Security interests over patents must be registered with the Chinese State Intellectual Property Office (SIPO). As a result, there are interesting statistics, including the very substantial value1, of Chinese patents used as security. As well as reviewing these statistics, Toby Mak and Constance Rhebergen look at the criteria for registration and the impact of registering a security interest with some interesting contrasts, and reminder of the conflicts with laws in other jurisdictions. Notably however, only six security interests in favour of foreign entities were registered over the relevant period.

In China, intellectual property assets, including patents, have certain similarities to other property rights such as real estate and tangible property, and the owner is able to dispose of these assets in any legally allowable manner.

Typical transactions involving real estate include buying and selling, renting, and mortgaging. Although patents are extensively the subject of buying and selling (assignment) and renting (licensing), mortgaging (granting a security interest or pledge) of patent rights is less common and often overlooked. Reasons contributing to this include the difficulty and expense in evaluation of security interest status of patents, uncertainty of the rights due to invalidation attacks, and the challenge of foreclosing on a security interest in IP rights to enable realization (whether the recovery of money or the transfer of the secured asset), particularly when compared with real estate.

While intellectual property shares certain similarities with real estate and tangible property, the treatment of intellectual property differs in important aspects and is not intuitive.

Therefore, expert advice regarding taking security over intellectual property should be included in the early stages of the development of any strategy to ensure optimization of rights and value, both for financial institutions offering financing and companies involved in transactions.

Notably, while there are a large group of patent attorneys knowledgeable about patent prosecution, managing security interests in patents is not necessarily part of their training. Similarly, while corporate attorneys focus on security interests and financing, these specialist may be not be versed in the unique aspects of intellectual property. Identifying the right expert early in the process allows for structures and for drafting that will streamline efforts at a later date.

The Chinese government has been actively promoting commercial uses of intellectual property including patents since 2008, and patent mortgage or security interests is one such use. Various governmental notices have been issued to regulate and promote these, see the panel on page 39.

Pate nt secu rity inte rest regi stra tion stat isti cs from 2009 to 2013

Unlike banks in other jurisdictions, all banks in China are state-owned. Therefore, they are bound by the policy documents outlined on page 39, resulting in a willingness of many Chinese banks to make use of patent security interests, lending money to patentees with a mortgage on their patents.

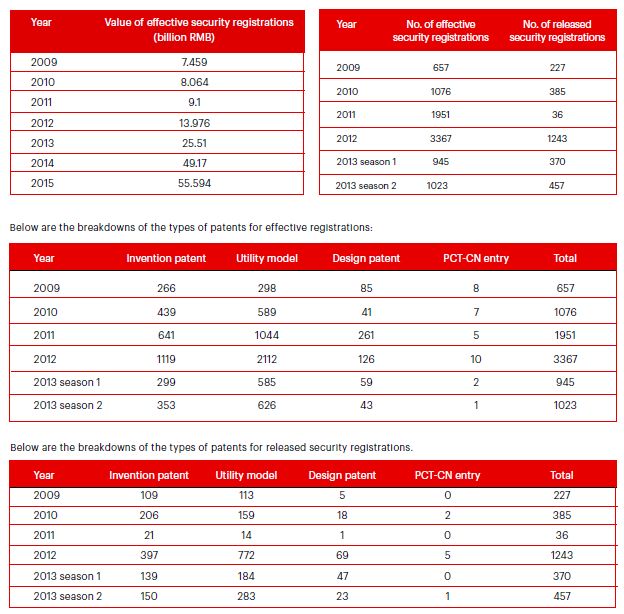

Below are figures showing the volume of registrations from 2008 to the first six months of 2013, which highlight some of the trends in this area, and figures showing the value of registrations up to 2015, and the breakdown between different areas (again for the period up to the first two months of 2013).

Patent security interest registration statistics

The following can be noted from the figures set out on the page opposite:

- The number of effective registrations in a year refer to the number of patents against which security interest were registered in that year.

- In 2013, only the numbers for the first two seasons were provided individually. Therefore, although there seems to be a significant drop in the numbers in the last two three- month periods, the trends in fact increased. For example, there was in fact a 34% increase in the number of effective security registrations comparing to half of the number of 2012 registrations.

- The values involved were staggering. In 2009, about 7.45 billion RMB was involved (about £884 million), on average a patentee borrowed 11.34 million RMB per patent (about

£1.35 million). The total value in 2008 was 1.38 billion RMB (about £163 million), and thus 2009 showed a substantial increase in the total value of registered security interest. The numbers keep increasing to 55.594 billion RMB in 2015 (about £6.479 billion).

- According to the most recent report from SIPO, on 5 January 2017, the value of security interest recorded at the SIPO was 43.6 billion RMB (about £5.45 billion), decreased by 21.6% comparing to that of 2015.

- According to SIPO's 2009 and 2010 reports, most of the security interest registrations had a term of between one and two years (about 50% of the total security interest registrations in 2009 and 2010).

