The following is a guide for companies that wish to launch their initial going public transaction in Canada and obtain a listing on the Toronto Stock Exchange (TSX) or TSX Venture Exchange (TSX-V).1

WHY CONSIDER GOING PUBLIC IN CANADA?

Canada is a stable country with a liquid and wellregulated secondary market and direct access to the United States capital markets. Canada's financial system has been ranked as the soundest in the world for two years in a row according to the World Economic Forum's 2010-11 Competitiveness Report. Canada's banks are well-managed, well-regulated and well-capitalized. Canada's strong and stable banking system is fundamental to the stability of the country's financial markets.

By going public in Canada, companies can achieve healthy valuations and raise funds from a deep and knowledgeable pool of institutional and retail investors.

The TSX is Canada's senior equities exchange, providing domestic and international investors access to the Canadian marketplace.

The TSX-V is Canada's junior listings exchange, providing companies at the early stages of growth the opportunity to raise capital.

Benefits of listing on the TSX

- Market for well established businesses and management teams with experience in public markets

- Access to international institutional investors

- Opportunities for greater analyst coverage

- 155+ year history

- Average market cap of C$1.2 billion

- 29 per cent of TSX issuers >C$500 million in market cap are interlisted on a U.S. exchange

Benefits of listing on the TSX-V

- Access to capital for earlier stage companies and smaller financings (typical financing range: C$500,000 to C$20 million)

- Tailored listing and corporate governance requirements for small-cap companies

- Streamlined graduation to the TSX

- 100+ year history

- Average market cap of C$16.5 million

- Cost-effective stepping stone for international companies looking to list on a quality North American exchange

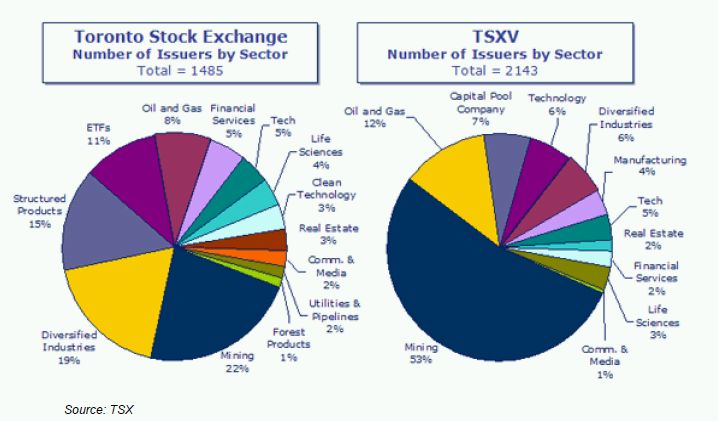

With over 3,600 listed issuers, the TSX and TSX-V rank among the world's leading stock exchanges and are home to the largest number of issuers in North America.

The industry sectors represented on the TSX and TSX-V are diverse. Canada is home to unparalleled mining and metals knowledge and expertise, attracting 55 per cent of all public mining companies from around the world to raise capital in Canada and to list on the TSX and TSX-V. The world's largest annual mining conference is hosted by the Prospectors and Developers Association of Canada, and takes place in March of each year in Toronto.

In addition to Canada's pre-eminence in mining and metals, 35 per cent of the world's public oil and gas companies are listed on the TSX and TSX-V. Other sectors on the TSX and TSX-V include diversified industries, technology, life sciences, clean technology, financial services, real estate, communications and media, utilities and pipelines, and forest products.

Some advantages to listing in Canada over listing in the U.S.

Aside from cost advantages, Canada has much less onerous corporate governance requirements than the U.S. (i.e., no Sarbanes-Oxley). Canadian securities regulators introduced new corporate governance rules, but the Canadian response has been shaped by conditions unique to the domestic market.

In the resource sector, Canada has developed the world's leading stock market in part because under National Instrument 43-101, natural resource companies are entitled to disclose, after following the proper process, both mineral reserve and "resource" estimates. In the U.S., by comparison, under SEC Industry Guide 7, the only estimates that may be disclosed are mineral "reserves."

FREQUENTLY ASKED QUESTIONS (FAQs)

Following are answers to a handful of "frequently asked questions" we receive from our clients as they contemplate an initial public offering or other method of going public in Canada.

STOCK EXCHANGE LISTING

What are the requirements to list on the TSX and TSX-V?

