Two updates to the impairment standards provide an opportunity for many companies to reduce the cost and complexity of the annual test. Craig McMillan and John Williamson explain what you should focus on in implementing these changes.

Annual impairment tests for goodwill and indefinite lived intangible assets have been challenging and the mandated valuations were burdensome and required significant effort. Some relief is now available for companies with the introduction of an impairment diagnostic test for both goodwill and indefinite-lived intangible assets. These changes are intended to reduce the cost and complexity of the annual test.

These amendments are reflected in the Intangibles – Goodwill and Other section of the FASB Codification Topic 350 through ASU 2012-02, Testing Indefinite-Lived Intangible Assets for Impairment, and ASU 2011-08, Testing Goodwill for Impairment.

Early adoption

The changes to the goodwill guidance are effective for annual and interim impairment tests for fiscal years beginning on or after December 15, 2011 while the changes for indefinite-lived intangible assets are effective for annual and interim impairment tests for fiscal years beginning on or after December 15, 2012. Early adoption is permitted for both standards. Companies planning to adopt these revisions early should begin considering the relevant factors for the qualitative assessment.

Still an annual review

The changes do not remove the requirement for an annual impairment review. The revisions only add an initial screening test that may simplify a company's evaluation of impairment for these assets. This diagnostic assessment considers whether there are events and circumstances that might indicate impairment exists. If the assessment indicates that impairment exists, the current quantitative testing methods must be applied to determine whether an actual impairment loss needs to be recognized.

The qualitative assessment for both goodwill and indefinite-lived intangible assets is optional and may be bypassed in any period. The assessment can be applied to none, some or all of the reporting units or intangible assets, as applicable. These choices are not accounting policy choices and can be changed freely year to year.

Assessment focuses on fair value

The qualitative assessment outlined in the standards for goodwill and long-lived intangibles are similar but not identical. A company considers whether it is more likely than not that:

- the fair value of goodwill is less than its carrying amount; or

- an indefinite-lived intangible asset is impaired (which occurs when the fair value of the asset is less than its carrying amount).

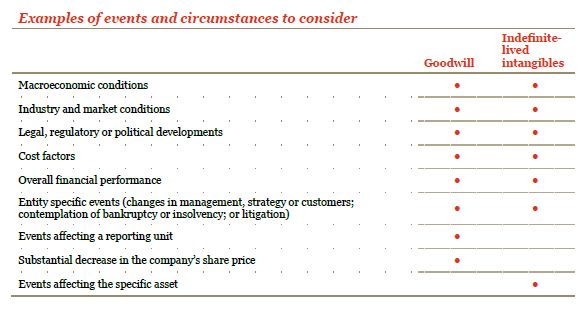

For both types of assets, a company needs to make a comprehensive and balanced evaluation of all relevant events and circumstances that affect the fair value or carrying amount of goodwill, or the significant inputs used to determine the fair value of intangible asset or the carrying amount of the intangible asset. Examples of events and circumstances that are relevant have been provided in each of the standards (see table on next page).

Some pointers

The standards provide several pointers for companies when making the assessment. A comprehensive assessment is required of all events and circumstances – adverse, positive and mitigating. There is no free pass. A "drive-by" assessment would not be sufficient to meet the standards' requirements.

Companies should consider the extent to which each adverse event or circumstance could affect the comparison of the fair value and carrying amount of a goodwill reporting unit or the significant inputs used to determine the fair value of the intangible asset. This does not require a detailed separate quantitative analysis, but rather is an assessment of each adverse indicator identified to determine, on a qualitative basis, what its consequences are.

Management will have to understand the valuation models used to value a reporting unit or intangible asset to determine the key assumptions that have the most significant affect on fair value. These valuations will often have key assumptions, for example, revenue growth, customer attrition, cost escalation, and terminal growth and discount rates. Understanding how changes in these assumptions affect the valuation is a good starting point to monitor how any changes may affect the relevant fair value. When an adverse event or circumstance occurs, the impact on those key assumptions should be considered.

The information to make these assessments is often available from the company's budget process and sensitivity and other analysis used in the budget or financial reporting process. For example, the loss of a major customer may have a significant impact on revenues and net cash flows whereas customer attrition higher than expected but within the sensitivity analysis completed in the budget process may not have a significant impact. Understanding the interaction of the event and circumstances with cash flows and uncertainties will be important in completing the diagnostic tests.

Positive or mitigating events and circumstances should be included in the analysis. For example, the loss of a major customer may have provided capacity to fulfil other customer orders. Positive or mitigating factors, however, do not represent a rebuttable presumption that further testing is not required. More weight should be placed on events and circumstances that most affect the fair value or carrying amount of the reporting units for goodwill or the significant inputs used to determine the fair value of the intangible asset. The events or circumstances provided in the examples are not all-inclusive. The examples are not intended to represent standalone events and circumstances that necessarily require further testing of the respective asset. The existence of one or more of the factors in the examples does not lead to an automatic requirement to complete the more detailed testing.

The most recent valuation of a reporting unit or the intangible asset cannot be ignored. The extent of the cushion between the fair value and carrying amount of any recent valuation of the reporting unit for goodwill or the intangible asset would be considered in the assessment.

Processes & controls important

While these revisions may simplify the annual impairment review for goodwill and indefinite-lived intangible assets, companies will have to develop processes and internal control over the diagnostic test. It is clear from the wording of the standards that evidence must be gathered to support the assertions that further testing was not required. These conclusions will need to be adequately documented. The efforts to develop a framework and appropriate internal control over the assessment process may be more significant than some may have expected.

Companies will need to ensure they have:

- included all relevant events and circumstances – adverse as well as positive and mitigating;

- determined those that have the most significant affect on the fair value or carrying value of reporting units and the fair value of indefinitelived intangible assets;

- considered the appropriate weighting for the identified events and circumstances; and

- the extent of any cushion.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.