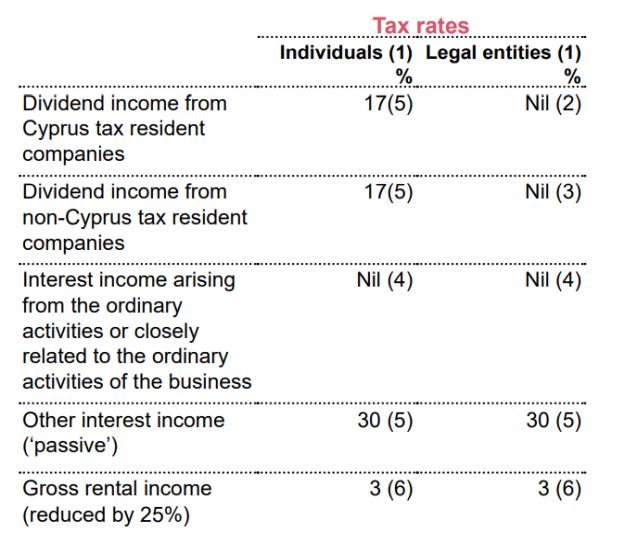

Special Contribution for Defence is imposed on dividend income, 'passive' interest income and rental income earned by companies tax resident in Cyprus and by individuals who are both Cyprus tax resident and Cyprus domiciled. It is charged at the rates shown in the table below:

Notes:

- Legal entities are subject to Special Contribution for Defence if they are tax resident in Cyprus (see page 12). Prior to 16 July 2015 individuals were subject to Special Contribution for Defence if they were tax resident in Cyprus (see page 2). As from 16 July 2015 individuals are subject to Special contribution for defence if they are both Cyprus tax resident and Cyprus domiciled. An individual is domiciled in Cyprus for the purposes of Special Contribution for Defence if (s)he has a domicile of origin in Cyprus per the Wills and Succession Law (with certain exceptions) or if (s)he has been a tax resident in Cyprus for at least 17 out of the 20 tax years immediately prior to the tax year of assessment. Anti-avoidance provisions apply.

- Dividends received by a Cyprus tax resident company from other Cyprus tax resident companies are exempt, subject to certain anti-avoidance provisions.

- The exemption of this section does not apply if:

- more than 50% of the paying company's activities result directly or indirectly in investment income and

- the foreign tax is significantly lower than the tax burden in Cyprus. The tax authorities have clarified through a circular that "significantly lower" means an effective tax rate of less than 6,25% on the profit distributed.

When the exemption does not apply, the dividend income is subject to Special Contribution for Defence at the rate of 17%.

As from 1 January 2016 this section also does not apply to dividends which are deductible for tax purposes by the paying company. In such cases, dividends are subject to corporation tax and not Special Contribution for Defence.

- Such interest income is subject to personal income tax / corporation tax.

- The Special Contribution for Defence rate on interest income of

30% is effective for interest received or credited from 29 April

2013 onwards.

Interest income earned by individuals from corporate bonds (as from 26 June 2019 ), Cyprus government savings and development bonds as well as all interest earned by a provident fund and the Cyprus Social Insurance Fund is subject to Special Contribution for Defence at the rate 3% (instead of 30%).

As from 8 June 2022, the reduced rate of 3% applies to both legal persons and individuals tax resident in Cyprus earning interest income from: (i) Cyprus government bonds, (ii) Cyprus and foreign corporate bonds listed on a recognised stock exchange and (iii) bonds issued by Cyprus state organisations, or by Cyprus or foreign local authorities, listed on a recognised stock exchange. Furthermore, the reduced rate of 3% also applies to pension funds.

In the case where the total income of an individual (including interest) does not exceed €12.000 in a tax year, then the rate on interest income is reduced to 3% (instead of 30%).

- Rental income is also subject to personal income tax /

corporation tax.

- For Cyprus sourced rental income where the tenant is a Cyprus

company, partnership, the state or local authority Special

Contribution for Defence on rental income is withheld at source and

is payable at the end of the month following the month in which it

was withheld. In all other cases the Special Contribution for

Defence on rental income is payable by the landlord in 6 monthly

intervals on 30 June and 31 December each year.

For Cyprus sourced interest and dividends Special Contribution for Defence due is withheld at source and is payable at the end of the month following the month in which they were paid.

However for foreign sourced dividends, interest and rental income Special Contribution for Defence is payable in 6 month intervals on 30 June and 31 December each year.

Foreign taxes paid can also be credited against the Special Contribution for Defence liability.

Deemed dividend distribution

A Cyprus tax resident company is deemed to distribute as a dividend 70% of its accounting profits (as adjusted for Special Contribution for Defence purposes(1) and net of Corporation Tax, Special Contribution for Defence on company incomes, Capital Gains Tax and unrelieved foreign taxes) two years from the end of the tax year in which the profits were generated.

Such a deemed dividend distribution is reduced with payments of actual dividends paid during the relevant year the profits were generated and the two following years.

On the remaining net amount (if any) of deemed dividend 17% Special Contribution for Defence is imposed to the extent that the ultimate direct/ indirect shareholders of the company are individuals who are both Cyprus tax resident and Cyprus domiciled (see page 31 ). Prior to 16 July 2015 the imposition applied to the extent the ultimate direct/indirect shareholders of the company were Cyprus tax resident individuals.

When an actual dividend is paid after the deemed dividend distribution date, then if Special Contribution for Defence is due on such a dividend, the 17% is imposed only on the amount of the actual dividend paid which exceeds the dividend that was previously deemed to have been distributed and previously suffered Special Contribution for Defence.

Notes:

A number of adjustments to the accounting profit are required for deemed distribution purposes, including for tax years 2012, 2013 and 2014 if the company has acquired in those years plant, machinery or buildings (excluding private motor vehicles) for business purposes; the full cost of these assets will be deductible against the accounting profits.

Disposal of assets to shareholder at less than market value

When a company disposes of an asset to an individual shareholder or a relative of his/her up to second degree or his/her spouse for a consideration less than its market value, the difference between the consideration and the market value will be deemed to have been distributed as a dividend to the shareholder. This provision, does not apply for assets originally gifted to the company by an individual shareholder or a relative of his up to second degree or his/her spouse.

Company dissolution

The cumulative profits of the last five years prior to the company's dissolution, which have not been distributed or deemed to have been distributed, will be considered as distributed on dissolution and will be subject to Special Contribution for Defence at the rate of 17%.

This provision does not apply in the case of dissolution under a Reorganisation (see page 19).

Reduction of capital

In the case of a reduction of capital of a company, any amounts paid or due to physical persons shareholders over and above the previously paid-in equity will be considered as dividends distributed subject to special Defence Contribution at the rate of 17% after deducting any amounts which have been deemed as distributable profits.

The redemption of units or shares in a Collective Investment Scheme is not subject to the above provisions.

Prior to 16 July 2015 the above three provisions applied only to the extent that the ultimate shareholders (direct or indirect) are Cyprus tax resident individuals. As from 16 July 2015 the above provisions apply only to the extent that that the ultimate shareholders (direct or indirect) are Cyprus tax resident and domiciled individuals.

To read this Report in full, please click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.