About this research

Transformation: The Future of Alternative Investments explores the ways in which the alternative investment industry is adapting and evolving.

Up until late 2007, the industry had largely enjoyed uninterrupted growth. From 2007 to 2009 a series of dramatic market events coupled with poor performance, exacerbated in a number of cases by operational shortcomings, resulted in an overall loss of confidence in the sector. Since early 2009, the industry's fortunes have improved considerably. The credit crisis is receding into the background. Managers are refining business models and focus; institutional investors are reviewing allocations and operational requirements; administrators are eyeing technology and the labor pool; and the industry as a whole is preparing for the anticipated impact of increased regulation. What is clear is that the structure of the industry ahead will be vastly different than it is today.

Written in cooperation with International Fund Investment, this report is based on surveys and structured interviews conducted globally between February and June 2010. The study has benefited from the participation of 200 respondents across 26 countries, and includes: alternative investment managers with US$515 billion under management; administrators with US$4.2 trillion under administration; and, institutional investors with US$884 billion under management. In addition to the above groups, interviews were also conducted with lawyers and independent directors.

References within the report to alternative investment managers are based on a sample of respondents that invest in either (or a combination of) hedge funds, private equity, real estate, infrastructure and structured products, although the main focus has been on the hedge fund sector.

Headline messages

The following headlines represent the views expressed from each of the three main groups of participants involved in our research: alternative investment managers, administrators and institutional investors. Their insights are developed as 10 key themes in the rest of this executive summary, and further in sections 2, 3 and 4. Together, they provide a detailed analysis of the future of the alternative investment industry as it faces unprecedented change.

- The majority of institutional investors intend to increase their allocations to alternative investments in the next 3 years. As a result, they will have a far greater influence over the shape of the industry in the future.

- Anticipated regulation, driven by external forces that continue to blame alternative investments for the meltdown of the global financial system, is not wanted by the majority of investors, managers or service providers. The widely held view is that the industry did not cause or contribute to the credit crisis. Furthermore, investors believe more regulation will not produce any tangible benefits.

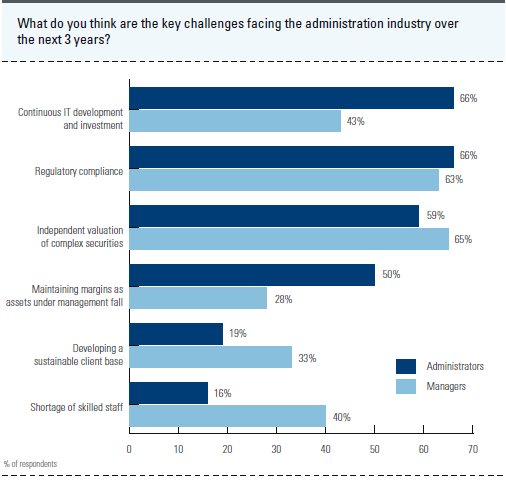

- Managers and administrators believe that regulation and governance are the most important challenges facing the alternative investment industry over the next 3 years.

- There will be four different manager business models that will come to dominate the industry in future. In addition to 'niche' boutique managers and the 'super-boutiques' (independent managers moving on to become multi-billion dollar players) there will be further and significant development of managed account platforms as well as the emergence of what might be termed the 'entrepreneurial-institutional' manager.

- Investors forecast that managed account structures will experience substantial growth. Whilst their benefits include improved transparency, liquidity, control and customized fee arrangements, managers believe that cost and operational complexity are some of their key shortcomings.

- Investors want a better alignment of interests with managers. The main changes will likely feature longer term performance fee arrangements, increased capital investment from managers, and a move towards enhanced liquidity and transparency.

- The overwhelming majority of existing alternative investors are happy to continue to allocate to funds that are located in offshore jurisdictions.

- There will be a further move towards independent administration, particularly in the US where many alternative investment managers administered their funds in-house. This will exacerbate the capacity mismatch that is developing in the industry. Administrators report that they are operating at near to full capacity whilst less than half of managers interviewed stated that they are in a similar position.

- The 'bifurcation' of the alternative investment industry is continuing. Newer institutional investors into alternatives are more likely to be attracted to managers promoting funds with greater liquidity and transparency than experienced, longer term institutional allocators.

- Levels of investor satisfaction with alternative allocations are correlated to the length of time that they have been active in allocating to alternatives because of their detailed understanding of the industry. Investors with the most experience of this activity tend to be the most satisfied with their allocations.

- There is little to no consensus amongst investors on the route to take to allocate to hedge funds. The popularity of fund of funds is in decline but there is no obvious replacement for most investors. As a result the well known billion dollar fund of funds will prosper but there is also likely to be significant consolidation amongst the smaller players.

