The Iberian financial sector is generating plenty of disputes, but while this may be lucrative work for lawyers in Lisbon, it is less so for those in Madrid

Financial sector-related disputes are common in both Spain and

Portugal at the moment. While class actions against banks are

becoming more popular in Spain, the fallout from the collapse of

major banks in Portugal continues. However, there is one important

distinction between the two jurisdictions, while advising clients

on disputes relating to the collapse of Portugal's Banco

Espírito Santo, for example, are a rich source of work for

law firms, banking-related cases in Spain are, in contrast, not

particularly lucrative, though lawyers accept the work in the

interests of maintaining good relations with clients. Lawyers

specialising in dispute resolution in Spain generally find richer

pickings in energy-related cases. With regard to alternative

dispute resolution (ADR), uptake in Spain is particularly slow,

however there is a feeling that Portugal is beginning to make some

notable progress in this respect.

There is more litigation than arbitration in Spain, according to

Gómez-Acebo & Pombo partner Francisco A. Peña. He

adds that there is a significant amount of litigation in the areas

of renewable energy and gas, with disputes occurring in the latter

sector due to "difficulties in fulfilling long-term gas supply

agreements". There are also many banking-related disputes,

however the bad news for lawyers is that such cases do not amount

to particularly lucrative work.

Class actions in fashion

Uría Menéndez partner Álvaro López

de Argumedo points out that there are now more "multi-tier

clauses" in contracts. Such clauses demand that parties

negotiate, and, if that fails, proceed to mediation and then to

arbitration. López de Argumedo adds that class actions are

becoming "more fashionable" in the financial sector

– highlighting the example of a recent case involving 1,200

consumers who are in dispute with banks in relation to terms and

conditions relating to mortgages.

Lawyers have highlighted the introduction of a new law on

international legal cooperation in civil matters as one of the

major developments in the last year and add that it will create

significant opportunities for law firms. The purpose of the new law

(Law 29/2015, of July 30, 2015) is to establish rules on

international judicial cooperation between Spanish and foreign

authorities in civil and commercial matters.

In recent years, most litigation has fallen into two distinct

categories – cases related to regulators and disputes

involving consumers, according to Rafael Murillo, partner at

Freshfields Bruckhaus Deringer. However, he adds that, in general,

there has been a decline in appetite for litigation. Murillo says

there has been a huge increase in claims by consumers and that,

given the approach of courts has changed, a large number of

consumer claims have been successful.

Financial institutions are now wondering whether they should try

and reach an agreement in consumer disputes relating to mortgages,

for example, because such claims are being accepted by the courts,

explains Baker & McKenzie´s Spain managing partner

José María Alonso, who is head of the firm's

litigation and arbitration department. He adds that, in such

instances, legal costs are incurred by the financial institutions.

However, Alonso says the defendants in such cases know that, if

they do not continue fighting such claims, there will be a growing

queue of people looking to bring similar cases. Meanwhile, he

explains that the modification of the criminal code in Spain means

lawyers are increasingly needed by clients to advise on

compliance.

Another new phenomenon is a rise in lawyers selling their services

to consumers in an effort to generate legal work, according to

Clifford Chance partner Iñigo Villoria. He adds:

"People are investing in legal business as there is less

certainty about what outcomes can be expected in courts."

Pérez-Llorca partner Guillermina Ester says that in 2016 we

will see more decisions made by the European Court of Justice that

will have a direct impact on ongoing cases in Spain, especially in

relation to banking litigation.

Banking litigation can be divided into that brought by "common consumers" and disputes involving "sophisticated consumers", says Cuatrecasas, Gonçalves Pereira partner Alfonso Iglesia. With regard to claims brought by sophisticated consumers, banks have often strong defences, he adds. Iglesia also highlights the trend for disputes related to price amendments in public-private partnerships (PPPs), and says that some of such cases are "now being seen in the criminal courts because they are being presented as potential fraud".

Cultural barriers

Villoria says mediation is not working in Spain as it is in

other jurisdictions, while Araoz & Rueda partner Clifford

Hendel adds: "We don't yet see a lot of ADR in Spain, or

in much of continental Europe – mediation is a long-term

project, but when decision makers realise that 75 per cent of

mediations tend to settle on the very day of mediation, they will

begin to take notice. When they do, today's vicious cycle

– and the view 'it will never work here' –

could give way to a virtuous circle, where understanding leads to

confidence and confidence leads to results." López de

Argumedo says lawyers have "pressed hard to convince clients

that mediation is one of the possible ways" with limited

success. He adds: "Lawyers need to take the lead and show

clients the benefits of mediation or judges must force parties to

mediate."

