computing power or verifying transactions in exchange for transaction fees, paid in bitcoins by anonymous users or paid in newly-issued bitcoins. To the extent that those services constitute a taxable supply made in Canada by a person who is registered or required to register, it will often be practically impossible for the supplier of such services to collect tax from the recipient given the relative anonymity built into the Bitcoin protocol.

Securities considerations

The volatility and speculative nature of bitcoins, as well as their potential implications with money laundering, has led to significant debate over the government's regulatory oversight surrounding cryptocurrencies. While no specific directives have been proposed, the Autorité des marches financiers (the "AMF"), Québec's securities regulator, issued a warning following the unveiling of the first bitcoin ATM in Montreal in March 2014. The AMF provided some clarity by affirming that cryptocurrencies are not covered by the Fonds d'indemnisation des services financiers of the Fonds d'assurance-dépôt. In addition, the AMF announced that it intends to monitor cryptocurrencies with regard to the Securities Act, Derivatives Act and Money-Service Business Act.

The Ontario Securities Commission (the "OSC") was similarly prudent in its initial publication on cryptocurrencies, refraining from discussing any of their potential advantages. Instead, the OSC warned that all cryptocurrencies should be approached with extra caution, emphasizing instances of fraud and exchange shutdowns and their potential connection with money laundering and terrorist financing. The OSC did state that it will closely monitor investment activity related to cryptocurrencies and will take action where violations of the Ontario Securities Act are concerned.

To date, no Canadian securities regulator has come forward to suggest whether cryptocurrencies should or would be considered a "security" or "derivative" for the purposes of securities laws.

It is important to note that despite the lack of clarity surrounding government oversight of cryptocurrencies, users have not found themselves beyond the reach of the law.

Although Saskatchewan's securities watchdog, the Financial and Consumer Affairs Authority (the "FCAA") may not have taken action so far to specifically regulate Bitcoin or the mining of Bitcoin, it has taken action against a Bitcoin-related business. In early May, the FCAA issued a temporary cease-trading order against Dominion Bitcoin Mining Company Ltd., a Regina-based mining company that was soliciting investors through its website. The FCAA said that regardless of the property used to pay for shares, be it Canadian dollars, bitcoins or other, securities laws apply to the sale of shares. Since the company was not registered in Saskatchewan to trade in securities, the FCAA alleged that Dominion Bitcoin Mining may be in violation of Saskatchewan securities laws.

In 2013, the United States Securities and Exchange Commission (the "SEC") brought an enforcement action against Trendon T. Shavers, who offered and sold bitcoin-denominated investments on the Internet using his company, Bitcoin Savings & Trust ("BTCST"). The U.S. District Court for the Eastern District of Texas ruled in favour of the SEC, stating that BTCST investments constituted investment contracts and were therefore securities as defined by US federal securities laws. Although this was a step forward in clarifying the landscape surrounding cryptocurrencies, the Court was clear that it is the investments that constitute a security and not the bitcoins themselves.

Other Important Legal Areas

In Federal Budget 2014, it was announced that the Federal government intends to adapt certain aspects of the Proceeds of Crime (Money Laundering) and Terrorist Financing Act in order to specifically and clearly deal with cryptocurrencies. Under this act, activities that constitute a "money services business" must comply with extensive reporting requirements aimed at deterring (or, alternatively, identifying) money laundering and related illicit activities.

Conclusion

Cryptocurrencies and their underlying software protocols may manifest themselves in a number of different forms in the very near future as developers continue to build on the technology. Whether cryptocurrencies ultimately revolutionize how we see and use money or whether they remain a preferred mechanism for fraudsters and money launderers remains to be seen. The legal landscape is likely to remain unclear for some time, so it is best to heed regulators' warnings, remain cautious and carefully plan cryptocurrency transactions, investments and other dealings, to avoid possible legal issues.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.