- Manager fee structures are expected to be less uniform in the future, as institutional investors negotiate more local agreements.

- Barriers to entry from regulation and institutionalization will impact the rate of new start-ups. Moreover, managers with assets of less than US$100m will find it increasingly challenging to run a long term business as a result of increased costs from regulation.

- Fund servicing related issues are growing in importance. Investors now take fund servicing very seriously and a number of managers report that events over the last 18 months have had a dramatic effect upon the type of firms that they would want to hire as service providers.

- The fallout from the credit crisis and events such as Madoff have led to substantially increased levels of due diligence across investment management, particularly from institutional investors.

Executive Summary

"Twas the best of times, 'twas the worst of times.

'Twas the age of wisdom, 'twas the age of foolishness"

Charles Dickens

The era of transformation

One of the constants in the alternative investment industry is the presence of change. From its origins to expansion in the 1990s and through the explosive growth of the 2000s, the one thing that the industry could count on was continued change. However, in reality, the basic structures of the alternative investment business were not very different in 2007 than they were in 1997. The industry was a great deal larger but practices and structures remained largely unaltered. Investors considering alternatives, including the world's largest institutions, had to do so on the manager's terms, not their own.

Those days are now over. The industry is going through a period of transformational adjustment to a very different and more regulated operating environment. The majority of institutional investors included in the survey intend to increase their allocations to alternative investments in the next 3 years, with some intending to allocate over 10% of their total assets. As a result, these investors will have a far greater influence over the shape and culture of the industry in the future - they will demand institutional grade controls, increased transparency and flexible product strategies in order to invest their capital. In addition to the credit crisis, events such as Madoff, whilst not a hedge fund, highlighted the need for a robust due diligence process. The influx of more institutional capital into alternatives will result in further substantial growth of the well known, billion-dollar managers.

The desire for more transparency and liquidity is the main driver behind the recent growth in new product structures in hedge funds, including managed accounts and managed account platforms as well as onshore regulated products. Managers are being forced to make adjustments to the new environment, whether they like it or not (and some emphatically do not). For many of them, the frustration of having to review internal procedures and systems, consider different domiciliation options, gear up for more regulation and so forth has a pay off. They believe that this painful and expensive process will enable them to attract many more and different types of investors to their funds.

The paradox of regulation

The results of this survey show that the anticipated increase in regulation is not wanted by the majority of investors, managers or service providers. Despite regulation being widely promoted as a way to protect the investor, it is these investors who are most strongly against it. Few investors believe it will produce any tangible benefits. Some see it as being protectionist to certain jurisdictions and therefore detrimental to the development of the global alternative investment industry whilst others fear that it will inhibit the competitive positioning of investment managers by adding to costs. As a result, many investors in Europe believe it will reduce the number of new start-ups, thereby stalling the industry's engine of creativity – the production line of boutiques that provide vitality and talent in the future.

Nevertheless, the universal view is that further regulation is on the way. Investors, managers and service providers take a fatalistic approach to this subject. It is viewed as an inevitable consequence of the recent well publicized scandals affecting the industry, combined with the dramatic market volatility in recent months. Furthermore, numerous respondents made the point that alternative investments were in no way responsible for the market crisis. Indeed they were often victims themselves. Nonetheless, managers recognise that they cannot escape from the increase in financial regulatory supervision occurring around the world.

Regulation is coming to the alternative asset management industry on both sides of the Atlantic. The impact of various US regulatory and legislature initiatives, including the so called 'Volcker' rule, which proposes a ban on proprietary trading by banks, will likely be considerable for the alternative investment industry, as talent migrates towards boutiques. In Europe, the Alternative Investment Fund Managers Directive (the "AIFM Directive") is closer to finalization. The European Parliament's Committee for Monetary and Economic Affairs recently voted for the draft directive and the EU council's group of finance ministers followed suit on its version of the text.

A new breed of manager and what it means for the industry

As the alternative investment industry expands and matures so it continues to add variety to its manager models. The business started as a fragmented collection of niche boutiques. As the industry developed, a number of these managers then became 'super-boutiques' - investing institutions in their own right. For many years, the industry was characterized as being divided between these multi-billion dollar 'super-boutiques' and numerous smaller 'niche' boutiques.

Two other types of structures have come into the business to challenge the boutique model. In addition to the next generation of niche boutique managers and the 'super-boutiques', there will be further and significant development of managed account platforms as well as the emergence of what might be termed the 'entrepreneurial-institutional' manager.

'Entrepreneurial-institutional' managers started out as smaller alternative investment managers but have since diversified their businesses into mainstream fund management, as well as other complementary investment activities such as financing, private placements, proprietary trading, restructuring, and structured products. This development will have consequences for the entire financial world, not just alternative asset management. 'Entrepreneurial-institutional' managers will be able to outflank competitors by offering allocators a range of investment opportunities covering other alternative, and perhaps even mainstream, asset classes. Their controls and processes are likely to be institutional grade, yet they retain their creativity and focus on alpha, rather than asset gathering.