There are cultural barriers to using mediation in Spain, according

to Alonso. "Unless the clients are big companies, they think

that if the issue is not solved in a short meeting then it should

be resolved in the courts," he adds. Murrilo says that, while

lawyers have shown a commitment to promoting arbitration, there has

not been the same effort at promoting mediation. He continues:

"Clients have less appetite for mediation."

"One may think that there is little incentive for defendants

in cases to go to mediation," says Ester. "Litigation is

not expensive, and clients may think [given the time litigation

takes], it is better to pay in five years, for example, than pay

now." Iglesia says another problem affecting efforts to

promote mediation is that "many mediations do not end with an

agreement accepted by both parties".

Law firms that settle a dispute via mediation can earn a reasonable

amount in fees, says Alonso. However, he adds that the challenge

lawyers face in mediation is that they have to perform many

different roles when serving their clients, such as acting like a

"psychiatrist", for example. Hendel says that mediators

in Spain face the problem of a lack of real-life experience and

effective training: "Until they have had substantial, hands-on

experience, they are not serious, sophisticated mediators –

we have a situation where classroom-trained mediators are not

developing their skills where they really can best be developed, in

the conference room."

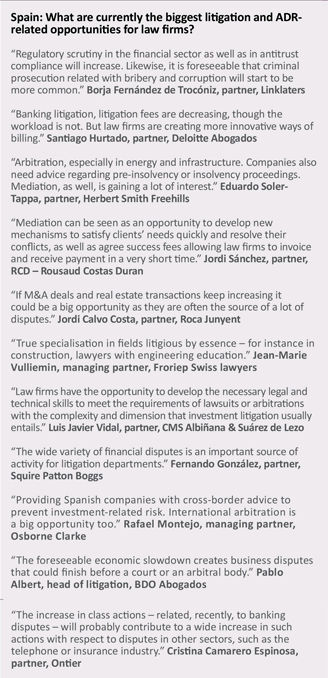

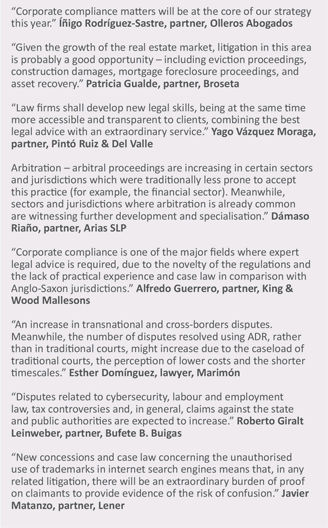

Regarding major opportunities in the future in the area of

litigation and ADR, Murillo identifies insolvency proceedings,

cases involving consumer associations. as well as criminal law

cases. Hendel says that a notable trend in Spain has been the

emergence of a "sub-industry" in which funds, for

example, are financing insolvency claims. The coordination of

international litigation in multijurisdictional cases is also a big

opportunity for law firms, according to López de Argumedo,

who also highlights Latin American arbitration as a growing area.

There will be a considerable number of gas and electricity-related

disputes in the coming year, according to Peña. He adds that

shareholder disputes will also be on the increase: "There is a

lot of co-investment and different institutions need to

disinvest."

Fees not increasing

Maintaining profits remains a significant challenge for law

firms. "Margins are a real problem," according to Alonso.

"Prices are not increasing, we need to improve efficiency and

knowledge management systems." In reference to the political

uncertainty in Spain, Ester says a scenario of political stability

will lead to more M&A transactions. She adds: "If the

economy recovers we will see an increase in disputes related to

M&A."

Law firms have to re-think their business models, according to

Murillo. He adds: "Rather than having a huge office in Madrid,

it may make sense for some firms to have a smaller office in Madrid

and a cheaper location elsewhere for business services."

José Luis Huerta, partner at Hogan Lovells, says clients are

now choosing legal services on price, so law firms need to have

more flexible structures. He adds: "Now, when you talk to

young people in law firms, you have to tell them their career path

is not as predictable as it used to be." On the issue of law

firms needing more flexible structures, López de Argumedo

highlights a new service called Lawyers on Demand, which involves

lawyers providing legal services to clients on a short-term

basis.

br /> Criminal litigation is on the rise, according to

Peña. However, he adds: "There are some problems in the

criminal courts when they are dealing with cases that would

previously have been considered civil litigation." In

addition, Peña says that law firms can earn fairly big fees

for litigation related to intellectual property. Meanwhile, a

number of significant disputes related to gas supply contracts are

expected to go to arbitration.

The coming year will be a challenging one for law firms in Spain,

according to one partner. "There has been a drop in litigation

work, so we have to find new products." Meanwhile, Hendel

believes shareholder disputes, as well as energy litigation will

continue to provide opportunities for law firms in 2016. However,

he adds: "ADR is a concern as it has had a long period of

gestation in Spain."

Alonso expects an increase in criminal cases in the coming year,

that is, in relation to the criminal liability of legal entities.