Attached in Appendix A are charts setting out key listing requirements. The TSX-V, designed for more junior issuers, classifies issuers into two tiers based on historical financial performance, stage of business development and financial resources. Many TSX-V issuers also graduate to the TSX, and many TSX and TSX-V issuers are interlisted on U.S. or European stock exchanges.

How do these listing requirements compare to other stock exchanges?

Attached in Appendix B is a chart which compares listing fees and listing requirements for the TSX, TSXV, NASDAQ and Hong Kong exchanges. The TSX and TSX-V, unlike the NASDAQ and Hong Kong exchanges, have tailored listing requirements for different industry groups.

IPO OVERVIEW

Can you provide an overview of what is to be expected?

An issuer wishing to go public by way of an initial public offering (IPO) does so by preparing and filing a preliminary prospectus with Canadian securities regulators and the TSX or TSX-V. After the comments of Canadian securities regulators and the TSX or TSX-V have been addressed, the issuer files a final prospectus and obtains a decision document that allows shares to be qualified for sale to the public. The prospectus performs two functions. First, it is used by the issuer and the underwriters as a marketing document for the offering. Second, it is required to provide potential investors with "full, true and plain disclosure of all material facts" relating to the securities offered.

How long is the process and what are the different steps?

Bringing an IPO to market typically takes several months, depending on how organized the issuer is, the size of the offering and the experience of the significant players in the IPO process. The process can be broken down into five phases:

1. The Initial Preparation Phase – Initial planning should commence as early as six months in advance of the targeted date for filing the preliminary prospectus and will include:

- Creation or updating of a business plan

- The selection of lawyers, auditors and underwriters

- Review of and, if necessary, strengthening of internal systems and procedures

- Review of accounting policies and financial records, and preparation of financial statements to be included in the preliminary prospectus and final prospectus (see more detailed discussion under "Financial Statements")

- Preparation of a technical report if the issuer is a mining or oil and gas company (see more detailed discussion under "Technical Reports")

- Tax planning and corporate restructuring

- Review of the makeup of the board and management team to ensure that the governance structure of the issuer meets with all applicable corporate and securities law requirements as well as TSX or TSX-V requirements

- Review of and, if necessary, documentation of employment contracts as well as stock option and other incentive plans

- Review of material contracts and compilation of materials for due diligence purposes

- Identification of the appropriate stock exchange for listing (see more detailed discussion under "Stock Exchange Listing")

A pre-filing consultation with the TSX or TSX-V is encouraged.

2. The Preliminary Prospectus Phase – The issuer and its counsel should commence preparation of the preliminary prospectus several months in advance of the targeted date for filing. Once underwriters are selected, due diligence should begin with the input of the issuer and underwriters and their counsel. Over this period, a number of drafts will be circulated to all members of the working group for comments and revisions. Once the preliminary prospectus is filed with Canadian securities regulators, and a decision document has been issued, the issuer and underwriters can commence marketing the IPO. The period between the filing of the preliminary prospectus and the final prospectus is known as the "waiting period."

3. The Waiting Period Phase – Following the filing of the preliminary prospectus, it is reviewed by Canadian securities regulators and their comments are issued. The duration of this review varies with each issuer. It can be as short as four weeks if the issuer has complied fully with all disclosure requirements, including those relating to financial statements. Comments issued by Canadian securities regulators are addressed and a draft of the final prospectus is prepared, which is essentially the preliminary prospectus modified to reflect the regulators' comments. Contemporaneous with receiving and responding to comments from Canadian securities regulators, a similar process takes place with the TSX or TSX-V, which will review the listing application and supporting documents to ensure they meet all applicable requirements (see more detailed discussion under "Stock Exchange Listing"). Also during this phase, the underwriters and key members of the issuer's management team make presentations to institutional investors and investment dealers over a period of five to 10 days (often referred to as the "road show"). The underwriting agreement is also negotiated and finalized.

4. The Final Prospectus Phase – Once all comments have been resolved with the Canadian securities regulators and the TSX or TSX-V, clearance is obtained to file final material with the regulators. The issuer will want to ensure by this point that the TSX or TSX-V has issued its conditional letter of approval for the listing of the issuer's shares, subject to conditions itemized in the letter. With respect to timing, it is best to reach this point when the market is most receptive to the offering, as this is the point when the issuer and the underwriters finalize the price and size of the offering, enter into the underwriting agreement and file the final prospectus.