The rise of the 'entrepreneurial institutional' manager does not, however, signal an end to the boutique – far from it. As the industry institutionalizes, through increased bureaucracy, formalization and rigidity, the allure of reward, creativity and freedom will continue to attract talent to the niche end of the industry. Hence, the number of boutiques will thrive. Furthermore, their numbers may be impacted considerably by the proposed 'Volcker' rule in the US, as proprietary traders are forced out of the mainstream to set up their own firms. Nonetheless, if they are successful in their diversification strategy, whilst maintaining healthy performance in their core funds, the coming breed of 'entrepreneurial-institutional' managers will likely attract a large proportion of institutional capital – the boutiques may be able to compete on numbers, but not on asset size.

Managed accounts: great in theory, more difficult in practice

Separately managed accounts have always been a mainstay of the investment management industry. Managed account platforms, however, are a relatively new phenomenon.

Using managed account structures as a method of investing in alternative investments, has become considerably more attractive than fund of funds with institutional allocators. Investors surveyed forecast that managed account structures will experience substantial growth. (After direct investment into single manager funds, managed accounts are predicted to see the largest increase in asset allocations over the next 3 years.)

The control that managed accounts offer investors was mentioned by all those that use, or intend to use, these structures. After control, liquidity (in particular avoiding gates, lock-ups etc) and transparency were the next most popular reasons for turning to managed accounts. As a result, managed accounts are being used almost systematically by large institutions when they wish to make a large allocation to a manager.

However, managed accounts have drawbacks. Their biggest drawback is that they do not provide access to all managers or strategies. They are also difficult to implement for illiquid strategies, like distressed funds, due to increased reporting and administration demands. In addition, investors are conscious of the added costs, resources and responsibilities that are imposed upon them. Only large institutions have the means to employ the staff to implement and monitor a successful managed accounts program. Other concerns included performance diminution and the fact that they place more operational risk on the investor (and less on the manager). In addition to complexities with implementation, capacity constraints are already emerging in the managed account sector and investors are likely to have some difficulty finding the managers they want via these structures. Managers interviewed complain that managed accounts are taking up too much of their time and resources. They are concerned that their own fund investors must come first. Some managers have declined to take on managed accounts and others are imposing limits.

Imposing limits on managed accounts could become a badge of honour with successful, well known managers in the future. Pre market crisis, finding capacity with such well regarded managers, those that were often technically closed, was a concern for large investors. Post crisis, a variation of this problem could reappear within the managed account universe. Hence, direct investment into alternative investments is forecast by investors to increase more quickly than investment via managed accounts over the next three years.

Twin track alternative fund domiciliation

The alternative investment industry has always been drawn to offshore jurisdictions. They have grown up together. These domiciles are ideal locations both for their original core investors – the high net worth crowd – and managers. Locations offering regulation where it is quick, flexible and inexpensive to launch funds are what alternative managers want. However, a combination of increased investor nervousness, and the evolving regulatory environment have led managers to question whether they should continue to domicile their funds offshore or re-domicile onshore. Some managers have taken the step of re-domiciling onshore. Others have launched funds in onshore locations, such as Dublin, whilst keeping their offshore funds in operation.

Results indicate that the overwhelming majority of investors are happy to continue to allocate to alternative funds that are located in offshore jurisdictions. There is no evidence that the domiciliation structure of the alternative investment industry is of concern to those that currently allocate to these products. These respondents represent the bedrock of the industry's investor base. Investors in this category often view with disdain more regulated alternative fund domiciliation, which has become something of a craze in Europe.

In addition, investors with longer tenures of investing in alternative investments tend to be the least concerned with operational issues and fund domiciliation, whilst being the most sceptical that more regulation is in any way beneficial. Managers would therefore be wise to maintain their offshore fund range for their bedrock investors. For the next wave of investors, a different strategy looks likely to be beneficial to secure such investors' capital (at least for European allocators). They are more likely to want onshore funds in addition to their offshore structures.

Alternative investment domiciliation is diverging. The traditional homes of the hedge fund and private equity industries are not under significant threat. They will continue to be the logical place to go for funds aimed at the traditional alternative investor. However, EU domiciles are developing complementary structures to compete for this business and appeal to the new generation of investors. How these funds fare remains to be seen.

The growing role of the administrator

Third party, independent fund administrators find themselves in a pivotal position as the alternative investment industry is transformed in this new era of increased regulation, investor scrutiny and institutionalization.

