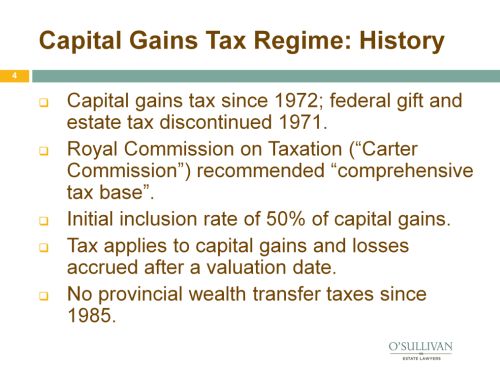

- A majority of the Carter Commission advocated a "comprehensive tax base", as "[t]he first and most essential purpose of taxation is to share the burden of the state fairly among all individuals and families." (Report of the Royal Commission on Taxation, as cited in Duff, infra, at 91).

- With regard to capital gains the Carter Commission recommended the recognition of capital gains and losses on a realization basis (and upon gifting or death) rather than an accrual basis, for administrative reasons. It also recommended that the value of gifts and inheritances be included in income, which was not implemented, and that wealth taxes be repealed accordingly. The inclusion rate of 50% was a political concession upon reactions to a government White Paper.

- Valuation date: December 31, 1971.

- The federal government's reasons for the repeal of federal gift and estate tax included concerns about the substantial cumulative impact in certain cases of both estate taxes and capital gains taxes.

- After 1972, provincial estate and/or gift taxes were not uniform across the provinces. Many provinces ceased levying wealth transfer taxes during the 1970s, and by 1985 no province levied such taxes.

- See David G. Duff, "The Abolition of Wealth Transfer Taxes: Lessons from Canada, Australia and New Zealand", 3 Pittsburgh Tax Review 71 (2005) .

- Generally, Canada includes in income for taxation purposes a portion of capital gains, being the growth in the value of non-inventory capital property on the disposition of that property. The Income Tax Act (Canada) defines a capital gain as the difference between the proceeds of disposition of an asset (for example, its sale price) and its adjusted cost base, less outlays and expenses of disposition.

- A taxable capital gain is 50% of a capital gain. Allowable capital losses may be deducted from taxable capital gains for a taxation year.

- A disposition is broadly defined as "any transaction or event entitling a taxpayer to proceeds of disposition of the property" (s. 248(1)), and includes a sale and any transfer where there is a change of beneficial ownership, including gifts, resulting in a disposition of capital property. There is a deemed disposition of capital property at fair market value immediately before a taxpayer's death. Generally, there is a deemed disposition of capital property held in a personal trust every 21 years (21 years after the creation of the trust or 21 years after January 1, 1972, whichever is later).

- "Rollovers" permit deferral of recognition of capital gains or losses, typically by allowing another taxpayer to receive capital property at the original taxpayer's adjusted cost base – for example, for a transfer of capital property to a Canadian resident surviving spouse or common-law partner or qualified spousal trust during lifetime and on a spouse's or partner's death.

- A lifetime capital gains exemption can shelter $800,000.00 of capital gains from limited sources, including qualified small business corporation shares, qualified farm property and qualified fishing property.

Image

Tax Filings

For the purposes of Canadian federal income tax, married spouses (whether they are of the same-sex or opposite sex) are required to indicate their marital status as of December 31 of the tax year for which a filing is being made, as well as report the name, social insurance number and net income of their spouse. Each spouse files a separate return—Canada does not have a spousal joint-filing system as in the U.S. Note that all of the following comments also apply to common-law spouses who meet the following statutory requirements for a "common law partner" under s. 248(1) of the Income Tax Act:

"common-law partner", with respect to a taxpayer at any time, means a person who cohabits at that time in a conjugal relationship with the taxpayer and

- has so cohabited throughout the 12-month period that ends at that time, or

- would be the parent of a child of whom the taxpayer is a parent, if this Act were read without reference to paragraphs 252(1)(c) and (e) and subparagraphs 252(2)(a)(iii),

and, for the purpose of this definition, where at any time the taxpayer and the person cohabit in a conjugal relationship, they are, at any particular time after that time, deemed to be cohabiting in a conjugal relationship unless they were living separate and apart at the particular time for a period of at least 90 days that includes the particular time because of a breakdown of their conjugal relationship.

As the thrust of this presentation is "marriage" in Canada, however, all references will be to legally married spouses. Personal tax returns are due to be filed with Canada Revenue Agency on or before April 30 of the year immediately following the taxation year.