5. The Closing Phase – Closing occurs approximately five business days following the date on which the final prospectus is filed and a decision document for the final prospectus is issued by the Canadian securities regulators. At the closing, the securities offered under the prospectus are issued, the proceeds from the issue are delivered to the issuer and the issuer's shares begin to trade on the TSX or TSX-V, as the case may be.

What information must the prospectus contain?

The prospectus must contain several components:

- Description of the offering (nature of the securities, plan of distribution and use of proceeds)

- Description of the company (issuer's business, corporate structure, recent acquisitions and risk factors)

- Detailed financial information (see more detailed discussion under "Financial Statements")

- Management's Discussion and Analysis (often referred to as the "MD&A"; discussion by management of the issuer's financial performance, financial condition and future prospects)

- Detailed information on management, directors and principal shareholders (biographical information, compensation and corporate governance)

What is the standard of disclosure for the prospectus?

Every prospectus must contain a certificate signed by the chief executive officer, chief financial officer and, on behalf of the board, two directors, and any person or company who is a promoter of the issuer, which states:

This prospectus constitutes full, true and plain disclosure of all material facts relating to the securities offered by this prospectus as required by the securities laws of [insert the jurisdictions in which qualified].

The prospectus must contain a similar certificate signed by the underwriters, except that their statement is qualified by the phrase "to the best of our knowledge, information and belief."

A high onus is placed on companies accessing the Canadian capital markets to ensure that the prospectus contains adequate disclosure. Should the prospectus contain a misrepresentation (a rare event in Canada), the issuer, its directors, its officers, the underwriters and experts could face civil liability and penalties. In preparing the prospectus, the issuer works closely with its professional advisers, including lawyers and accountants as well as the underwriters, to ensure that proper disclosure is made in the prospectus.

What can be expected in terms of due diligence that will be conducted by underwriters?

In general, the issuer and parties preparing the prospectus are personally liable for misrepresentations in the prospectus, subject (other than for the issuer) to a "due diligence" defence. Accordingly, the due diligence process is taken seriously by all parties and generally involves a thorough review of corporate records, financial information and material agreements as well as an inspection of operating facilities and management backgrounds. In essence, every fact in the prospectus must be verified and detailed records of the due diligence process must be maintained.

FINANCIAL STATEMENTS

What financial statements must be included in the prospectus?

In general, the preliminary prospectus and the final prospectus must include a statement of income, retained earnings and cash flow for each of the three most recently completed financial years, and a balance sheet as of the end of the two most recently completed years accompanied by an auditor's report.

The required annual financial statements are for years that ended more than 90 days before the date of the prospectus (120 days before the date of the prospectus for companies intending to list on the TSX-V).

There are exceptions to the rule if neither the issuer nor a predecessor entity has completed three financial years. Also, an issuer may be allowed to omit the statement of income, retained earnings and cash flow for the third most recently completed financial year as well as the balance sheet for the second most recently completed financial year, if the prospectus includes audited financial statements for a financial year ended less than 90 days before the date of the prospectus. They may also be omitted in a situation where the business of the issuer is not seasonal and the issuer includes audited financial statements for a period of at least nine months commencing the day after the most recently completed financial year.

For any quarterly period that has ended subsequent to the most recent financial year, the preliminary prospectus and final prospectus must also include quarterly financial statements with comparative statements for the corresponding interim period in the immediately preceding financial year.

Quarterly financial statements are required for periods ending more than 45 days before the date of the prospectus (60 days before the date of the prospectus for companies intending to list on the TSX-V).

Which of the financial statements included in a prospectus must be audited?

Annual financial statements included in a prospectus must be audited. Exceptions to this are the second and third most recently completed financial years, if the issuer is a "junior issuer." An issuer is deemed a "junior issuer" if (i) total consolidated assets in the latest balance sheet included in the preliminary prospectus are less than C$10 million; (ii) consolidated revenue in its most recent annual income statement included in the preliminary prospectus is less than C$10 million; and (iii) shareholders' equity as at the date of the most recent balance sheet of the issuer included in the preliminary prospectus is less than C$10 million.

What accounting principles and auditing standards are acceptable for the financial statements to be included in the prospectus?