- The numbers of released security interests consistently fell behind those of the security interest registrations. As

mentioned above, according to the SIPO's reports, most of the security interest registrations are for between one and two years in 2009 and 2010. Assuming that these were also true in 2011 to the first half of 2013, this may infer that a significant number of the mortgagees could not recover the loan from these borrowing activities, in which 2011 was a particularly bad year. However, it should also be noted that these discrepancies may be due to a lack of awareness, or even due to laziness in registering the release of security interest.

- In 2009 and 2010, the numbers of invention patents and utility models were neck and neck for effective security registrations. However, since 2011, the ratio between the numbers of invention patents and utility models became about 1:2. Therefore, utility models appear to be commercially more active than invention patents as far as security interest is concerned.

- Compared to invention patents and utility models, design patents were a lot less active in security interest registration, with a percentage of about 5% in the number of effective security interest registrations.

- There were only very few security registrations based on PCT national phase entries into China.

- All of the mortgagors and mortgagees involved were

Chinese entities, other than a mere six entries involving foreign entities (five registrations, one released registrations) from 2009 to the first half of 2013 among over 11,700 registrations.

- Mortgagors, as expected, are mostly technology companies, but there were also significant number of individual patentees.

- Mortgagees, other than Chinese banks (including their local branches), involved technology investment/ incubation companies.

- The registrations tended to be done in batches.

- SIPO stopped providing security interest registration figures from 2013 with the explanation: "misunderstanding of the figures resulting in many

incorrect analyses of the actual patent security interest environment in China".

What is required for patent security registrations in China

According to the relevant regulations issued by SIPO in 2010, a number of points should be noted.

SIPO is the only official body responsible for registrations.

A written agreement between the mortgagor and the mortgagee is required to register security interest on patents. The written agreement pledging the patent assets can be a separate contract relating only to patents, or can be a main contract that includes mortgage clauses directed to intellectual property.

For a patent with multiple patentees, all co-owners must consent to the security interest to be valid and enforceable.

The documents and information below are required in order to register patent security with SIPO:

- A completed application form.

- Power of Attorney if an agent is appointed (this is necessary for foreign entities).

- Identification of the involved parties, for example, identification card of an individual, or business registration for a company.

- The written patent security interest contract including the party details, kind of security and amount, details of the patent (patent applications are not eligible) and scope of interest. Other aspects may be covered such as maintenance obligations, assignment, challenges to the patent and supply of technical information if the security is realised.

SIPO will refuse security registration in a number of situations:

- The mortgagor(s) is different from the patentee(s) on the Patent Register.

- The patent has ceased (due to non-payment of annual

- maintenance fee or the full term has expired), or is announced to be invalid.

- The patent is still an application and not yet granted.

- The patent is within the six-month grace period for late payment of annual maintenance fee.

- Invalidation or entitlement proceeding has been initiated against the patent.

- The time limit for the mortgagor to repay the debt to the mortgagee exceeds the full term expiry of the patent.

- The contract recites that the patent should belong to the mortgagee if the mortgagor failed to repay the debt within the time period prescribed in the patent security interest agreement.

- The patent security interest agreement does not have consent from all of the co-owners for a patent owned by multiple patentees (this usually means the agreement is not signed by all of the patentees).

- The patent is subject to another in force security interest registration that was registered first.

Moreover, a patent security interest registration will be revoked ab initio if any one of a-i occurs – mainly a, b, d, and e – after a security interest registration comes into force, as other issues should result in the upfront refusal of the security interest registration. In particular, i is a catch-22.

The security registration will released if the debt is paid, or the security realised or abandoned, or if the agreement granting it is held to be invalid or void

Once a patent security interest registration is effective, SIPO will publish the identity of the parties, the main classification of the patent and details such as number and grant date.

When a security interest is registered, SIPO will not record the surrender, assignment or licence of the patent.

SIPO will notify the mortgagee upon non-payment of the annual maintenance fee of a patent subject to effective security interest registration.

Observations

As in mortgages of other forms of properties, registering the security interest at the proper authority could provide various protections to the mortgagee. In the case of an effective security interest registration on a Chinese patent, a mortgagee will be notified of non-payment of the annual maintenance fee, and assignment and licensing of the patent could not take place without the mortgagee's consent.

According to regulations issued in 2010, SIPO is the only authority for registering security interest on Chinese patents and a security interest on a Chinese patent will only become effective after the security interest registration is recorded at SIPO. Leaving a security interest unregistered could result in diffi culties in enforcing the security interest, particularly if the mortgagor is dissolved or deceased.

It should be noted that SIPO's patent security registration system adopts a first-to-register system, allowing only one registration to be effective at any time. These have the following consequences:

- Whoever has an effective security interest registration prevails, which could prevent later registrations from becoming effective.

