Overview

On November 28, 2017, Ontario's Bill 148, the Fair Workplaces, Better Jobs Act, 2017, received Royal Assent. Major changes are now on the horizon for all provincially-regulated workplaces in Ontario.

This is the second in a series of posts providing a practical overview of upcoming Bill 148 changes. Our previous post discusses the Bill 148 changes to Ontario's statutory leaves of absence under Ontario's Employment Standards Act, 2000 (ESA). This post pertains to the Bill 148 changes that will impact an employee's compensation under the ESA.

Minimum Wage

As of today's date, the general minimum wage rate in Ontario is $11.60. This will increase by approximately 29 percent over the next 13 months. Other minimum wage rates will be increasing as well.

If a minimum wage increase occurs during a pay period, an employer must split that pay period into halves. The first half must be calculated according to the minimum wage before the day of the change. The second half must be calculated according to the minimum wage rate as of the day of the change.

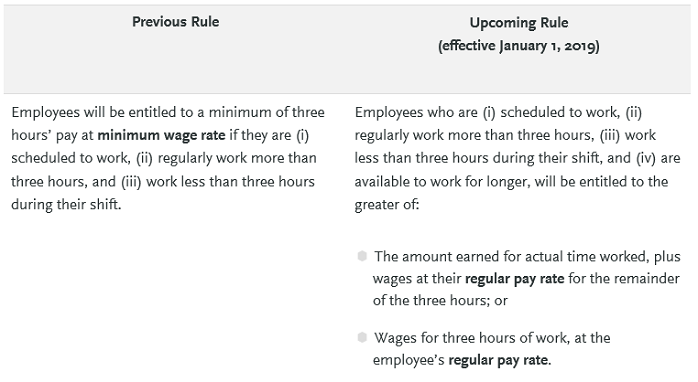

Minimum Shift Lengths (or, the "3 Hour Rule")

Under certain conditions, Ontario employees who work shifts under three hours will still be entitled to three hours' pay. However, Bill 148 will introduce a new formula that will generally increase the amount of pay an employee is entitled to in these circumstances. The new formula, subject to certain exceptions, also applies for employees who are "on call".

Vacation Time and Vacation Pay Entitlements

Vacation time and vacation pay entitlements will be increasing for Ontario employees with five or more years of service. This change brings Ontario in-line with other provinces.

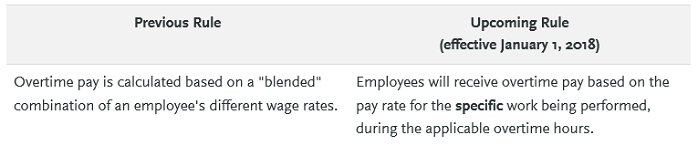

Overtime Pay

The overtime pay calculation formula for Ontario employees with multiple pay rates (depending on the work being performed) will be overhauled.

Public Holiday Pay

Ontario employees will still be entitled to take public holidays off work and receive public holiday pay for those days. The formula for calculating public holiday pay will be modified. A significant effect of this change is that employers who work fewer than five days a week will receive public holiday pay more reflective of their average daily wages.

Practical Implications for Ontario Employees

To comply with these amendments, provincially-regulated employers in Ontario should consider taking the following steps:

- Ensuring that payroll and HR software currently being used is capable of reflecting the changes above. This may require manually updating payroll systems and records to account for different minimum wage rates, vacation entitlements and holiday pay calculations.

- Considering in advance whether the increased minimum wage rates will affect scheduling or staffing needs and planning accordingly.

- Incorporating anticipated wage rate increases into budgetary forecasting on a going-forward basis. This may require a multi-year plan to manage the significant minimum wage increases occurring in both 2018 and 2019. Scheduling and staffing needs may be impacted as a result.

- Being prepared for requests for wage rate increases from employees who have historically been paid higher than minimum wage and will now earn the minimum or close to it.

- Reviewing and updating policies, handbooks and employment agreement templates as required.

- For current employees whose employment agreements specify only two weeks' vacation time, confirming new vacation entitlements by a letter amending the employment agreements.

- Tracking employees' vacations and ensuring employees are taking their minimum vacation time each year.

Stay tuned for our next post, which will discuss the "equal pay for equal work" provisions under Bill 148.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.