On 1 January 2020, with the effectiveness of the Foreign Investment Law, the Foreign Investment Law Implementation Regulations and the associated department rules and judicial interpretation, China has entered into a completely new era of foreign investment administration and regulation. The previous three basic laws governing foreign-invested enterprises ("FIEs") in China, i.e., the PRC Sino-Foreign Equity Joint Ventures Law; the PRC Sino-Foreign Contractual Joint Ventures Law; and the PRC Wholly Foreign-Owned Enterprises Law, together with their implementation regulations, were abolished at the same time.

As the most significant legal development in the past 40 years in the area of foreign investment, the Foreign Investment Law and its associated regulations have brought fundamental and systematic changes to the way Chinese government manages and supervises foreign investment activities in China. This article highlights a few important practical changes brought by the new foreign investment legal regime and their impact on doing M&As in China by foreign investors.

Approval and Filing System of MOFCOM Abolished and Replaced by an Information Reporting System

Since the promulgation of the PRC Sino-Foreign Equity Joint Ventures Law in 1979, the establishment of FIEs or the acquisition of equity interest of Chinese companies by foreign investors had required approval of the Ministry of Commerce or its predecessor ("MOFCOM"), the in-charge authority of foreign investment activities in China. Since 2016, with the issuance of the foreign investment negative lists, such single foreign investment approval system was changed into a parallel approval and filing system – for foreign investment projects which fell within the negative lists, they required approval from MOFCOM; for foreign investment projects which fell outside of the negative lists, a filing with MOFCOM sufficed.

This parallel approval and filing system has been abolished under the new foreign investment legal regime. According to the Foreign Investment Law and the associated MOFCOM regulations, any direct or indirect investments made by foreign investors in the form of greenfield investments or acquisitions (no matter in an industry within the negative list or outside of the negative list) now require an online reporting to MOFCOM only, which can be completed in the same day of the submission of the reporting forms.

Reporting for Setting Up FIEs by Greenfield Investments or Acquisitions

For the purpose of such initial report when setting up an FIE1 in China, the foreign investor is required to submit to local MOFCOM where the FIE is located an application form providing (1) basic information of the FIE concerned; (2) basic information of the foreign investor and its actual controller; and (3) information about the acquisition transaction. Such reporting is to be done through the Enterprise Registration System, an online system of State Administration for Market Regulation ("SAMR"), at the same time when applying for the business license of the FIE concerned. No transaction documents (such as joint venture agreement, share purchase agreement, capital increase subscription agreement and even articles of association of the FIE concerned) are required to be submitted as part of the initial report. MOFCOM no longer reviews or examines any transaction documents.

Such simplified reporting system has greatly reduced uncertainties in doing M&As in China by foreign investors as they no longer need to worry whether their projects will be approved by MOFCOM (assuming such projects fall within the negative lists) and whether their agreed commercial arrangements (e.g., adjustment of valuation, conditions and timeline for payment of consideration) will be acceptable to MOFCOM or not due to lack of precedents or unfamiliarities of MOFCOM with such arrangements. The parties can agree on their cooperation and transaction terms purely based on their commercial needs and intention, subject to no violation of mandatory PRC legal requirements.

Reporting for Indirect Foreign Investments Made by Existing Non-investment FIEs

Under the old foreign investment legal regime, re-investments made by existing non-investment FIEs in an industry falling outside of the negative lists were treated as domestic investments, hence not subject to approval or filing with MOFCOM. Under the new foreign investment legal regime, such re-investments made by existing non-investment FIEs (no matter in an industry in the negative lists or outside of the negative lists) now require an initial report to MOFCOM. The difference for such initial report between direct foreign investment made by foreign investors and indirect foreign investment made by existing non-investment FIEs is that the initial report for such indirect foreign investment will be done by SAMR when issuing the business license for the company invested by the FIE and no submission of the initial report form by the investing FIE itself is needed.

Reporting for Offshore Acquisitions of FIEs

For offshore acquisition of FIEs (i.e., acquisition of shares of the foreign shareholder of the FIE instead of the equity interest of the FIE itself), previously before the implementation of the Foreign Investment Law, such offshore acquisition of FIEs required no approval or filing with MOFCOM. Now under the new foreign investment legal regime, such offshore acquisition of FIEs would require a change report by the onshore FIE to MOFCOM if such offshore acquisition will lead to a change of the actual controller of the FIE concerned.

No transaction documents need to be submitted for such change report. The onshore FIE is required to submit the change report notification form through the online Enterprise Registration System of SAMR within 20 working days from the date when its overseas shareholder passes the shareholder's resolution approving the sale (assuming no regulatory approval is required for such offshore acquisition). Although such change report can be done in the same day of the submission of the notification form, it is a mandatory legal requirement failing which may lead to a fine in the amount of RMB100,000 to RMB500,000 to be imposed by MOFCOM on the FIE concerned. Therefore, foreign investors need to be mindful about such new legal requirement and make the completion of such MOFCOM reporting as a condition precedent or a post-closing undertaking in offshore acquisitions of companies which have Chinese subsidiaries to ensure full compliance.