- After borrowing money from one bank and having the security interest registered at SIPO, it is very unlikely that the patentee could use the same patent to borrow money from another bank. This restriction is understandable bearing in mind that all Chinese banks are state-owned.

- As a mortgagee, the consequences of not checking the Chinese security interest register before engaging in the mortgage of a Chinese patent could be disastrous. If there was an effective security interest registered, this could mean that the intended mortgagee's interest would not be recognized at all in China.

However, the statistics show that this has been ignored by foreign mortgagees (there are only six entries involving foreign entities).

This could become messy if no security interest has been registered at SIPO, particularly if both the mortgagor and the mortgagee are foreign entities, in the event that a bankruptcy proceeding is filed by the mortgagor (the owner of a Chinese patent), and the mortgagee having the security agreement wishes to exercise its security rights over the Chinese patent. First of all, it is not certain whether a foreign court would realise, or if so would take into account, the fact that security interest on a Chinese patent is not effective until the security interest has been successfully registered at SIPO. If the bankruptcy administrator is clever and knowledgeable enough to raise this point at the bankruptcy court, it is not certain how this would end. Even if an assignment was signed under the order of a foreign court (a Chinese court would not issue such an order, as the security interest is not effective in China in the first place), the assignment is subject to revocation or at least challenge, for example, by a licensee of the patent. Even more so, if assignment or licence of the patent were recorded at SIPO before the mortgagee takes any action, the mortgagee has no way to stop the recordal of the assignment or licence, as legally speaking the mortgagee has no right on the patent.

According to SIPO regulations and the relevant law, security interest on a patent would only become effective after such is successfully registered at SIPO. This means that an unregistered security agreement would not be recognized and enforceable in China by the mortgagee and any third-party who later buys/licenses/mortgages the patent.

Therefore, it is vital to anyone involved in a Chinese patent transaction to perform a search for security interest registration.

Therefore, it is vital to anyone involved in a Chinese patent transaction to perform a search for security interest registration.

An unwitting business person who pays for a Chinese patent but later discover that the Chinese patent is subject to a security interest may find they have lost their entire investment. Performing due diligence early in the negotiation protects the lender or the buyer and may provide additional information that weighs on the value of the portfolio.

On the other hand, checking the existence of security interest may not be as easy as one may think. First, the database can only be searched using the patent number, which restricts the searcher to searching each asset individually. There is no current availability to search by the name of the owner. For large portfolios, this becomes unwieldy and expensive. It is also necessary to check whether the patent is no longer in force, and if it is possible to restore the patent.

Unlike in the US or UK, SIPO is obliged to ensure that the security agreement fulfils the requirements outlined above before registering it.

It should be noted that without the mortgagee's consent, an effective security interest registration would prevent assignment or licensing of a patent to be recorded at SIPO. This is different from US practice, for which the assignment could still be recorded, but the new patentee/licensee is on notice of and is subject to the security interest.

Very little case law surrounds the handling of patent security interests therefore, using best practices in securing patents will avoid uncertainty as to interpretation and future expense or loss.

Intellectual property experts should also be involved in the drafting of clauses related to intellectual property in order to optimize rights. As noted above, only granted patents are subject to security interest recordals. Therefore, patent applications are left without substantial protection. Security interests in future

assets generally cannot be granted, so it is important to include an intellectual property professional in the preparation of instruments to create a mechanism to allow for securing of patents that later come into existence as a result of the identified patent applications.

SIPO regulations do not specify a period of time allowed for the filing the registration. It is interesting to note that SIPO's regulations do not prohibit an agreement with the time period of paying the loan already expired to be registered, but it is diff cult to imagine that SIPO would register expired agreements. In any event, SIPO regulations do not stipulate any time limit for registration. In some countries, notably those with an Common law history, there are restrictive time periods in which security interests must be registered or the right to register is lost. Certain countries, such as the US, have a hybrid system where there is a specific time period for registration to gain maximum protection, but the right to register continues after that time period has elapsed provided, however, that another party may acquire superior rights by filing first. A third category of countries, including China, have no time limit for registration. Regardless of the system, early planning and execution of the registration is advantageous.

It is interesting to note that SIPO regulations prohibit the mortgagee automatically owning the patent if the mortgagor fails to repay the debt within the time period prescribed in the patent security interest agreement. As far as the writers are aware, this is uncommon in the field of security interest. This may be driven by public interest, which may have the effect of forcing the mortgagee to put the patent in an auction for better distribution of technology know how.

This article was published in the February 2018 issue of the UK Chartered Institute of Patent Attorneys (CIPA) Journal, and are re-posted here with the kind permission from the UK CIPA. The UK CIPA Journal covers updates, articles and case law reviews on IP in the UK, Europe, and around the world. The Journal is available for subscription at GBP130 per year, and for free by becoming a foreign member at GBP405 per year. For more information on the CIPA Journal please email editor@cipa.org.uk.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.