This article has been updated and adapted from an earlier version that was first published in the Bangkok Post in February 2006. The updated version is current as of August 2011.

One question that is frequently asked by individual shareholders concerns the utilization of tax credit on dividends granted under Section 47 bis of the Thai Revenue Code. This article will discuss the conditions for using tax credit and explain how the tax credit can benefit a shareholder.

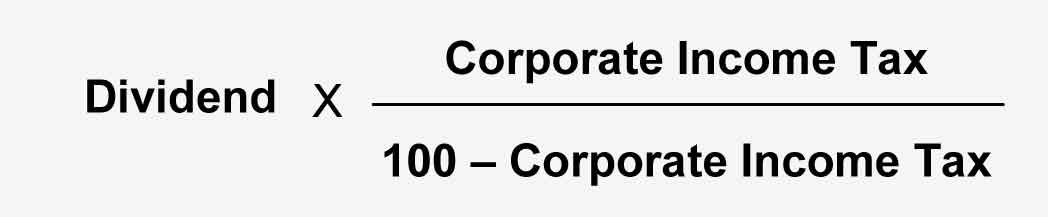

The dividend paid by a Thai company to an individual shareholder is subject to 10% withholding tax. An individual shareholder who is domiciled or is a resident of Thailand may choose to (1) treat the 10% withholding tax as a final tax payment for such dividend, or (2) include the dividend with other income in the computation of individual income tax payable in the filing of an annual tax return. Under alternative (2), the individual will receive a tax credit equal to the amount of dividend multiplied by the corporate income tax rate divided by the result of 100 minus the corporate income tax rate.

If the company paying dividends pays corporate income tax at the rate of 30%, an individual shareholder will receive a tax credit of 3/7 [30 ÷ (100-30)] of the dividend received. The tax credit of 3/7 of the dividend will first be included with the dividend (treated as income) and then deducted from the individual income tax payable (treated as a tax credit). The 10% withholding tax on dividend deducted by the Thai company is also allowed as a credit against the individual income tax payable.

The foregoing tax credit eliminates double taxation imposed at both corporate and shareholder levels. By granting a tax credit of 3/7 of the dividend received by an individual shareholder, the 30% corporate income tax imposed at the corporate level is eliminated and the income tax imposed is only at the shareholder level (at the progressive rate of 10% to 37%).

It should be noted that for tax purposes, a resident of Thailand means a person, whether Thai or foreign, who resides in Thailand at one or more times for an aggregate period of 180 days or more in any tax (calendar) year.

The following examples will illustrate how the tax credit benefits a shareholder:

In 2010, Mr. A (a Thai or foreign individual who is domiciled or is a resident of Thailand) earned employment income (salary, bonus, etc.) of Baht 200,000 per month (Baht 2,400,000 per year) from which a withholding tax of Baht 528,000 was deducted by his employer. In addition to his employment income, Mr. A received a dividend of Baht 1.4 million from a Thai company from which a withholding tax of Baht 140,000 (10% of Baht 1.4 million) was deducted.

Alternative 1If Mr. A chooses to treat the 10% withholding tax as a final tax payment for such dividends, his annual income tax payable will be as follows:

| Salary | Baht 2,400,000 |

| Less | |

| standard deduction (40% of employment income but not more than Baht 60,000) | 60,000 |

| Income before deduction of allowance | 2,340,000 |

| Less | |

| Personal allowance | 30,000 |

| Net assessable income | 2,310,000 |

| Tax payable: | Baht |

| Baht 150,000 exempted | = 0 |

| Baht 350,000 x 10% | = 35,000 |

| Baht 500,000 x 20% | = 100,000 |

| Baht 1,310,000 x 30% | = 393,000 |

| Tax payable | 528,000 |

| Less Withholding tax | 528,000 |

| Additional tax to be paid when filing a tax return | 0 |

Based on the above, Mr. A's total income tax paid for 2010 will be Baht 668,000 (withholding tax on employment income of Baht 528,000 plus withholding tax on dividends of Baht 140,000).

Alternative 2If Mr. A chooses to include the dividends with other income in the computation of individual income tax payable in the filing of his 2010 annual tax return, rather than paying additional tax, he will be entitled to a tax refund of Baht 118,300 (refund of corporate income tax imposed at corporate level). A detailed computation of his individual income tax and the tax refund is provided below.

| strong>Salary | Baht 2,400,000 |

| Less | |

| standard deduction (40% of employment income but not more than Baht 60,000) | 60,000 |

| Income before deduction of allowance | 2,340,000 |

| Dividend | 1,400,000 |

| Plus | |

| Tax credit 3/7 of dividend (3/7 x 1,400,000) | 600,000 |

| Dividend income including tax credit | 2,000,000 |

| Total income (Baht 2,340,000 + 2,000,000) | 4,340,000 |

| Less | |

| Personal allowance | 30,000 |

| Net assessable income | 4,310,000 |

| Tax payable: | Baht |

| Baht 150,000 exempted | = 0 |

| Baht 350,000 x 10% | = 35,000 |

| Baht 500,000 x 20% | = 100,000 |

| Baht 3,000,000 x 30% | = 900,000 |

| Baht 310,000 x 37% | = 114,700 |

| Tax payable | 1,149,700 |

| Less WHT on employment income | 528,000 |

| WHT on dividend (10%) | 140,000 |

| Tax credit on dividend | 600,000 |

| 1,268,000 | |

| Tax Refund | 118,300 |

Based on the above, Mr. A is entitled to receive a tax refund of Baht 118,300. Thus, the total income tax paid by Mr. A for the 2010 tax year will be only Baht 549,700 (Baht 528,000 + 140,000 – 118,300) instead of Baht 668,000 under Alternative 1.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.