At the beginning of this year, the corporate reporting landscape underwent significant change with the start of the phased application of the EU's Corporate Sustainability Reporting Directive(CSRD) (Directive (EU) 2022/2464), which introduced new and significantly more complex and robust ESG public disclosure obligations for large companies, listed SMEs (except micro-enterprises), and parent companies of large groups operating in EU Member States (MS), and in certain circumstances to non-EU-based companies.

If your company falls into one of these categories, then you will need to be aware of the new reporting rules and take the necessary steps to prepare to comply when they start to apply to you.

Here, our ESG experts explain what you need to know.

Background to the Directive

Sustainability reporting in the EU was initially governed by the 2014 Non-Financial Reporting Directive (NFRD) (Directive 2014/95/EU).

The NFRD is itself an amendment of the 2013 Accounting Directive (Directive 2013/34/EU). The NFRD introduced disclosure of 'non-financial and diversity information' for certain (large) companies, including information on:

- Environmental and social matters

- Treatment of employees and diversity on company boards

- Respect for human rights

- Anti-corruption and bribery

The NFRD applies to large 'public-interest' companies with >500 employees, including:

- Listed companies

- Banks and insurance companies

- Other companies designated at MS level as public interest

The new CSRD (Directive (EU) 2023/2464) is the product of the review of the NFRD under the EU's Green Deal. Responding to increased global demand for sustainability reporting equal to financial reporting, it aims to:

- Increase and improve information that companies disclose to investors and the public on the company's social and environmental performance and impacts

- Standardise reporting to increase its reliability and enable accurate comparisons to be made

The CSRD was published on 16 December 2022. It entered into force on 5 January 2023, and started its phased application from January 2024 for certain categories of companies.

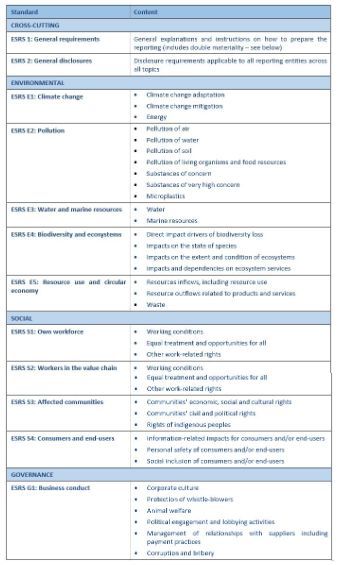

Companies subject to the CSRD will have to report according to European Sustainability Reporting Standards (ESRS) which were adopted in a Delegated Regulation.

Who has to comply and when?

The CSRD extends the scope to:

- All EU large companies and parent companies of large groups (see the Accounting Directive for definitions) whether listed or not

- Listed SMEs excluding listed microenterprises

- Non-EU headquartered companies with substantial business in the EU

Compliance timeline

| Financial Year | Entities required to report |

| 2024 → reporting in 2025 |

|

| 2025 → reporting in 2026 |

|

| 2026 → reporting in 2027 |

|

| 2028 → reporting in 2029 |

|

Why do companies need to comply?

Avoidance of penalties

Member States are responsible for the provision and enforcement of penalties. Non-compliance will lead to national administrative and/or criminal penalties, depending on the Member State.

It is possible that national penalties for breach of EU non-financial reporting rules will be strengthened as the CSRD is transposed into Member State law. However, the currently applicable penalties can already be significant.

For example, in Ireland, a breach of the NFRD may lead to six months' imprisonment for company directors and/or a €5000 fine. In Italy, the penalty is a fine of between €20,000 and €150,000, and in Germany, companies face fines of up to either €10 million, 5% of the total annual turnover or twice the total profits made/losses avoided due to the breach.

Global increase in demand for ESG transparency from investors and public

This rapid evolution of reporting requirements reflects a universal increase in public awareness of sustainability issues and the associated role and responsibilities of businesses operating in all sectors.

Accordingly, there is a greater demand for transparency towards investors and clients, in order for them to be able to choose products and services that align with their values. Therefore, by anticipating and complying with ESG reporting, companies might wish to demonstrate that they are forward-thinking and in tune with this changing investor and public landscape and demands, which will also most likely result in beneficial financing arrangements and a higher valuation of companies that comply with such ESG factors.

In the same vein, companies might also want to avoid the negative reputational impact associated with non-compliance, as corporate ESG performance comes under increasing media scrutiny. Tangibly, this will help to avoid negative financial impacts such as potential future exclusion from investment portfolios, as investors increasingly move away from non-ESG compliant placements.

What needs to be disclosed?

The CSRD requires in-scope companies to produce annual sustainability reports on the material sustainability impacts associated with its business operations and value chain, and on the company's sustainability related policies and targets. These reports must comply with the ESRS, consisting of twelve standards: two general (General Requirements and General Disclosures) and ten topical standards. In certain cases, reporting to other standards will be also allowed.

Double Materiality Perspective

- The CSRD also requires in-scope companies to adopt a "double-materiality" approach for disclosure, this means that information should be disclosed if it is considered material, except for certain obligatory disclosures. Additionally, companies are required to provide explanations for the non-disclosure of other items.

The topic will be considered "material" if it satisfies either or both of the below:

- Impact materiality: the company's operations, including its upstream and downstream value chain, affect society or the environment

- Financial materiality: sustainability topics affect the company's financial health

How can we help?

- One-stop shop for legal advice on CSRD given the breadth of expertise and European-wide offices and network

- Assessing national transposing measures

- Mapping relevant material information - to report or not? Interpretation issues

- Developing company policies to meet sustainability objectives and strategy

- Legal horizon-gazing and risk assessment

- Enforcement

- Interplay with other ESG initiatives

- Ability to partner with consultants who can actually populate the reports

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.