In continuance to our earlier article on General Overview of Business Entities in Indonesia (link: Vol. 1), we provide the second volume of the series, with the summary and general overview of non-legal business entities in Indonesia.

Forms of non-legal business entities acknowledged in Indonesia's jurisdiction include civil partnership (maatschap), commanditaire vennootschap (CV), firm, and sole proprietorship. In contrast to legal business entities, these ones are classified as non-legal entities as there limitation between the personal assets of its founders or member with the entity's assets. These types of entities are generally regulated under the Indonesian Commercial Code ("Commercial Code") and the Indonesian Civil Code ("Civil Code"), except the ones established under a sole proprietorship, which are not specifically regulated under the statutory regulations. However, Regulation of the Minister of Law and Human Rights Number 17 of 2018 ("MoLHR Regulation 17/2018") stipulates that the establishment of a maatschap, CV, or firm must be drawn in the form of a notarial deed and registered to the Ministry of Law and Human Right. MoLHR Regulation 17/2018 also stipulates the procedures for the dissolution of these non-legal entities.

Please refer to the points below for the summary of: (a) Civil Partnership, (b) CV, and (c) Firm.

A. Civil Partnership (Maatschap)

The term civil partnership is translated from Dutch, maatschap. Article 1618 of the Civil Code defines a civil partnership as an agreement between two or more individuals who bind themselves to jointly contribute into the entity's operation with the intention of sharing the proceeds. The contributions (inbreng), in this matter, can be in various forms including cash, goods, or labor (Article 1619 of the Civil Code). Based on Article 1626 of the Civil Code, failure to make such contribution, will result in the partner to be considered as ipso jure liable for debt interest on that amount of contribution, calculated from the day on which this amount should have been contributed. Profit sharing can be stipulated in the agreement. Nevertheless, in the absence of such agreement, the profit sharing is determined by the amount of each partner's contribution (pro rata), as stipulated in Article 1633 of the Civil Code.

A civil partnership can be classified into:

a. General Civil Partnership (algehele maatschap), a partnership in which the partners contribute all of their assets or their equal portions without any itemisation. However, Article 1621 of the Civil Code prohibits the existence of this type of partnership on the basis that the contribution of all or part of the assets without itemisation will result in an equitable sharing of profits. This form is permissible provided it has been agreed in advance that all partners will contribute with labour to obtain a profit that can be shared among them. This partnership is referred to as a civil partnership of profit (algehele maatschap van winst).

b. Special Civil Partnership (bijzondere maatschap), a partnership in which the partners stipulate the details of certain assets that are fully or partially contributed by the partners. This is the most common form of civil partnership.

There are two types of management under a Civil Partnership. The first type is the management that is stipulated in the Civil Partnership's deed of establishment. Members of this partnership are called statutory partners (gerant statutaire). A statutory partner cannot be dismissed, unless for reasons stipulated under the prevailing laws and regulations. The second type of partner/management of a Civil Partnership is stipulated after the entity's establishment (bijzondere geding) by the members who are appointed as the management's mandatory partners.

In contrast to a statutory partner, this partner can be dismissed or may request to be dismissed. Article 1637 of the Civil Code allows each partner to have the authority to perform all matters related to the duties of the partnership, unless there is a limitation clause in the agreement where it must be authorized by the other partner.

Terms of liability to third parties are provided in Articles 1642 to 1645 of the Civil Code. Under the general principle, partners are not bound nor liable for the entire obligations of the partnership. Each partner is also not bound by and not liable for the legal acts of the other partners in the absence of a power of attorney. Therefore, the liability to the third parties is only applicable to the partners who perform the legal acts, and such persons shall be personally liable (persoonlijke aanspraakelijkheid).

B. Limited Partnership (Commanditaire Vennootschap)/ CV

The concept of a CV is recognized under Articles 16 to 35 of the Commercial Code. Article 19 paragraph (1) defines a CV as "a partnership formed by lending money, which is formed between a partner or between several partners who are jointly and severally liable with one or more partners who act as the lenders". Meanwhile, Article 1(1) of MoLHR Regulation 17/2018 stipulates that CV is a partnership established by one or more commanditaire partners and one or more complementary partners, to run a continuous business.