He adds that there will be an increase in transnational disputes

and, consequently, law firms will have a role to play in

coordinating disputes in different parts of the world because

Spanish companies are "moving to markets they are less

familiar with". However, Alonso says law firms face the

challenge of trying to attract talent because it is getting

"more and more difficult to become a partner at a law

firm".

br /> Law firms do not face the challenge of commoditisation in

the area of litigation and ADR whereas this is an issue in other

areas of practice, according to Iglesia. He continues: "In

complex cases, price is not the key factor for clients". Ester

says she expects the level of insolvency cases to continue in the

coming year, and also anticipates more consumer cases against

banks. She adds that disputes relating to Spanish companies'

activities in Latin America should create opportunities for law

firms. Huerta fears the political situation in Spain will slow down

investment and this will have an impact on litigation and ADR. He

adds: "Lawyers will have to recover their entrepreneurial

spirit as we need to be innovative and find new products for

clients – however, corporate disputes will increase as well

as stand-alone and follow-on actions, compliance-related work will

also increase."

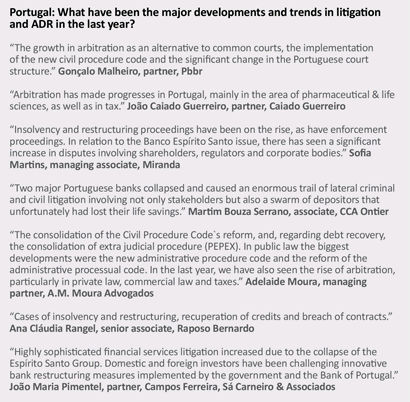

Portugal: BES fallout continues

In Portugal, the "tsunami" of litigation related to

the collapse of Banco Espírito Santo continues, according to

one partner, who adds that the disputes relate to a wide range of

areas including, banking and finance, criminal law and public law.

Meanwhile, the recent collapse of the Portuguese bank Banif will

also lead to significant dispute resolution-related work for

lawyers.

There is a significant amount of litigation related to

transnational insolvencies involving Luxembourg, Switzerland and

the Cayman Islands, PLMJ partner Nuno Líbano Monteiro

explains. He adds: "There are also cases related to the

liability of boards of directors with disputes concerning D&O

policies." With regard to arbitration work, in addition to

matters related to the collapse of BES, there is also some major

disputes in the pharmaceutical sector that are going to

arbitration. Meanwhile, Fernando Aguilar de Carvalho, partner at

Uría Menéndez Proença de Carvalho, says

disputes relating to white collar crime continue to be on the

rise.

Commercial mediation is making progress but it is still

practically non-existent in Portugal, according to MLGTS partner

Miguel de Almada, though he adds that, in contrast, arbitration is

used more and more frequently. Meanwhile, Abreu Advogados partner

Natália Garcia Alves says that the Portuguese civil courts

are handling cases more quickly, but that there are still problems

with enforcement courts. In the view of Rui Tabarra e Castro,

associate at FCB Advogados, the judicial courts are not properly

prepared to deal with some BES-related cases because some judges do

not have the relevant experience.

This view is echoed by Sérvulo partner António Teles

who says that sometimes commercial courts are worried that they

will have to deal with particularly difficult cases. He adds:

"There is the fear on the part of lawyers that courts will try

to oversimplify these cases." Linklaters counsel Ricardo

Guimarães says that judges in Portugal often take too long

to decide disputes. "In some cases, after 10 years we're

still waiting for the first decision," he adds.

Though there is pressure on fees in respect of litigation and ADR

– as there is in other practice areas – Vieira de

Almeida partner Frederico Gonçalves Pereira says that

dispute resolution work is becoming a more important source of

revenue for law firms." AAA Advogados partner José

Jácome says that litigation is an important source of

revenue for law firms: "The litigation department was the poor

relation in law firms, but now it's one of the rich

relations."

The market for legal services relating to litigation and ADR in

Portugal is fiercely competitive, according to Aguilar de Carvalho.

However, he adds that there are many foreign investors seeking

legal advice, who are used to different fee structures and

Portuguese firms are having to adapt: "This is both a

challenge and an opportunity, particularly in the wake of the Novo

Banco/BES-related litigation, with complex and high-level services

being sought." If a law firm quotes very low fees for its

services, it may deter some clients from using them, according to

Jácome: "One US investment fund said some fees proposed

by other firms were so low, they didn´t think the law firms

could be good."