Administrators are at the center of structural changes occurring throughout the industry. Increased standardization of administration will be the main change, particularly with regards to reporting transparency and liquidity requirements for investors. The anticipated increase in regulation is also forecast to have consequences for all industry practices, including administration. One respondent referred to the speed at which internal control reports (e.g. SAS70) have become standard in the industry as an example of how quickly practices can change.

Administrators included in our survey also believe there will be significant developments in the use of technology, in order to keep pace with increased demands placed upon their businesses by the alternative investment industry. There will be a requirement to accommodate an exponential increase in data demanded from fund managers, investors and regulators. As a result, administrators will need robust and flexible technology platforms that are capable of high volume transaction processing and customized 'real-time' reporting. Furthermore, for several years, administrators have been diversifying into services that are complementary to their core activities, such as performance attribution analysis and risk reporting services. The new environment is likely to see an acceleration of complementary services offered, including functions that support managers' front and middle office activities. In Europe, administrators have been particularly successful in diversifying their product range to capture reporting requirements for UCITS funds. Globally, it is significant that when asked the question, 'Which services do you provide currently and which do you expect to grow significantly in the next 3 years?' Administrators said that they expect there will be a big jump in front and middle office services and risk management.

However, with demand comes challenge. Despite a significant investment in technology, the administration industry remains very labor intensive and lacks operational leverage. There is an increasing capacity mismatch, with nearly 3 in 4 administrators operating at between 71-100% capacity. M&A activity is therefore inevitable. A number of administrators have already expanded into other areas and we are beginning to see convergence (hedge fund administrators buying into private equity for example). New firms and new product offerings are also likely to emerge to service the operational demands of clients. If alternative inflows develop as forecast, or anywhere near to it, administrators will face serious infrastructural challenges. This is an issue that few have yet to address.

The bifurcation business

Bifurcation of the alternative investment industry is occurring in a number of ways. It can be seen in the growing gulf between the boutiques, those managers that have stayed focused upon implementing their particular specialist investment strategy, and a number of the multi-billion dollar managers that diversified into other areas of the market and/or whose business models have moved beyond fund management.

There is now evidence that bifurcation is also occurring between institutional investors. The offshore fund industry will continue to serve the majority of those currently investing in alternatives, largely sophisticated and experienced investors who remain satisfied with its structure. However, new investors into alternatives are more likely than seasoned allocators to be attracted to managers promoting funds with greater liquidity and transparency than is typical in traditional alternative structures. This has been an important part of the reason for the growth in UCITS, or 'Newcits', funds in Europe. Meanwhile, much of the wealth management sector, as well as the longest serving and most sophisticated institutional investors, remain prepared to allocate to funds in offshore jurisdictions that are less transparent and considerably more illiquid than alternative UCITS products. These investors are also more understanding of industry practices such as gates, lock-ups and side-pockets, that evolved and were subject to so much criticism during the credit crisis.

The continued establishment of onshore regulated products will fundamentally change the dynamics of the alternative investment industry. It is likely to lead to a considerable increase in fund launches as parallel, or 'mirror' funds, are launched in onshore locations that mimic established offshore funds. Established offshore jurisdictions will continue to thrive and prosper in the new environment. There will also be a lot of activity in locations such as Ireland, Luxembourg and Malta as alternative UCITS become established in Europe.

The changing structures available to allocators

The way in which institutional investors currently access alternative investments will change in the next 3 years. At present, investors generally allocate capital to alternative investments through fund of funds, managed accounts, indexed products or direct investment. Institutional investors with the requisite resources are now moving to a hybrid allocation model. A clear trend in favor of single manager funds and managed accounts is emerging as allocations to fund of funds diminish.

Fund of funds did not have a good market crisis, say their investors. Their raison d'être to reduce market risk through enhanced diversification failed to materialize when it mattered most. Whilst large institutional investors favor a hybrid model of single manager funds and managed accounts, smaller institutional investors have more limited allocation options and fund of funds will remain their gateway to the industry. A number of these investors note that larger fund of funds are proving to be adaptable and innovative; some have enhanced their communication with investors and provide a far more customer centric experience.

Fund of fund managers with assets in excess of US$5 billion have the resources to expand into managed accounts and to diversify their offerings in other ways. In 2010 and beyond, the best of these large, multi purpose operations are likely to continue to expand into new areas (offering investors different structures and strategies). Convergence and divergence across strategies and structures will drive consolidation. Recent mergers in the hedge fund industry, including that of two well known firms in the business, both with assets in excess of US$5 billion, are an example of this. This is widely expected to lead to a further wave of M&A activity. There is always a possibility that something similar to the 'merger mania' that gripped the custody industry in the 1990s could be replicated amongst today's independent alternative asset managers.

To read this document in its entirety please click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.