Adopted by the International Accounting Standards Board, International Financial Reporting Standards (IFRS) are the basis of financial reporting for all public companies in Canada as of January 1, 2011. Accordingly, financial statements included in prospectuses and prepared for continuous disclosure following completion of an IPO should be prepared in accordance with IFRS. There are exceptions for (i) an SEC issuer; and (ii) a "designated foreign issuer" if, among other things, the issuer is subject to the disclosure requirements in specified countries including Australia, France, Germany, Hong Kong, Italy, Japan, Mexico, the Netherlands, New Zealand, Singapore, South Africa, Spain, Sweden, Switzerland or the United Kingdom. However, one of the conditions of being a "designated foreign issuer" is that the total number of equity securities beneficially owned by residents of Canada does not exceed 10 per cent, on a fully diluted basis, of the total number of equity securities of the issuer. Accordingly, while an issuer may be able to rely on an exception from the requirement to use IFRS for purposes of the IPO prospectus, it will be difficult to rely on the "designated foreign issuer" exemption for purposes of continuous disclosure following completion of an IPO if the primary market for the issuer's securities will be in Canada.

Our financial statements for prior financial years have been prepared using accounting principles other than IFRS. Can we include in the prospectus financial statements that utilize two different sets of accounting principles?

Yes you can, by presenting two sets of financial statements. An issuer may elect to present the two most current years of financial statements in accordance with IFRS and present the third-year financial statements in accordance with the issuer's previous accounting principles. For example, one set of financial statements can present the information for the most recent two years utilizing IFRS, and a second set can present the information either (a) for a third and fourth year, or (b) a second and third year, using the issuer's previous accounting principles.

In (a), the issuer is including a fourth year not otherwise required to be included, while in (b), information for the second year is being presented in both sets of financial statements utilizing two different sets of accounting principles.

What auditors are acceptable?

An auditor's report filed by an issuer must be prepared and signed by an auditor that is authorized to sign an auditor's report under the laws of a jurisdiction of Canada or a foreign jurisdiction, and meets the professional standards of that jurisdiction.

Are there special requirements for financial statements if we have made an acquisition prior to the IPO?

If the issuer has completed a "significant acquisition" in its most recently completed financial year or proposes to complete one, the general rule is that the prospectus must include, in respect of the acquired business, a statement of income, retained earnings and cash flow for the most recently completed financial year and for the financial year immediately preceding that (if applicable), as well as a balance sheet at the end of each of those periods, all of which statements must be audited. Quarterly unaudited statements are also required for periods that ended before the date of the acquisition.

The prospectus must also include a pro forma balance sheet and pro forma income statement.

TECHNICAL REPORTS

We are a mining company. Is there a requirement for a technical report on the properties?

Yes, in the case of a mineral property that is material to the issuer, scientific or technical information contained in a preliminary or final prospectus must be supported by a technical report filed with Canadian securities regulators. This technical report must be prepared by one or more "qualified persons" who are independent of the issuer. A "qualified person" is an engineer or geoscientist with at least five years of relevant experience and one who is in good standing with a specified professional association. The form o the technical report is prescribed by National Instrument 43-101 of Canadian securities regulators. Moreover, for exploration or development stage mining companies, one of the key requirements of the TSX or TSX-V is a technical report prepared in compliance with National Instrument 43-101 that contains a recommended work program.

For mining companies that are producing, one of the key listing requirements is a technical report prepared in compliance with National Instrument 43-101 that supports three years of proven and probable reserves.

We are an oil and gas company. Is there a requirement for a technical report on the properties?

Yes, any information disclosed in a preliminary prospectus or final prospectus in respect of oil and gas reserves, resources or related information must be supported by a technical report filed with Canadian securities regulators. The report must be prepared by one or more "qualified reserves evaluators or auditors," in accordance with the form prescribed by National Instrument 51-101 and in accordance with the Canadian Oil and Gas Evaluation Handbook. A "qualified reserves evaluator or auditor" is a person independent of the issuer who possesses professional qualifications and experience appropriate for the estimation, evaluation, review and audit of reserves data, resources and related information, and who is in good standing with a specified professional association. Furthermore, the qualified evaluator or auditor must have evaluated or audited at least 75 per cent of the future net revenue (calculated using a discount rate of 10 per cent) attributable to proved plus probable reserves, and must also have reviewed the balance of future net revenue of the issuer in preparing the report.

To read this document in its entirety please click here.

Footnote

1 On February 9, 2011, the TMX Group Inc., which operates the TSX and TSX-V, entered into an agreement to merge with London Stock Exchange Group PLC. Completion of the merger is subject to regulatory and other approvals.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.