Resolving conflicts

Aguilar de Carvalho says one of the major challenges for law

firms is "sorting out conflicts of interest",

particularly in BES-related matters. He adds: "This is

relatively new and has led to lots of firms having to say no to

work they would have been keen to take on." Improving

efficiency is another major challenge facing law firms, according

to Guimarães. He continues: "Some clients are open to

paying fees that are higher than the standard, but they want

efficiency, quality and results". Jácome says that

clients want to have certainty regarding what they will spend on

legal fees and this means there is a "higher recourse to

success fees". According to Líbano Monteiro, clients

are demanding fee caps and "they want to cap the different

parts of the case, such as the preliminary hearings, the trial and

the appeal, for example".

Another difficulty law firms face is that clients' in-house

legal teams are becoming stronger and more accomplished.

However,the big opportunity for lawyers lies in more complex

litigation because, in this area, clients generally do not have the

expertise. An additional trend being observed in the market is

clients now asking several law firms for a quotation when seeking

to outsource work.

Determining fee caps can be problematic for lawyers, according to

Teles: "It can be difficult to predict how a case will evolve

– in a judicial court, a two-day hearing could end up lasting

60 days." But hourly rates are largely a thing of the past. De

Almada says: "Arrangements based solely on hourly rates are

almost dead." SRS Advogados partner José Carlos Soares

Machado says the biggest concern for law firms with regard to

pricing is "limiting the risk". He adds: "When

clients want a capped fee, the risk is ours – the key is to

omit unpredictable events out of the fee estimate, but it depends

on the client, some want to know all the potential

outcomes."

How are current market trends impacting on the litigation and

ADR departments at law firms? Líbano Monteiro says that

departments need to organise along industry sector lines, such as

banking and finance, for example: "BES was proof that this was

necessary." Soares Machado adds that pressure from clients

means that law firms "need lawyers with a tendency to work in

a particular area".

Gonçalves Pereira says the first challenge litigation and

ADR departments have is ensuring they have the correct leverage. He

continues: "You need a strategic view of how to conduct

litigation, you need partners, managing associates and then you

need young associates – you also need specialisation, and you

also have to work with other teams." Guimarães says

that a key challenge is to "build the legal team you need for

specific cases".

BES-related matters have represented a strange new world for

banking and finance departments in law firms, according to Nuno

Pena, founding partner of CMS Rui Pena & Arnaut. He adds:

"In six months, we have had three different legal regimes

– we are dealing with new decisions and a lot of questions,

our litigation team has been updating our banking and finance team

[on the latest developments]."

One partner at a leading Portuguese firm expects a number of

arbitrations involving private equity funds, though he identifies

frequent challenges to arbitrators as a potential problem. He adds:

"The market is small and the fear is that such behaviour will

be repeated in arbitration concerning other sectors such as

pharmaceuticals." Jácome says the legal environment as

well as the Portuguese state courts' organisation is improving

and all major litigation practices are doing better. He continues:

"Lawyers are also more fairly paid, the question is are we up

to the challenge of improving in relation to ADR, for

example?"

'Pessimistic outlook'

With political uncertainty in Portugal, there is a possibility

that tax laws could change and privatisations could be reversed,

says Aguilar de Carvalho. "This will create a lot of

litigation opportunities, but it could be bad for law firms as a

whole – Portugal's economy depends on foreign investment

and funding and the uncertainty may drive investors away and make

funding more difficult," he adds. Tabarra e Castro says that

it is uncertain whether the current Portuguese government will

last: "It´s difficult to explain to clients that this

government will change the reforms of the previous government.

However, I'm optimistic that we may get faster judicial court

decisions."

Pena says he is "completely pessimistic" about the

outlook under the new government. However, he adds that law firms

now have more complex and demanding work, though he says he does

have concerns about courts in Portugal. "We have had no

evolution in our courts," says Pena. "You are lucky if

you get a judge capable enough to deal with these complex cases, it

is a complete mess – we should have a specialised commercial

court for complex cases, such as cases related to the collapse of

banking institutions."

Garcia Alves says one of the challenges for law firms is to

"make a difference". She continues: "There are a lot

of good law firms, clients will go to three or four firms before

making a choice, and they may not decide on price, empathy with the

client is important." De Almada says that growth in

arbitration and litigation will provide greater opportunities for

law firms: "Litigation and ADR departments can match the glory

of the transactional departments – the challenge is to focus

the competition on quality and not on pricing."

Political pessimism in Portugal is not necessarily bad for

litigators, according to Soares Machado, who believes there will be

a significant amount work related to financial litigation,

insolvencies, restructuring and white collar crime in the coming

year. He adds that the cases related to the collapse of BES and

Banif will go on for another five or six years. "Proceedings

will be faster as there has been a change in culture and in the way

judges act – enforcement is getting faster and there is

increased efficiency."

The prospects for litigation teams are good, according to

Gonçalves Pereira. However, he warns that the prospects for

the Portuguese economy in the medium term are not so healthy:

"Aside from the food distribution chain, we don't have a

lot of big companies – we need the economy to create new

opportunities, but foreign investment will decrease.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.