Tax Credits

For married spouses, there are a variety of tax credits that may be claimed. For example, there are credits available to be claimed with respect to supporting a financially dependent spouse at any time during the tax year whose net income was below the threshold amount. Other credits and amounts, such as age and tuition amounts, may be transferred between spouses in order to minimize the total tax payable as between spouses. Married spouses may also combine certain other credits such as medical expenses and charitable donations by claiming such amounts on one spouse's return in order to obtain the maximum credit available. Other credits or benefits, however, such as the Canada Child Tax Benefit, may be reduced or lost entirely when using a combined net family income to calculate the income threshold for such benefits.

Income Splitting

There are a variety of income splitting strategies available to married spouses in Canada. With respect to retirement savings plans (RSPs), the higher income spouse is permitted to use his or her contribution room to make contributions to a spousal RSP held by the lower income spouse. Contributions to the lower income spouse's RSP would be deducted from the income of the higher income spouse. Further, when funds are ultimately withdrawn by the lower income spouse during his or her retirement, any such withdrawals are fully taxable in his or her hands. With respect to retirement income funds (RIFs), income paid from the RIF is eligible to be split between the spouses if both are 65 years of age or older.

In terms of further income splitting opportunities, if both spouses are over the age of 60 years and receive monthly Canada Pension Plan payments, they may share up to 50% of the benefits earned during the period of their relationship. Pension income splitting allows spouses receiving income that qualifies for the pension income credit to allocate up to 50% of that income to their spouse. In addition, pension income from a defined benefit or defined contribution pension plan may be split with a spouse at any age.

Tax-Deferred Spousal Rollovers

Transfer during lifetime:

A spouse may, during his or her lifetime, transfer non-registered assets to his or her spouse outright without triggering tax on capital gains. The income attribution rules (discussed in greater detail below) will, however, apply to such assets so transferred.

A spouse, if he or she is 65 years of age or older, may also transfer assets into a joint partner inter vivos trust, which would permit a spousal rollover of the assets held in the trust to the surviving joint partner (i.e., his or her spouse) on a tax-deferred basis. To qualify as a joint partner trust, income must be paid to the settlor and his or her spouse, and tax on such income is paid by the settlor and his or her spouse at his, her or their respective graduated tax rates unless a special tax election is made to tax the income in the trust. Further, there is a deemed realization of the assets of a joint partner trust on the date of death of the survivor of the partners, as well as every 21 years thereafter unless an election is made to trigger an earlier disposition. Due to the deemed realization, tax is payable on any taxable capital gains.

Upon death:

Upon death of one spouse, RSPs and RIFs can be transferred to the surviving spouse on a tax-deferred, rollover basis.

Moreover, other capital property may be transferred on death to a surviving spouse through a deceased spouse's will without triggering tax on capital gains. Such rollovers on death may be accomplished through either an outright distribution in the deceased spouse's will, or by way of transfer to a qualifying spouse trust. A qualifying spouse trust is a trust whereby the surviving spouse is entitled to receive all of the income that may arise during the lifetime of the spouse. The surviving spouse is the only person who can receive, use or have the benefit of, any income or capital of the trust during his or her lifetime. The spousal rollover will usually apply to a transfer of property to a spousal trust if all of the following requirements are satisfied: (a) the deceased spouse was resident in Canada prior to his or her death; (b) the trust is resident in Canada immediately after the property is transferred to it; and (c) the property so transferred vests indefeasibly in the spousal trust within 36 months after the death of the deceased spouse. This vesting period may be extended at the discretion of the Minister of National Revenue within the 36-month period.

A Tax Free Savings Account (TFSA), which offers tax-free growth of amounts held in the account, can also be transferred on a tax-free basis to a surviving spouse.

Attribution Rules

As noted above, non-registered assets can be transferred from one spouse to another during their lifetimes outright on a tax-deferred basis without triggering tax on accrued capital gains. In this instance, however, the attribution rules will attribute any subsequent income or gain earned on the asset back to the transferring spouse. There are certain strategies though that can be used to avoid attribution in certain situations.

Reduced Availability of Principal Residence Exemption

If prior to marriage both spouses own a home and they continue to each own a home upon moving in together in one of the homes, there may be reduced availability of the exemption on both properties and taxable capital gains may potentially arise when the one property is eventually sold. The principal residence exemption is available only to one family unit if the taxpayer is designating a property as his or her principal residence for 1982 or any subsequent year, which includes, in addition to the taxpayer, the following persons (if any):

- The taxpayer's spouse or common law partner throughout the year, unless the spouse or common-law partner was throughout the year living apart from, and was separated under a judicial separation or written separation agreement from, the taxpayer; and

- The taxpayer's children, except those who were married, in a common-law partnership or 18 years of age or older during the year; and

- Where the taxpayer was not married,

in a common-law partnership or 18 years of age or older during the

year:

- The taxpayer's mother and father; and

- The taxpayer's brothers and sisters who were not married, in a common-law partnership or 18 years of age or older during the year.

To view the full article click here

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.