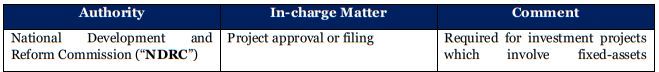

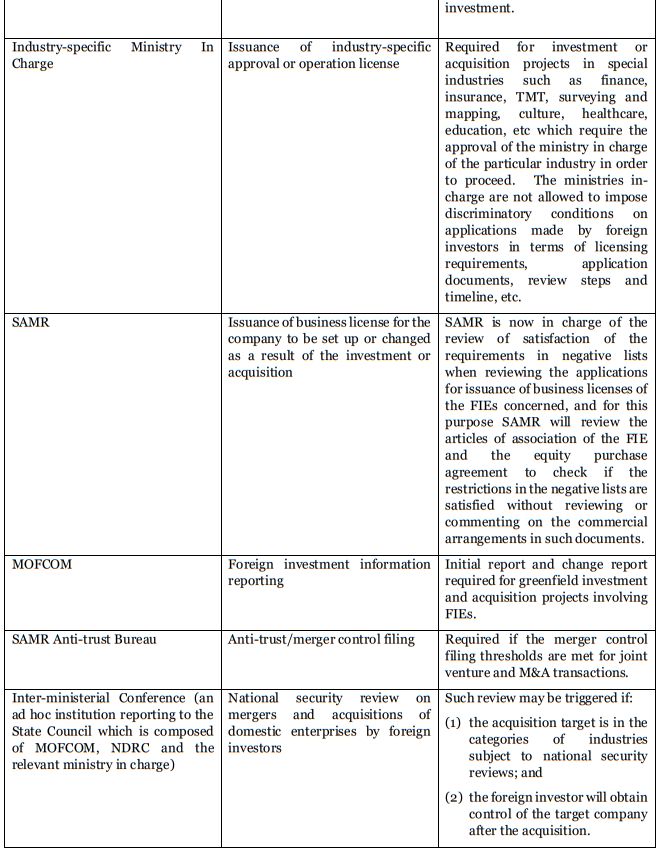

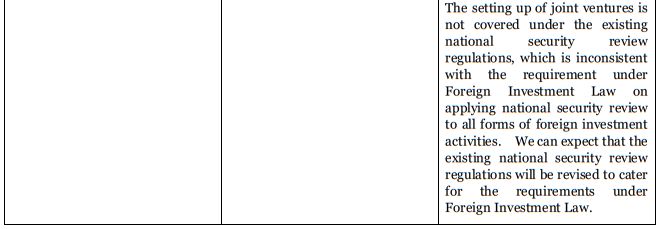

Government Approval Bodies and Roles

Though approval or filing with MOFCOM for foreign investment projects has been abolished, this does not mean foreign investment projects into China are free from any regulatory approvals and reviews. We set out below a summary of the government authorities responsible for approving joint venture and M&A transactions in China and their respective roles under the new foreign investment legal regime. Under the Foreign Investment Law, national treatment is a basic legal principle offered to foreign investment projects falling outside of the negative lists. Therefore, unless specified below, the following approvals apply to both domestic and foreign joint venture and M&A transactions:

Setting Up Joint Ventures with Chinese Individuals

Another practical change is that foreign investors can now directly set up joint ventures with Chinese individuals. Under the previous laws, this was not allowed unless such Chinese individuals had been shareholders of the target company for at least one year before the acquisition of such target company by foreign investors. Now under the new legal regime, such restriction has been abolished and Chinese individuals no longer need to set up a legal entity in order to form a Sino-foreign joint venture for legal reasons.

Unified Corporate Governance Structure

With the abolishment of the three basic laws governing FIEs, FIEs to be set up under the Foreign Investment Law will have the same corporate legal form and governance structure as those of domestic legal entities. Sino-foreign equity or contractual joint venture is no longer a separate legal vehicle and the Company Law or the Partnership Enterprise Law will apply depending on the legal form of the legal entity to be set up by Chinese or foreign investors. For existing Sino-foreign equity or contractual joint ventures, the Foreign Investment Law granted a five year transitional period since the effectiveness of the Foreign Investment Law (i.e., by 31 Dec 2024) for the parties to revise the joint venture agreements and articles of associations to be in line with the corporate governance structure provided under the Company Law, failing which the SAMR will not handle any registration applications of such FIEs and will also publicly announce such non-compliance.

Due to the substantive differences in corporate goverance structure between Sino-foreign equity or contractual joint ventures and limited liability companies, such adjustment of corporate government structure will involve changes concerning, among other things, the highest decision making body of the company, the way of appointment of directors, term of directors, quorum for board meetings, voting mechanism for important matters at shareholder and board levels, restrictions on equity transfer, etc. Most of these required changes are critical which may involve a new round of bargaining and negotiation among Chinese and foreign shareholders in order to agree on the required changes.

Conclusion

The Foreign Investment Law has been widely recognized as a legislative milestone in China's legal history. It aims to create a level playing field for FIEs and domestic companies and safeguard foreign investors' interests in China. So far, MOFCOM has abolished 62 department notices, regulations and rules in various areas concerning the administration of foreign investments and FIEs. It is expected that more changes will come to help foster and build up a more transparent and predictable administrative system for foreign investments.

Footnote

1. The Foreign Investment Law is silent on the definition of FIE. Based on our experience, the FIE here under the MOFCOM Information Reporting Measures refers to a company with any percentage of foreign investment, not necessarily limited to those with at least 25% equity interest held by foreign investors.

Originally published February 2020

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.