Remember the Ikea TV commercial from a couple of years ago which showed a shopper heading anxiously to her car and urging her husband to "START THE CAR!"? The ad was playing on that idea that Ikea's prices were so low that, when you shopped there, you felt like you were paying less than you were supposed to.

Wouldn't it be nice to get that feeling when you were dealing with the Canada Revenue Agency? If you own public company shares that have appreciated in value, there is a way to get that feeling and make a contribution to your community at the same time.

The Canada Revenue Agency allows taxpayers who donate public

company shares to a registered Canadian charity to do so without

first paying capital gains tax on the disposal of the shares.

The math is fairly simple and quite compelling.

An illustration:

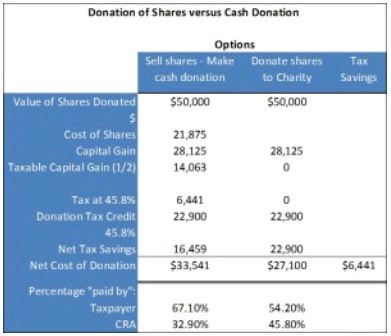

Suppose you are a resident of British Columbia, at the top marginal tax rate of 45.8% (2015) and wanted to donate $50,000 to your favorite charitable organization.

You were fortunate enough to buy shares of a major Canadian bank back in early 2009, just after the economy cratered in the Fall of 2008. You bought 625 bank shares at $35 per share and by November 2015 they were trading for $80 per share.

You could either sell the shares and donate $50,000 cash to a charity or donate $50,000 worth of shares to the charity.

In the case illustrated below, donating the shares rather than making a cash donation would put an additional $6,441 in your pocket (being the capital gains tax saved). The government would be covering you for 45.8% of the donation. Maybe not quite like getting a kitchen table and chairs for $125, but impressive none the less.

The results are even more impressive, the higher the inherent gain on the donated shares, meaning you should choose wisely which shares to donate. Also, even if you still want to hold shares of a particular company in your portfolio, you should still consider donating them instead of a cash donation. You could simply repurchase replacement shares on the open market with the cash not donated, and by doing so the inherent capital gain on your shares can effectively be eliminated.

Recent proposed tax changes will introduce a similar opportunity upon the gift of cash proceeds following the sale of private company shares in certain cases.

Of course everyone's personal circumstances differ so professional advice should be obtained before you make a donation of public company shares to a charity. You will also need to confirm that the charity is properly registered and is able to accept the shares you are planning to donate. For more information please contact your local Crowe MacKay advisor.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.