An overview to how HST applies on purchases made outside Ontario by a resident of Ontario. This article was originally published in August 2012 but was updated September 2017 to reflect the new tax rates.

Purchase of goods

Vendors doing business in Canada and who are located outside of Ontario are usually required to register for GST/HST purposes and collect the appropriate tax, whether it is the Goods and Services Tax (GST) or the Harmonized Sales Tax (HST). This is normally based on the province in which the goods are delivered. For instance, vendors who deliver taxable goods to the address of a customer in Ontario must normally collect HST (13%) on the sale. This remains true even if the vendor does not have an establishment or presence in Ontario.

Vendors not doing business in Canada are normally not required to register for GST/HST purposes. As such, they will not be required to collect the HST even if they arrange for the goods to be shipped to the address of the customer in Ontario.

If the Ontario resident picks up the goods at a retailer's premises outside Canada (e.g., while on vacation in the US) and brings the goods back to Ontario, no HST nor GST will apply on the sale either, regardless of whether the vendor is registered for GST/HST purposes since the sale takes place outside Canada.

That being said, those of you who plan to escape paying HST by purchasing from online US retailers or heading to Buffalo should note that Canada Customs will collect the tax upon importation of the goods into Canada. Commercial goods imported by businesses will normally always be subject to GST (5%) while goods imported for personal consumption will always be subject to GST/HST depending on the province of residence of the importer. For example, a resident of Ontario decides that after his shopping trip in Buffalo, he would like to spend a few days in Montreal before returning home. He passes through the Canada Customs located in Quebec. He would be charged HST (13%) even if the goods are not in Ontario at the time of importation.

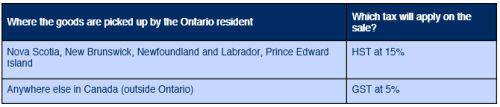

If the Ontario resident picks up the goods at a retailer's premises outside Ontario but within Canada (e.g., while on vacation in Quebec) and brings the goods back to Ontario, either GST or HST will apply on the sale based on the province in which the goods are picked up.

Based on the above table, the vacationing Ontario resident returning from Quebec will normally have to self-assess on the difference between the tax paid GST (5%) in Quebec and the HST(13%) applicable in Ontario. Note that if the Ontario resident had bought the goods in Nova Scotia instead of Quebec, he or she would normally have been able to claim a refund for the tax difference between the HST (15%) paid in Nova Scotia and the HST (13%) applicable in Ontario.

The above self-assessment does not apply to Ontario businesses that import goods into Ontario (whether from within or outside Canada) for consumption or to be used exclusively (i.e., 90% or more) for commercial purposes.

Purchases of services and intangible personal properties (IPP)

An IPP is a property that cannot be seen or touched such as a digital copy of a document or a trademark.

Generally, the sale of a service or an IPP by a GST/HST registered vendor to a resident of Ontario will be subject to either GST or HST in any of the following situations:

- The service is or will be performed in whole or in part in Canada;

- The service relates to real property situated in Canada;

- The IPP may be used in whole or in part in Canada (e.g., a computer program downloaded online from a non-resident vendor's website that can be used in Canada); or

- The IPP relates to real property situated in Canada; to tangible personal property ordinarily situated in Canada or to a service to be performed in Canada.

Purchase of a service

If the service is performed in whole or in part in Canada, the sale of that service to an Ontario resident will normally be subject to HST (13%). The same tax rate also applies in situations where the service relates to tangible personal property or real property situated in Ontario or is a personal service (e.g. haircut) or relates to an event or performance taking place primarily in Ontario.

There are many other specific rules that might apply deeming a sale of a service as occurring in Ontario. However, if none of the specific rules apply, the sale of a service to an Ontario resident will normally be subject to HST (13%) based on the business or home address of the customer.

Purchase of an IPP

The sale of an IPP will follow rules that are similar to those applicable to the sale of a service. Examples of IPPs could include goodwill, patents, trademarks or copyrights. The sale of an IPP to be used in Ontario to a resident of Ontario will generally be subject to HST (13%).

Purchase made outside Ontario

On the other hand, the sale of a service or IPP to Ontario residents will not be subject to either GST or HST in any of the following situations:

- The vendor is a non-resident of Canada and not registered for GST/HST purposes;

- The service is or will be performed wholly outside of Canada;

- The service relates to real property situated outside of Canada;

- The IPP may not be used in Canada; or

- The IPP relates to real property situated outside of Canada; to tangible personal property ordinarily situated outside of Canada or to a service to be performed wholly outside of Canada.

Where the sale of the service or IPP is made in Canada outside of Ontario, the sale may be subject to GST or to HST based on the province in which the sale takes place.

Self-assessment

Where the sale of a service or IPP is made outside of Ontario, the Ontario resident may have to self-assess the full amount of the HST (if the sale was made outside of Canada) or a portion of the HST (if the sale was made in Canada but outside of Ontario). The self-assessment is based on the value or benefit conferred by the use or consumption of that service or IPP in Ontario.

Similar to the self-assessment on the importation of goods, the self-assessment rules are not intended to apply to businesses who acquire the service or IPP outside Ontario for consumption or to be used exclusively (i.e., 90% or more) for commercial purposes.

Here is an example of a situation where self-assessment will be required:

An Ontario dentist purchases and downloads computer software (i.e., an IPP) from the website of a software vendor located in the USA. The dentist would self-assess HST (13%) on the value of the computer software. The dentist would have to remit the full amount of the HST to the Canada Revenue Agency (CRA) since no tax was paid by the dentist when purchasing the IPP. If the dentist had purchased the IPP outside Ontario but within Canada, GST would have applied and a portion of the HST may have had to be self-assessed.

Conclusion

The above summary provides an overview of the most common situations where the Ontario HST will be payable by an Ontario resident with respect to purchasing from a vendor located outside Ontario.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.