Having regard to the above definitions, there are two types of partners (sekutu) in a CV:

a. Complementary or Active Partners: The partners who manage the CV on the day-to[1]day operation and are entitled to act for and on behalf of the CV. They are liable to third parties, jointly and severally, to the extent of their personal assets, because there is no separation between the entity's assets and the personal ones.

b. Commanditaire or Passive Partners: A passive partner is not actively involved in the day-to-day operation of the CV. The partners only provide the loans and/or capitals for the CV. Their liability is limited to the amount of capital they have contributed. They are not involved in the management of the CV and are unable to act on behalf of that entity. However, they are deemed to bound themselves voluntarily to all the acts if they are involved in the management. Consequently, they are also personally liable for all the debts of the CV, severally or jointly (Article 20 of the Commercial Code).

The three forms of CV are as follows:

a. Pure CV (CV Murni): A conventional form of CV that consists of active and passive partners.

b. Mixed CV (CV Campuran): This type of CV is derived from the concept of Civil Partnership. If the Civil Partnership requires additional capital in its business, the Civil Partnership can offer the additional capital contribution to its members and/or other third parties. The party that contributes to the additional capital will be automatically considered as a passive partner. In this regard, the Civil Partnership will become a CV and shall amend its articles of associations.

c. CV with Shares: In general, there are no shares issued to the partners. A CV may issue shares for the purpose of conducting its business operation. In this regard, the CV may issue shares to be subscribed by its partners, but unlike a Limited Liability Company, the shares of a CV cannot be sold to a third party.

C. Firm

Firm or venootschap onder firma is defined as a partnership (maatschap) that operates a business under one common name (Article 16 of Commercial Code).

A firm is generally stipulated under Articles 16 to 35 of the Commercial Code. Due to the lack of rules in those articles, a firm is also acknowledged as a "Partnership".

A firm shall be established by, at least, 2 members. Each member of the firm is authorised to act on behalf of the firm. The actions of a member are binding on all members in terms of fulfilment of the obligations to the third parties, arising from those actions. To act on behalf of the firm, a member does not need any power of attorney from the other member(s), but all of them are jointly and severally liable to the third parties. There are exemptions to this liability. According to Article 17(2) of the Commercial Code, a member of a firm is exempted from the joint and several liability when the action taken by another member is beyond the authority and capacity of the firm (ultra vires).

There is no separation between the assets of the firm and those of its members. Therefore, the members are liable for, not only the assets of the firm, but in an extent, also their own personal assets.

D. Sole Proprietorship

A sole proprietorship is a non-legal business entity owned by one person called a sole proprietor. A sole proprietor owns all of the entity's assets and is personally liable for all of the company's debts. There is no separation between the entity's assets and personal assets. That is the main characteristic of a sole proprietorship compared to other non-legal business entities. In addition, a sole proprietorship can have employees. The sole owner can delegate a portion of his/her authority to these employees. However, this delegation does not impact his/her ultimate decision-making authority, which remains solely with the owner.

In contrast to the other non-legal business entities, a sole proprietorship is not specifically regulated in the statutory regulations. For this reason, there is no obligation for the owner to draw the establishment of a Sole Proprietorship into a notarial deed.

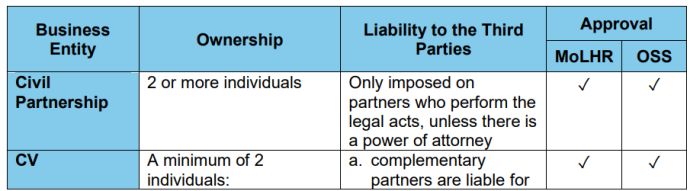

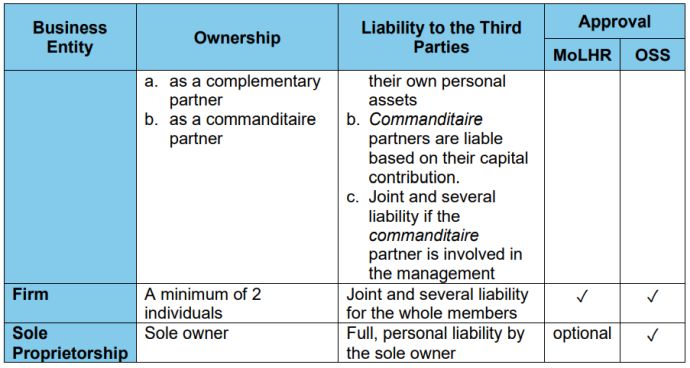

Comparison of Civil Partnership, CV, Firm, and Sole Proprietorship

Establishing a non-legal business entity could be a choice to initiate a business, besides establishing a legal one. As a conclusion, we have summarised the establishment of non-legal business entities in the table below:

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.